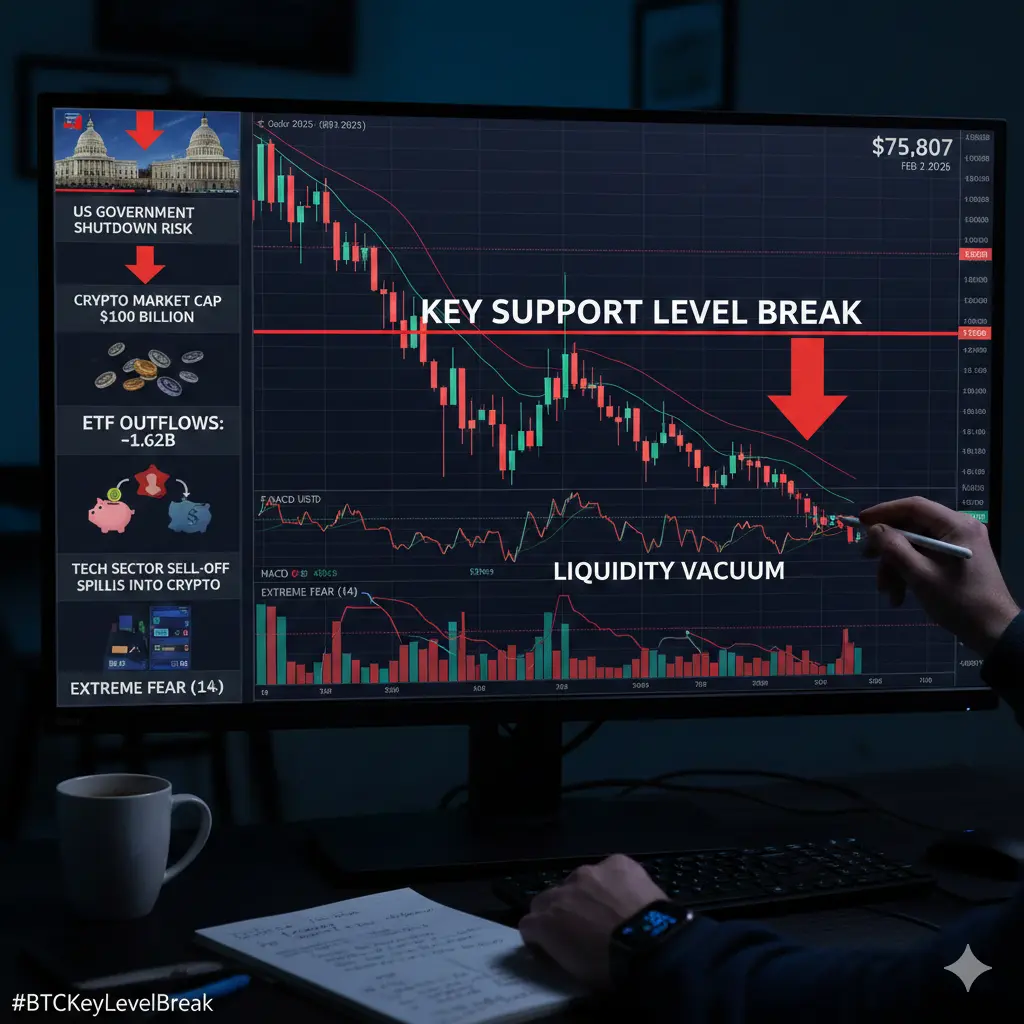

#BTCKeyLevelBreak

Bitcoin has experienced a dramatic selloff since peaking near $126,000 USDT in October 2025, currently trading around $75,807 USDT on Gate as of February 2026 — a drop of over 40% from previous highs. This represents a fully extended corrective phase, driven by both technical breakdowns and macroeconomic headwinds.

📊 Core Technical Insights

BTC’s decline is not just a normal pullback; it’s the result of a key level breakdown. The $126,000 level acted as a major long-term support zone and psychological anchor. Once BTC failed to sustain above it, it triggered:

Accelerated downtrend: The market violated multiple support levels as bears gained control.

Moving averages: All major daily and hourly MAs are now sloping down, with BTC trading below them — a clear trend exhaustion signal.

Momentum indicators: MACD shows strong bearish crossovers, while RSI sits near extreme lows, highlighting that the correction is almost “ but rebound strength remains limited.

Volume behavior: Falling volumes alongside price drops indicate a liquidity vacuum — selling pressure outweighs buying interest.

The breakdown below $126,000 USDT was compounded by a massive cross-platform liquidation event in late 2025, which weakened market structure and reduced the ability of market makers to provide price support.

🌍 Macro Drivers Behind the Breakdown

The technical weakness was amplified by several major macro factors:

US government shutdown risk: Uncertainty over federal funding and tense negotiations caused traders to de-risk. Financial markets reacted strongly, triggering roughly $100 billion wiped out in crypto market cap, according to Cointelegraph and Forbes.

Leveraged position liquidations: Volatility spikes forced the closure of over $750 million in crypto positions, mostly long, amplifying the selloff (Decrypt).

ETF outflows: US spot Bitcoin ETFs recorded $1.62 billion in net outflows over four days, signaling reduced institutional support.

Global tech sector risk-off: Weakness in tech equities spilled over into crypto. Bitcoin dropped below $84,000 while total market cap fell ~6% in a single day (The Block), alongside declines in precious metals as investors sought safe havens.

Liquidity concerns: Thin order books and stalled new inflows created heightened volatility, with long-term holders taking profits after last year’s ETF-driven rally (CoinDesk).

Together, these macro events created an extremely challenging environment, reinforcing technical weakness and keeping BTC near local lows.

💡 Professional Take

From a trading perspective, the current range of $74,600 – $75,800 USDT could serve as a potential tactical dip-buying zone, but only with tight risk management. Key supports at $74,600 must hold, as a breakdown below this could trigger further declines. Traders should watch for:

Trend reversal signals: Sustained reclaim of short-term moving averages, improving volume, or reduced liquidation pressure.

Market sentiment shifts: Extreme fear (Fear & Greed Index at 14) indicates strong risk-off sentiment, suggesting high volatility may persist

.

⚠️ Risk Advisory

Any rebound could be a “dead cat bounce” without follow-through buying.

Position sizing must remain cautious, with stop-losses below recent lows.

Macro headlines — from Washington DC to ETF flows — can trigger sudden, sharp moves in either direction.

In short, Bitcoin’s key level at $126,000 broke under the combined pressure of technical exhaustion and macro uncertainty, creating a fully extended corrective phase that has left BTC consolidating near $75,800 USDT. While deep crashes are less likely without forced selling from major holders, volatility is set to remain elevated.

Bitcoin has experienced a dramatic selloff since peaking near $126,000 USDT in October 2025, currently trading around $75,807 USDT on Gate as of February 2026 — a drop of over 40% from previous highs. This represents a fully extended corrective phase, driven by both technical breakdowns and macroeconomic headwinds.

📊 Core Technical Insights

BTC’s decline is not just a normal pullback; it’s the result of a key level breakdown. The $126,000 level acted as a major long-term support zone and psychological anchor. Once BTC failed to sustain above it, it triggered:

Accelerated downtrend: The market violated multiple support levels as bears gained control.

Moving averages: All major daily and hourly MAs are now sloping down, with BTC trading below them — a clear trend exhaustion signal.

Momentum indicators: MACD shows strong bearish crossovers, while RSI sits near extreme lows, highlighting that the correction is almost “ but rebound strength remains limited.

Volume behavior: Falling volumes alongside price drops indicate a liquidity vacuum — selling pressure outweighs buying interest.

The breakdown below $126,000 USDT was compounded by a massive cross-platform liquidation event in late 2025, which weakened market structure and reduced the ability of market makers to provide price support.

🌍 Macro Drivers Behind the Breakdown

The technical weakness was amplified by several major macro factors:

US government shutdown risk: Uncertainty over federal funding and tense negotiations caused traders to de-risk. Financial markets reacted strongly, triggering roughly $100 billion wiped out in crypto market cap, according to Cointelegraph and Forbes.

Leveraged position liquidations: Volatility spikes forced the closure of over $750 million in crypto positions, mostly long, amplifying the selloff (Decrypt).

ETF outflows: US spot Bitcoin ETFs recorded $1.62 billion in net outflows over four days, signaling reduced institutional support.

Global tech sector risk-off: Weakness in tech equities spilled over into crypto. Bitcoin dropped below $84,000 while total market cap fell ~6% in a single day (The Block), alongside declines in precious metals as investors sought safe havens.

Liquidity concerns: Thin order books and stalled new inflows created heightened volatility, with long-term holders taking profits after last year’s ETF-driven rally (CoinDesk).

Together, these macro events created an extremely challenging environment, reinforcing technical weakness and keeping BTC near local lows.

💡 Professional Take

From a trading perspective, the current range of $74,600 – $75,800 USDT could serve as a potential tactical dip-buying zone, but only with tight risk management. Key supports at $74,600 must hold, as a breakdown below this could trigger further declines. Traders should watch for:

Trend reversal signals: Sustained reclaim of short-term moving averages, improving volume, or reduced liquidation pressure.

Market sentiment shifts: Extreme fear (Fear & Greed Index at 14) indicates strong risk-off sentiment, suggesting high volatility may persist

.

⚠️ Risk Advisory

Any rebound could be a “dead cat bounce” without follow-through buying.

Position sizing must remain cautious, with stop-losses below recent lows.

Macro headlines — from Washington DC to ETF flows — can trigger sudden, sharp moves in either direction.

In short, Bitcoin’s key level at $126,000 broke under the combined pressure of technical exhaustion and macro uncertainty, creating a fully extended corrective phase that has left BTC consolidating near $75,800 USDT. While deep crashes are less likely without forced selling from major holders, volatility is set to remain elevated.