# GOLD

233.33K

Crypto_Buzz_with_Alex

#GoldandSilverHitNewHighs

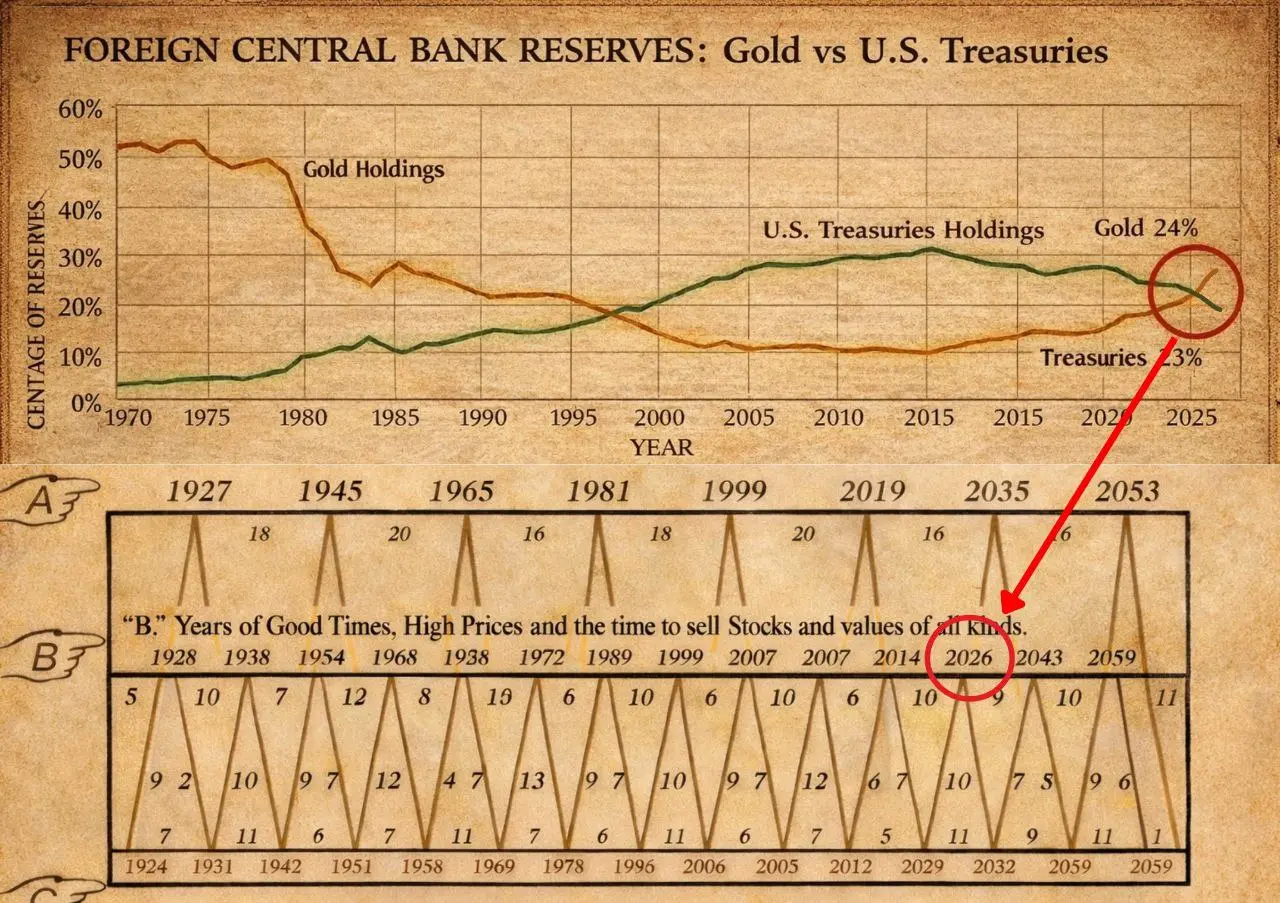

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

- Reward

- 7

- 8

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

Gold and Silver have surged to fresh record highs, signaling strong momentum in the precious metals market. This rally is being driven by a mix of global economic uncertainty, expectations of interest rate cuts, a softer US dollar, and rising geopolitical risks.

Gold continues to reinforce its role as a safe-haven asset, attracting institutional and long-term investors seeking stability against inflation and currency volatility. Meanwhile, Silver is outperforming on the back of both investment demand and its growing industrial use, particularly in renewable energy and

Gold and Silver have surged to fresh record highs, signaling strong momentum in the precious metals market. This rally is being driven by a mix of global economic uncertainty, expectations of interest rate cuts, a softer US dollar, and rising geopolitical risks.

Gold continues to reinforce its role as a safe-haven asset, attracting institutional and long-term investors seeking stability against inflation and currency volatility. Meanwhile, Silver is outperforming on the back of both investment demand and its growing industrial use, particularly in renewable energy and

- Reward

- 6

- 6

- Repost

- Share

楚老魔 :

:

🌱 "Growth mindset activated! Learned a lot from these posts."View More

#BitcoinFallsBehindGold

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

BTC0,03%

- Reward

- 4

- 5

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

The Unstoppable Surge in Precious Metals

The weekend has brought an explosive move in the commodities market. As we observe the #Gold and Silver Reach New Highs trend, the breakout above $4,950 for Gold and $97 for Silver marks a significant structural shift in global finance.

🔍 Key Drivers of the Rally:

Geopolitical Risk Aversion: Rising tensions and trade frictions have triggered a "flight to safety," making Gold the ultimate hedge.

Monetary Policy Tailwinds: With markets pricing in Federal Reserve rate cuts, non-yielding assets like Gold and Silver are becoming more attractive compared to

The weekend has brought an explosive move in the commodities market. As we observe the #Gold and Silver Reach New Highs trend, the breakout above $4,950 for Gold and $97 for Silver marks a significant structural shift in global finance.

🔍 Key Drivers of the Rally:

Geopolitical Risk Aversion: Rising tensions and trade frictions have triggered a "flight to safety," making Gold the ultimate hedge.

Monetary Policy Tailwinds: With markets pricing in Federal Reserve rate cuts, non-yielding assets like Gold and Silver are becoming more attractive compared to

- Reward

- 6

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

✨ Ride the Bull: Gold & Silver Shatter Records! 🚀

The market is witnessing a historic surge! With Spot Gold smashing through $4,950/ounce and Silver soaring past $97/ounce, the "safe haven" trade has turned into a high-speed chase. As risk aversion takes the driver's seat, precious metals are proving why they remain the ultimate hedge in a volatile economy.

Whether you are a seasoned commodity trader or just caught your first wave of the gold rush, now is the time to share your strategy!

🎁 Exclusive Weekend Benefits: Join the Conversation!

Gate Plaza is celebrating

✨ Ride the Bull: Gold & Silver Shatter Records! 🚀

The market is witnessing a historic surge! With Spot Gold smashing through $4,950/ounce and Silver soaring past $97/ounce, the "safe haven" trade has turned into a high-speed chase. As risk aversion takes the driver's seat, precious metals are proving why they remain the ultimate hedge in a volatile economy.

Whether you are a seasoned commodity trader or just caught your first wave of the gold rush, now is the time to share your strategy!

🎁 Exclusive Weekend Benefits: Join the Conversation!

Gate Plaza is celebrating

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

Sony will postpone the release of the PS6 to 2029 due to a shortage of RAM, the price will become much higher, - media.#GoldandSilverHitNewHighs

Gold and Silver: The 2026 "Grand Breakout" Analysis

The weekend of January 24–25, 2026, has solidified its place in financial history. As Spot Gold hits $4,988/ounce and Silver storms past $103/ounce, we are no longer just looking at a price rally—we are witnessing a fundamental shift in the global valuation of hard assets.

1. Macro Analysis: The Perfect Storm of 2026

The current surge isn't a fluke; it is the result of three powerful forces converging simultaneously:

Geopolitical Friction over Greenland: Tensions between the U.S. and the EU regarding strategic resou

Gold and Silver: The 2026 "Grand Breakout" Analysis

The weekend of January 24–25, 2026, has solidified its place in financial history. As Spot Gold hits $4,988/ounce and Silver storms past $103/ounce, we are no longer just looking at a price rally—we are witnessing a fundamental shift in the global valuation of hard assets.

1. Macro Analysis: The Perfect Storm of 2026

The current surge isn't a fluke; it is the result of three powerful forces converging simultaneously:

Geopolitical Friction over Greenland: Tensions between the U.S. and the EU regarding strategic resou

- Reward

- 2

- 1

- Repost

- Share

QueenOfTheDay :

:

good post#GoldAndSilverSoar ✨

Gold and silver are shining brighter than ever! 🌟 Both metals are hitting fresh highs, showing strong investor confidence in safe-haven assets. 📈

Gold is rallying amid economic uncertainty, while silver gains traction as both a precious and industrial metal. Together, they prove why metals remain a top hedge against inflation and market swings. 💰

With global risks still on the horizon, the precious metals market looks rock-solid — and traders and long-term investors are taking notice. 👀

Is this just the start of a major metals cycle? 🔥

#Gold #Silver #PreciousMetals #M

Gold and silver are shining brighter than ever! 🌟 Both metals are hitting fresh highs, showing strong investor confidence in safe-haven assets. 📈

Gold is rallying amid economic uncertainty, while silver gains traction as both a precious and industrial metal. Together, they prove why metals remain a top hedge against inflation and market swings. 💰

With global risks still on the horizon, the precious metals market looks rock-solid — and traders and long-term investors are taking notice. 👀

Is this just the start of a major metals cycle? 🔥

#Gold #Silver #PreciousMetals #M

- Reward

- 2

- 2

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

# GoldandSilverHitNewHighs

🏆 Gold &

Silver hit NEW HIGHS! 🏆

Driven by central bank buying and safe-haven demand, we

might see some institutional money rotate away from crypto short-term.

But zoom out 🧐: This strengthens

Bitcoin's 'digital gold' narrative in the long run.

💡 Strategy:

Monitor the rotation between metals and crypto. Keep your portfolio balanced

and watch for consolidation setups.

#Gold #Silver

🏆 Gold &

Silver hit NEW HIGHS! 🏆

Driven by central bank buying and safe-haven demand, we

might see some institutional money rotate away from crypto short-term.

But zoom out 🧐: This strengthens

Bitcoin's 'digital gold' narrative in the long run.

💡 Strategy:

Monitor the rotation between metals and crypto. Keep your portfolio balanced

and watch for consolidation setups.

#Gold #Silver

BTC0,03%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

40.89K Popularity

4.31K Popularity

3.6K Popularity

2.07K Popularity

1.96K Popularity

1.37K Popularity

1.43K Popularity

1.77K Popularity

68.38K Popularity

110.94K Popularity

77.47K Popularity

19.39K Popularity

44.04K Popularity

37.04K Popularity

192.77K Popularity

News

View MoreWhy is Bitcoin underperforming precious metals? Pompliano reveals market structure and demand changes

1 m

USD1 becomes the fastest-growing tokenized asset on Solana

6 m

TAG Heuer introduces Ethereum payments, luxury retail rides the wave of blockchain

8 m

First XRP custody unlock in 2026: Ripple releases 1 billion tokens, how does the community respond?

9 m

Data: 833.27 BTC transferred from an anonymous address, routed through a relay, and sent to another anonymous address.

11 m

Pin