Stocks Continue to Outperform Bitcoin Despite Trump’s Shenanigans

The cryptocurrency dipped 2.45% Wednesday afternoon after topping $94K on Tuesday. Meanwhile, stocks printed fresh all-time highs.

Stocks Keep Beating Bitcoin Despite Trump’s Latest Drama

In less than a week, U.S. President Donald Trump captured Venezuelan dictator Nicolas Maduro, assumed control of the world’s largest oil reserves, and allegedly threatened to annex Denmark. That last allegation may just be partisan hyperbole, but nonetheless, Trump has undoubtedly shaken up the geopolitical landscape over the past four days. Yet despite the chaos, stocks remain near record highs, even after dipping today. Bitcoin, on the other hand, continues marching to the beat of its own drummer, inexplicably up one day and down the next.

Read more: The US Economy Grows More Than Expected; Bitcoin Drops Anyway

Ten years ago in 2015, Venezuela was pumping out more than 2.5 million barrels per day. In 2024, that number had dwindled to just under a million barrels. After Maduro’s capture, oil prices dipped in anticipation of a supply shock. But on Tuesday, Trump announced that “Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America.”

(Crude oil prices have fallen to roughly $56 per barrel. / oilprice.com)

Perhaps Trump’s assurance is all the markets needed. Crude soared to more than $58 per barrel and stocks rallied in tandem on the day he posted that message. But oil’s run was short-lived. The commodity has now dipped to $56 per barrel, but surprisingly, shares of oil refinery companies are still trending upward. In fact, the S&P 500 and the Dow both posted record intraday highs on Wednesday, but they ended up closing slightly lower than Tuesday’s levels. Bitcoin followed oil however, shedding 2.45% and dipping below $91K for most of the day.

(Crude oil prices have fallen to roughly $56 per barrel. / oilprice.com)

Perhaps Trump’s assurance is all the markets needed. Crude soared to more than $58 per barrel and stocks rallied in tandem on the day he posted that message. But oil’s run was short-lived. The commodity has now dipped to $56 per barrel, but surprisingly, shares of oil refinery companies are still trending upward. In fact, the S&P 500 and the Dow both posted record intraday highs on Wednesday, but they ended up closing slightly lower than Tuesday’s levels. Bitcoin followed oil however, shedding 2.45% and dipping below $91K for most of the day.

“What’s happened in South America hasn’t changed the prospect for growth in the U.S. from an equity market standpoint,” said Globalt Investments Senior Portfolio Manager Keith Buchanan, according to a CNBC report. “We don’t feel like what’s happening in Venezuela has moved the needle in that regard up or down.”

Overview of Market Metrics

Bitcoin was priced at $90,922.80 at the time of reporting, down 2.45% for the day but up 3.71% for the week, Coinmarketcap data shows. The cryptocurrency’s price traded between $90,601.81 and $93,778.03 in the last 24 hours.

( Bitcoin price / Trading View)

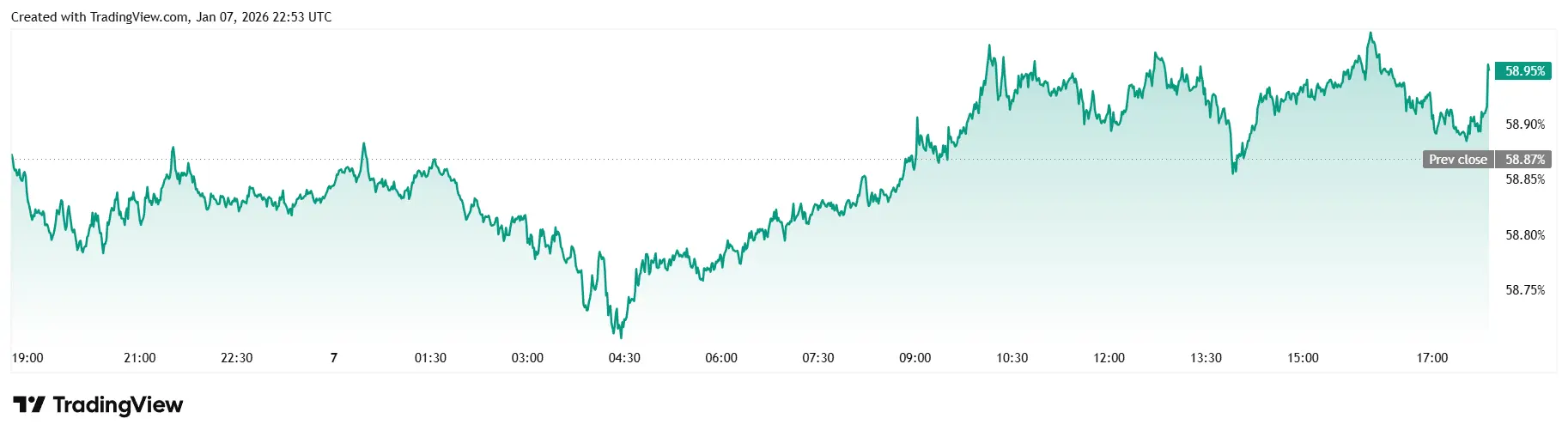

Daily volume fell 15.95% to $43.61 billion and market capitalization eased to $1.81 trillion. Bitcoin dominance rose 0.08% to 58.91% as the digital asset edged out competing alts.

( Bitcoin price / Trading View)

Daily volume fell 15.95% to $43.61 billion and market capitalization eased to $1.81 trillion. Bitcoin dominance rose 0.08% to 58.91% as the digital asset edged out competing alts.

( Bitcoin dominance / Trading View)

Total bitcoin futures open interest climbed 2.84% to $61.70 billion, according to Coinglass data. Total liquidations stood at $74.24 million, a number dominated by losses from long investors who got wiped out to the tune of $65.65 million in the last 24 hours. Short sellers recorded a significantly smaller $8.59 million in liquidated margin.

( Bitcoin dominance / Trading View)

Total bitcoin futures open interest climbed 2.84% to $61.70 billion, according to Coinglass data. Total liquidations stood at $74.24 million, a number dominated by losses from long investors who got wiped out to the tune of $65.65 million in the last 24 hours. Short sellers recorded a significantly smaller $8.59 million in liquidated margin.

FAQ ⚡

- Why are stocks outperforming bitcoin right now?

Stocks are benefiting from resilient U.S. growth expectations, while bitcoin is trading erratically and reacting more closely to commodity and risk sentiment swings.

- Did Trump’s Venezuela actions move markets?

Trump’s statements briefly pushed oil prices higher, supporting equities, but the effect faded quickly and did little to support bitcoin.

- Why did bitcoin fall even as stocks hit record highs?

Bitcoin tracked the pullback in oil and broader risk rotation, shedding gains despite equity markets posting intraday records.

- Is bitcoin underperforming for the week?

Not really. Bitcoin is still up on the week, but it has lagged stocks, which continue printing fresh all-time highs.

Related Articles

Tom Lee: Quantum risk may be reshaping the Bitcoin holding structure

The physical Casascius Bitcoin worth over $120 million suddenly awakens after 13 years

CEO PGI sentenced to 20 years in prison for Ponzi Bitcoin scam exceeding 200 million USD

Strategy: Even if Bitcoin's price drops to $8,000, you can still ensure you have enough assets to fully repay your debt.

Bitcoin shows strong divergence: Individual investors sell off, organizations accelerate long-term accumulation