# NonfarmPayrollsComing

271.25K

The first U.S. nonfarm payroll report of 2026 is out tonight, with 60K jobs expected. It could shape Fed rate-cut expectations and short-term BTC moves, as BTC consolidates near $90.5K. Will this data decide BTC’s next direction?

CryptoSeth

GM Fam ☘️

Non Farm payrolls and unemployment rate in 4h will add volatility. Unemployment rate expected to rise to 4.5% from 4.4%.

Non Farm payrolls and unemployment rate in 4h will add volatility. Unemployment rate expected to rise to 4.5% from 4.4%.

- Reward

- like

- Comment

- Repost

- Share

#NonfarmPayrollsComing #NonfarmPayrollsComing

#NonfarmPayrollsComing #NonfarmPayrollsComing

The Nonfarm Payrolls (NFP) report is a crucial economic indicator in the U.S., detailing the number of jobs added or lost, excluding sectors such as farm workers and government employees. This report significantly influences the U.S. dollar, interest rate expectations, and global financial markets.

Importance of NFP:

Strong employment growth signals a robust economy, often strengthening the U.S. dollar and likely leading to unchanged or rising interest rates. This scenario can pressure risk assets such

#NonfarmPayrollsComing #NonfarmPayrollsComing

The Nonfarm Payrolls (NFP) report is a crucial economic indicator in the U.S., detailing the number of jobs added or lost, excluding sectors such as farm workers and government employees. This report significantly influences the U.S. dollar, interest rate expectations, and global financial markets.

Importance of NFP:

Strong employment growth signals a robust economy, often strengthening the U.S. dollar and likely leading to unchanged or rising interest rates. This scenario can pressure risk assets such

BTC-1,79%

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

Watching Closely 🔍️View More

#NonfarmPayrollsComing #NonfarmPayrollsComing

#NonfarmPayrollsComing #NonfarmPayrollsComing

The Nonfarm Payrolls (NFP) report is a crucial economic indicator in the U.S., detailing the number of jobs added or lost, excluding sectors such as farm workers and government employees. This report significantly influences the U.S. dollar, interest rate expectations, and global financial markets.

Importance of NFP:

Strong employment growth signals a robust economy, often strengthening the U.S. dollar and likely leading to unchanged or rising interest rates. This scenario can pressure risk assets such

#NonfarmPayrollsComing #NonfarmPayrollsComing

The Nonfarm Payrolls (NFP) report is a crucial economic indicator in the U.S., detailing the number of jobs added or lost, excluding sectors such as farm workers and government employees. This report significantly influences the U.S. dollar, interest rate expectations, and global financial markets.

Importance of NFP:

Strong employment growth signals a robust economy, often strengthening the U.S. dollar and likely leading to unchanged or rising interest rates. This scenario can pressure risk assets such

BTC-1,79%

- Reward

- like

- Comment

- Repost

- Share

#NonfarmPayrollsComing The Nonfarm Payrolls (NFP) report is one of the most closely watched economic indicators in the U.S. It measures the number of jobs added or lost in the economy, excluding farm workers, government employees, and a few other sectors. NFP data has a major impact on the U.S. dollar, interest rate expectations, and global markets, including cryptocurrencies.

Why NFP Matters

Strong job growth signals a healthy economy. This typically strengthens the dollar and raises expectations for higher interest rates. In such an environment, risk assets like crypto, stocks, and gold may

Why NFP Matters

Strong job growth signals a healthy economy. This typically strengthens the dollar and raises expectations for higher interest rates. In such an environment, risk assets like crypto, stocks, and gold may

BTC-1,79%

- Reward

- 9

- 6

- Repost

- Share

StylishKuri :

:

2026 GOGOGO 👊View More

#NonfarmPayrollsComing #Crypto2026Vision 🌐💹

Engineering Resilience in the Era of Intentional Markets

The crypto market of 2026 is no longer a playground for reflexive speculation or hype-chasing. Velocity and spectacle are passé. What matters now is structure, insight, and endurance. Markets reward understanding systems—not reacting to them.

1️⃣ Analytical Conviction Over Emotional Reflex

• Speculative impulses—leveraged rotations, false narratives—are being systematically filtered.

• Success favors those who understand why value moves, not just when.

• Patience, research, and deliberate

Engineering Resilience in the Era of Intentional Markets

The crypto market of 2026 is no longer a playground for reflexive speculation or hype-chasing. Velocity and spectacle are passé. What matters now is structure, insight, and endurance. Markets reward understanding systems—not reacting to them.

1️⃣ Analytical Conviction Over Emotional Reflex

• Speculative impulses—leveraged rotations, false narratives—are being systematically filtered.

• Success favors those who understand why value moves, not just when.

• Patience, research, and deliberate

- Reward

- 8

- Comment

- Repost

- Share

#非农就业数据 | Non-Farm Payrolls (NFP) Market Impact

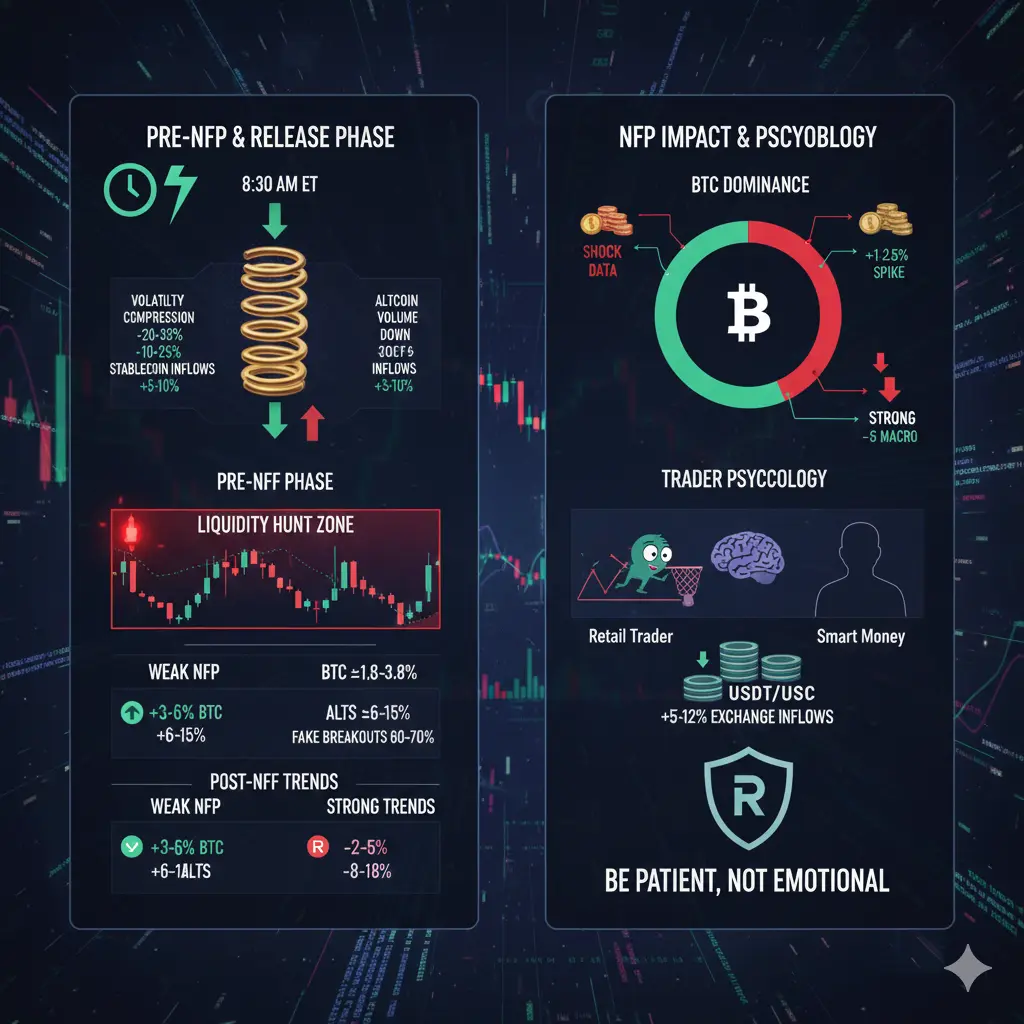

Today’s U.S. Non-Farm Payrolls data is a key driver for market volatility. NFP directly influences expectations around interest rates, USD strength, and overall risk sentiment, making it highly important for crypto traders.

Stronger-than-expected NFP:

Signals a strong labor market → higher rate expectations → pressure on risk assets like crypto.

Weaker-than-expected NFP:

Increases rate-cut hopes → USD softens → positive momentum for Bitcoin, Ethereum, and altcoins.

Ahead of the release, markets often stay cautious with reduced volume. After the d

Today’s U.S. Non-Farm Payrolls data is a key driver for market volatility. NFP directly influences expectations around interest rates, USD strength, and overall risk sentiment, making it highly important for crypto traders.

Stronger-than-expected NFP:

Signals a strong labor market → higher rate expectations → pressure on risk assets like crypto.

Weaker-than-expected NFP:

Increases rate-cut hopes → USD softens → positive momentum for Bitcoin, Ethereum, and altcoins.

Ahead of the release, markets often stay cautious with reduced volume. After the d

- Reward

- 9

- 8

- Repost

- Share

EagleEye :

:

Happy New Year! 🤑View More

🔥Nonfarm Payrolls Coming: What to Expect and How It Could Impact Markets 🔥

Tonight marks a significant moment for investors and traders worldwide as the first U.S. nonfarm payroll report of 2026 is scheduled for release. With an anticipated 60,000 new jobs added, this report is more than just a monthly employment update it’s a key indicator that could influence Federal Reserve policy decisions and market sentiment in the short term. The employment data released tonight will likely shape expectations around potential Fed rate cuts, which in turn could have a profound impact on various assets

Tonight marks a significant moment for investors and traders worldwide as the first U.S. nonfarm payroll report of 2026 is scheduled for release. With an anticipated 60,000 new jobs added, this report is more than just a monthly employment update it’s a key indicator that could influence Federal Reserve policy decisions and market sentiment in the short term. The employment data released tonight will likely shape expectations around potential Fed rate cuts, which in turn could have a profound impact on various assets

BTC-1,79%

- Reward

- 8

- 6

- Repost

- Share

SoominStar :

:

2026 GOGOGO 👊View More

#NonfarmPayrollsComing The Nonfarm Payrolls (NFP) report is one of the most closely watched economic indicators in the U.S. It measures the number of jobs added or lost in the economy, excluding farm workers, government employees, and a few other sectors. NFP data has a major impact on the U.S. dollar, interest rate expectations, and global markets, including cryptocurrencies.

Why NFP Matters

Strong job growth signals a healthy economy. This typically strengthens the dollar and raises expectations for higher interest rates. In such an environment, risk assets like crypto, stocks, and gold may

Why NFP Matters

Strong job growth signals a healthy economy. This typically strengthens the dollar and raises expectations for higher interest rates. In such an environment, risk assets like crypto, stocks, and gold may

BTC-1,79%

- Reward

- 1

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#NonfarmPayrollsComing

The U.S. Nonfarm Payrolls (NFP) report remains one of the most influential economic indicators in global markets. As the January 2026 NFP approaches, its significance extends far beyond employment numbers. The December 2025 report revealed the U.S. economy added approximately 50,000 jobs, below expectations, marking a slowdown in hiring activity. At the same time, the unemployment rate slightly improved to 4.4%, while wage growth remained steady at 3.8% year-on-year. This mix of slower hiring yet resilient wages presents a nuanced picture of labor market health, capturi

The U.S. Nonfarm Payrolls (NFP) report remains one of the most influential economic indicators in global markets. As the January 2026 NFP approaches, its significance extends far beyond employment numbers. The December 2025 report revealed the U.S. economy added approximately 50,000 jobs, below expectations, marking a slowdown in hiring activity. At the same time, the unemployment rate slightly improved to 4.4%, while wage growth remained steady at 3.8% year-on-year. This mix of slower hiring yet resilient wages presents a nuanced picture of labor market health, capturi

- Reward

- 16

- 17

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#NonfarmPayrollsComing

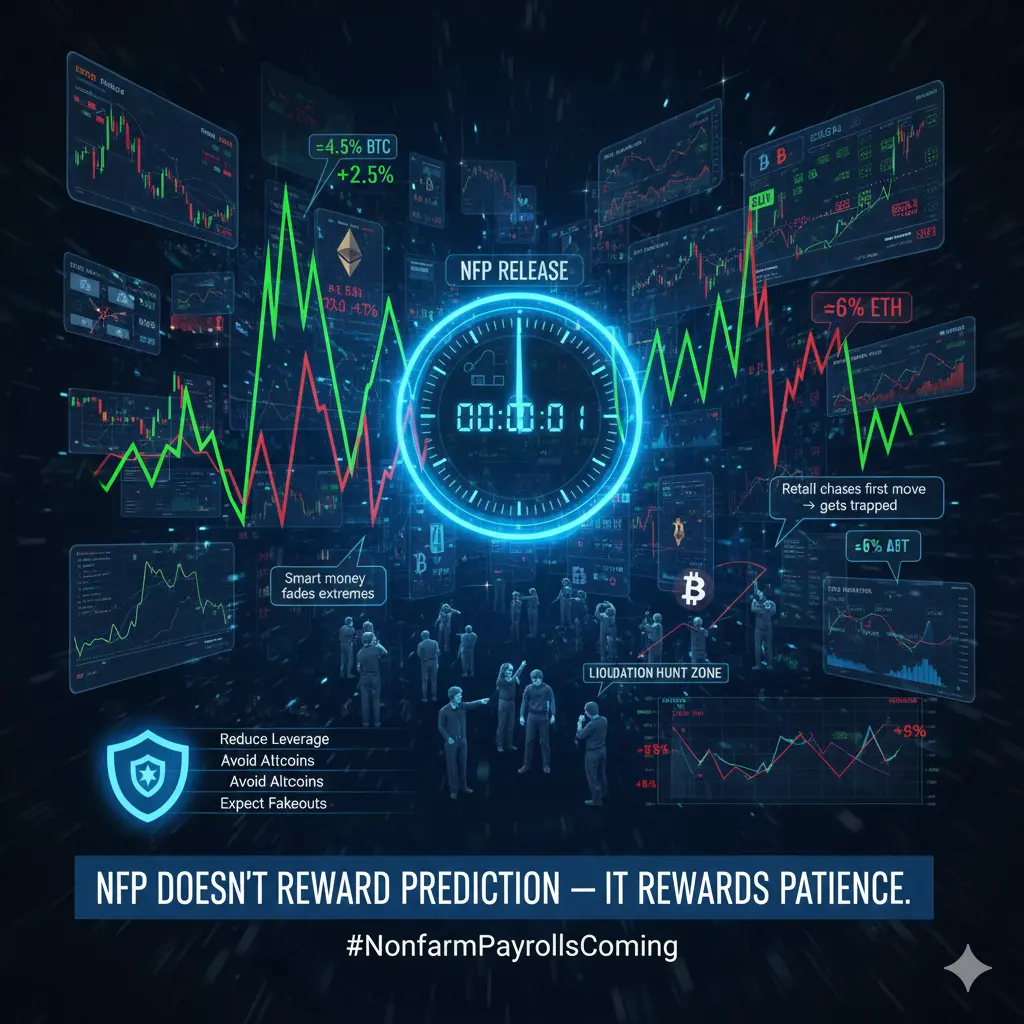

As Non-Farm Payrolls (NFP) approach, the crypto market enters one of its most sensitive macro phases. This is not just a news event — it’s a volatility multiplier that can move billions in liquidity across Bitcoin, altcoins, and stablecoins within minutes.

NFP defines expectations around interest rates, dollar strength, and risk appetite, which directly shape crypto price action.

⏳ Pre-NFP Phase: Positioning & Compression

Typically 24–72 hours before NFP, markets show clear patterns:

BTC volatility compresses by ~20–35%

Futures open interest drops 5–12%

Funding rates fl

As Non-Farm Payrolls (NFP) approach, the crypto market enters one of its most sensitive macro phases. This is not just a news event — it’s a volatility multiplier that can move billions in liquidity across Bitcoin, altcoins, and stablecoins within minutes.

NFP defines expectations around interest rates, dollar strength, and risk appetite, which directly shape crypto price action.

⏳ Pre-NFP Phase: Positioning & Compression

Typically 24–72 hours before NFP, markets show clear patterns:

BTC volatility compresses by ~20–35%

Futures open interest drops 5–12%

Funding rates fl

- Reward

- 30

- 19

- Repost

- Share

Vortex_King :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

357.69K Popularity

20.26K Popularity

60.22K Popularity

13.6K Popularity

468.13K Popularity

3.02K Popularity

3.07K Popularity

1.37K Popularity

874 Popularity

80.44K Popularity

41.94K Popularity

96.53K Popularity

14.33K Popularity

66.77K Popularity

1.63K Popularity

News

View MoreLobster rose by 620.27% after going live on Alpha; current price is 0.0013907 USDT

6 m

The yield on the 30-year U.S. Treasury bond drops to 4.63%, the lowest level since October 2022.

23 m

Pigeon increased by 114.89% after launching Alpha, current price is 0.0078895 USDT

35 m

Former U.S. President Clinton testifies regarding the Epstein case

57 m

Spot silver rose 6.48% intraday, and spot gold hit a new high since January 30.

1 h

Pin