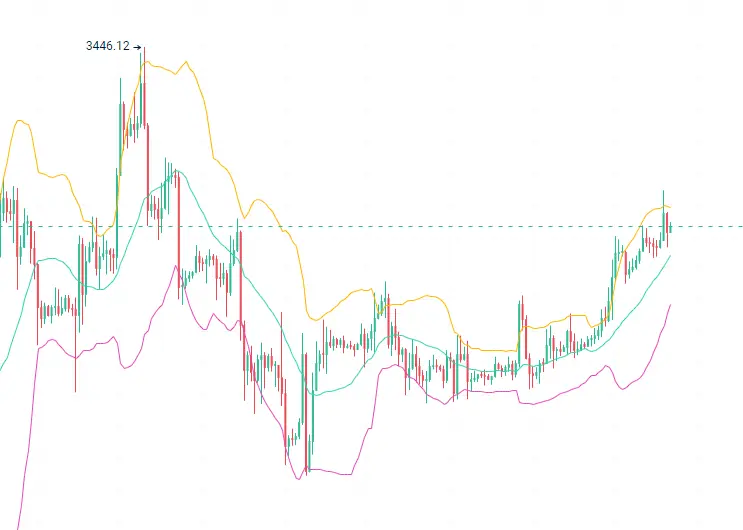

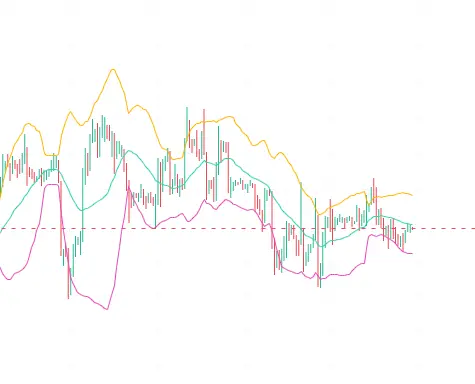

At midday, a pullback occurred, reaching the recent four-hour lower band around 8.7.

This point is also an ideal position after yesterday's surge and subsequent pullback, and the real trading high control has also been perfectly validated.

In the short term, it is still showing a clear wide-ranging oscillation pattern. Next, we will continue to observe whether the lower band support is effective.

The entry direction can be observed in the 8.7-8.75 range, looking towards the 8.9-8.95 range.

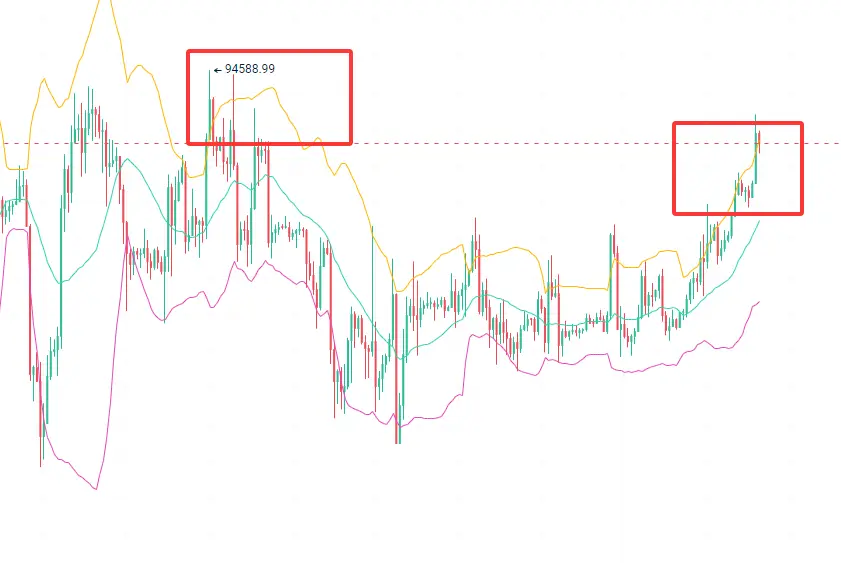

View OriginalThis point is also an ideal position after yesterday's surge and subsequent pullback, and the real trading high control has also been perfectly validated.

In the short term, it is still showing a clear wide-ranging oscillation pattern. Next, we will continue to observe whether the lower band support is effective.

The entry direction can be observed in the 8.7-8.75 range, looking towards the 8.9-8.95 range.