2025 NVIR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: NVIR's Market Position and Investment Value

NvirWorld (NVIR) is positioned as a next-generation Web3 gaming platform centered around its flagship product, NWS (Nvir Web3 Studio), which builds and distributes game titles ranging from hypercasual to AAA on web, desktop, and mobile platforms. Since its inception in 2022, the project has established itself as a gateway for non-crypto native users to participate in the Web3 movement through accessible and seamless gameplay experiences. As of January 2026, NVIR's market capitalization stands at approximately $153,383.37, with a circulating supply of around 1.28 billion tokens trading at $0.00011963 per unit.

This asset, which bridges traditional gaming and decentralized finance through its mission to generate financial value via engaging gameplay experiences, continues to play an increasingly important role in the Web3 gaming ecosystem. The project's foundation is strengthened by diverse user experiences shared through various services, while ongoing collaboration with specialized team members and partners provides the expertise and momentum for continued development.

This article will comprehensively analyze NVIR's price trends and market dynamics from 2026 to 2031, integrating historical price patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies for informed decision-making.

I. NVIR Price History Review and Current Market Status

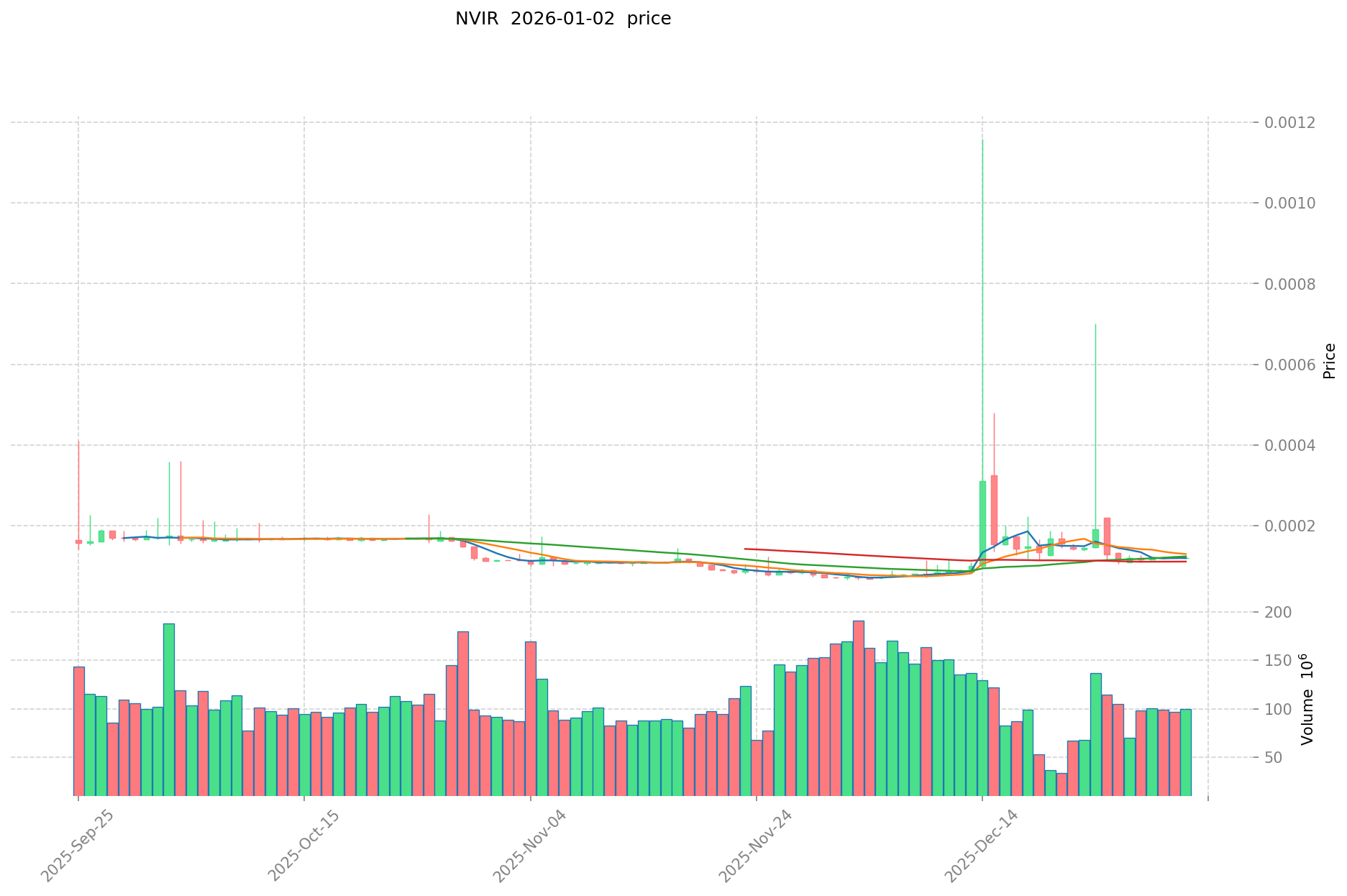

NVIR Historical Price Evolution Trajectory

- 2022 (March 25): Reached all-time high of $1.67, marking the peak of market enthusiasm during the early Web3 gaming platform adoption phase.

- 2022 (April 5): Declined to all-time low of $0.00000305, representing a significant market correction and loss of investor confidence.

- 2022-2026: Extended bear market period, with price declining from peak levels to current trading levels around $0.00011963, reflecting sustained pressure on the token value over a multi-year period.

NVIR Current Market Stance

As of January 2, 2026, NVIR is trading at $0.00011963, representing a 86.71% decline over the past year. The token demonstrates minimal 24-hour volatility with a 0% change, though short-term momentum shows a modest 0.22% gain over the last hour. Over the 30-day period, NVIR has recovered 78.55%, suggesting recent stabilization after prolonged downward pressure.

The token's market capitalization stands at approximately $153,383.37, with a fully diluted valuation of $1,279,884.50. Daily trading volume reaches $11,995.05, indicating limited liquidity in current market conditions. With 1.28 billion circulating tokens out of a maximum supply of 10.7 billion, the circulating supply represents approximately 11.98% of total supply, suggesting significant dilution potential.

The token maintains a market ranking of 4,431, reflecting its niche position within the broader cryptocurrency ecosystem. Current holder count stands at 17,599 addresses, indicating a relatively small but distributed investor base. The token's market dominance remains minimal at 0.000039%, underscoring its limited influence on overall market dynamics.

View current NVIR market price

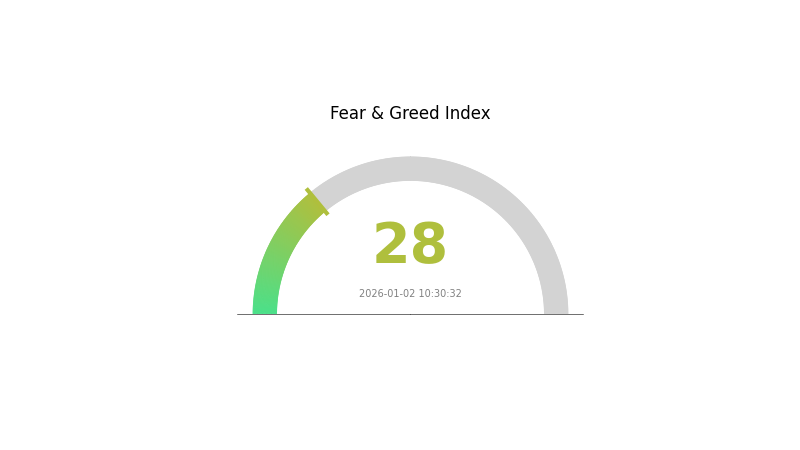

NVIR Market Sentiment Index

2026-01-02 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a fearful sentiment with an index reading of 28. This indicates significant market pessimism, where investors are adopting a cautious stance. During periods of fear, volatility typically increases as market participants reassess their positions. This environment often presents contrarian opportunities for experienced traders who can identify undervalued assets. Monitor market developments closely on Gate.com to stay updated on sentiment shifts and potential trading signals.

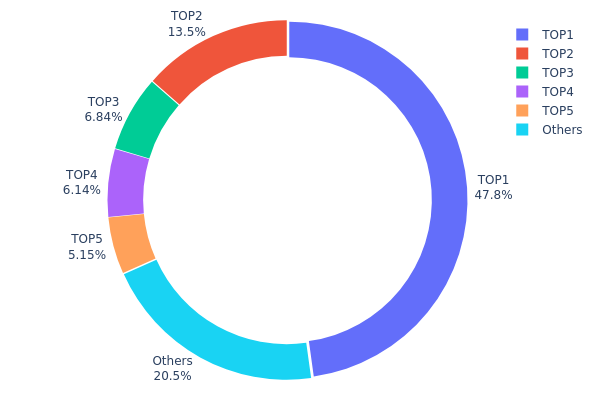

NVIR Holdings Distribution

The address holdings distribution represents the concentration of NVIR tokens across blockchain addresses, reflecting how token ownership is stratified among market participants. By analyzing the top holders and their proportional stakes, this metric provides critical insights into the decentralization status, potential governance risks, and market structure of the asset.

NVIR exhibits significant concentration characteristics, with the top five addresses controlling approximately 79.45% of total token supply. Most notably, the leading address (0x0000...00dead) commands 47.80% of all holdings, which typically indicates a substantial portion of tokens in a burn wallet or long-term lockup mechanism. The second-largest holder controls 13.54%, followed by progressively smaller stakes of 6.83%, 6.14%, and 5.14% respectively. The remaining addresses collectively represent only 20.55% of circulating supply, underscoring the highly concentrated distribution pattern.

This pronounced concentration raises material considerations regarding market dynamics and structural stability. While the dominant position held by what appears to be a dead or locked address may reduce actual circulating pressure, the combined 31.65% stake distributed among the second through fifth holders presents meaningful influence over market movements. Such concentration could potentially amplify price volatility during significant token transfers or liquidations, and may constrain true price discovery mechanisms. The limited fragmentation of holdings among the broader address base suggests NVIR maintains a relatively centralized on-chain structure, which warrants continued monitoring for potential governance implications and systemic risks inherent to concentrated token distributions.

Click to view current NVIR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 5115094.68K | 47.80% |

| 2 | 0x802a...d9f2c3 | 1449415.71K | 13.54% |

| 3 | 0x1297...216e03 | 731875.10K | 6.83% |

| 4 | 0x09d2...678edc | 657108.08K | 6.14% |

| 5 | 0x3335...7c5c6c | 550983.33K | 5.14% |

| - | Others | 2195523.10K | 20.55% |

II. Core Factors Influencing NVIR's Future Price

Supply Mechanism

- Limited Supply and Unique Distribution: NVIR employs a limited supply model with a unique distribution mechanism, distinguishing it from other cryptocurrencies with traditional tokenomics.

- Historical Patterns: Since its launch in 2022, NVIR has experienced significant price volatility, declining from its historical high of $1.67 in March 2022 to a low of $0.00000305, reflecting the impact of supply dynamics on price movements.

- Current Impact: The token's limited supply structure is designed to support long-term value retention, particularly as adoption in the Web3 gaming sector expands.

Institutional and Whale Activity

- Institutional Holdings: Top wallet holders demonstrate concentrated positions, with the largest holder (0x0000...00dead) controlling 47.80% of tokens, followed by significant holdings at 6.83%, 6.14%, and 5.14%, indicating major stakeholder concentration.

- Enterprise Adoption: NVIR focuses on Web3 gaming and marketplace solutions, positioning itself within the emerging gaming ecosystem rather than traditional finance or payment systems.

Macroeconomic Environment

- Monetary Policy Impact: Global central bank policies, particularly shifts in interest rates and liquidity conditions, directly influence cryptocurrency market sentiment and NVIR's price trajectory. Sustained inflation above central bank targets increases volatility in digital assets.

- Inflation Hedge Properties: As a Web3 gaming token, NVIR's inflation hedging characteristics remain limited compared to traditional store-of-value cryptocurrencies, though it benefits from technological innovation premiums.

Technology Development and Ecosystem Building

- Web3 Gaming Focus: NVIR's primary development direction centers on Web3 gaming infrastructure and marketplace solutions, leveraging blockchain technology for decentralized gaming experiences.

- Ecosystem Applications: The project targets integration with gaming platforms and decentralized applications within the Web3 space, positioning itself as a utility token for gaming transactions and rewards.

Disclaimer: This analysis is based on historical data and market predictions available as of January 2, 2026. Cryptocurrency markets exhibit significant volatility. The information provided does not constitute investment advice. Investors should conduct thorough research before making any decisions. Trading involves risk, so proceed with caution. For real-time NVIR price information and secure trading, visit Gate.com.

III. 2026-2031 NVIR Price Forecast

2026 Outlook

- Conservative Forecast: $0.0001 - $0.00012

- Neutral Forecast: $0.00012

- Bullish Forecast: $0.00017 (requires sustained market sentiment and ecosystem development)

2027-2029 Mid-term Outlook

- Market Stage Expectations: Consolidation phase with gradual accumulation, transitioning toward growth acceleration as adoption increases

- Price Range Predictions:

- 2027: $0.00007 - $0.0002 (20% upside potential)

- 2028: $0.00014 - $0.00018 (42% upside potential)

- 2029: $0.00013 - $0.00025 (45% upside potential)

- Key Catalysts: Project milestone achievements, strategic partnerships, increased institutional interest, liquidity expansion on platforms like Gate.com, and broader market recovery cycles

2030-2031 Long-term Outlook

- Base Case Scenario: $0.0002 - $0.00027 (76% upside potential by 2030), with moderate adoption and steady ecosystem expansion

- Bullish Scenario: $0.00021 - $0.00032 (101% upside potential by 2031), contingent on accelerated protocol adoption and market-wide growth

- Transformative Scenario: $0.00032+ (significant upside exceeding 100% by 2031), assuming breakthrough technological developments, major enterprise adoption, and favorable macroeconomic conditions

- 2026-01-02: NVIR consolidation phase initiated, positioning for multi-year appreciation trajectory

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00017 | 0.00012 | 0.0001 | 0 |

| 2027 | 0.0002 | 0.00014 | 0.00007 | 20 |

| 2028 | 0.00018 | 0.00017 | 0.00014 | 42 |

| 2029 | 0.00025 | 0.00017 | 0.00013 | 45 |

| 2030 | 0.00027 | 0.00021 | 0.0002 | 76 |

| 2031 | 0.00032 | 0.00024 | 0.00015 | 101 |

NVIR Investment Analysis Report

IV. NVIR Professional Investment Strategy and Risk Management

NVIR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Web3 gaming enthusiasts, early-stage project believers, risk-tolerant investors with long-term horizons

- Operational Recommendations:

- Establish positions gradually during market downturns, taking advantage of NVIR's current price level of $0.00011963

- Hold through platform development cycles as NWS (Nvir Web3 Studio) expands its game library and user base

- Monitor quarterly milestones for platform adoption metrics and developer partnerships

(2) Active Trading Strategy

-

Price Action Monitoring:

- Track the 30-day performance (+78.55%) against volatility patterns to identify consolidation zones

- Note the significant year-over-year decline (-86.71%) indicating potential accumulation opportunity for contrarian traders

- Monitor 24-hour volume of $11,995 to assess liquidity conditions before executing large positions

-

Wave Trading Focus Points:

- Identify support levels near historical lows ($0.00000305) for stop-loss placement

- Resistance zones approaching all-time high of $1.67 offer profit-taking opportunities on recovery rallies

- Current circulating supply of 1.28 billion tokens suggests potential for meaningful price movements with modest capital influx

NVIR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 2-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation

(2) Risk Hedging Approaches

- Portfolio Diversification: Allocate NVIR holdings alongside established cryptocurrencies to reduce concentration risk from a micro-cap asset (market cap rank: 4431)

- Volatility Hedging: Use position sizing to manage the inherent volatility of early-stage Web3 gaming tokens with limited trading history

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 wallet for active traders requiring regular transaction capability

- Cold Storage Approach: Hardware solutions for long-term holders prioritizing security over accessibility

- Security Precautions: Never share private keys; enable two-factor authentication on Gate.com exchange accounts; verify smart contract addresses before token transfers on Ethereum mainnet

V. NVIR Potential Risks and Challenges

NVIR Market Risks

- Liquidity Risk: With 24-hour volume of only $11,995 across a $153,383 market cap, significant buy or sell orders could cause substantial price slippage

- Token Supply Risk: Maximum supply of 10.7 billion tokens with only 11.98% currently circulating creates significant dilution potential if project releases tokens on aggressive schedules

- Market Sentiment Risk: Current market emotion indicator of 1 suggests neutral positioning; lack of strong community engagement could hinder price recovery

NVIR Regulatory Risks

- Gaming Classification Uncertainty: Regulatory treatment of tokenized gaming platforms remains ambiguous across jurisdictions, potentially affecting NWS's operational viability

- Securities Compliance: Web3 gaming tokens face ongoing scrutiny from regulators examining whether game tokens constitute securities

- Geographic Restrictions: Different jurisdictions may restrict NVIR trading or platform access, limiting market expansion

NVIR Technology Risks

- Platform Execution Risk: NWS must successfully build and maintain a competitive Web3 gaming ecosystem against established players

- Smart Contract Risk: Token contract on Ethereum mainnet (0x9d71CE49ab8A0E6D2a1e7BFB89374C9392FD6804) requires ongoing auditing and security monitoring

- User Adoption Risk: Mass onboarding of non-crypto-native users to NWS gameplay and tokenomics remains unproven at scale

VI. Conclusions and Action Recommendations

NVIR Investment Value Assessment

NVIR operates in the nascent Web3 gaming space with NWS positioned as an infrastructure layer for casual-to-AAA game distribution. The project shows ambition in bridging non-crypto users to blockchain gaming but faces significant execution risk given its micro-cap status, limited trading volume, and substantial 86.71% one-year decline. The 11-fold market recovery from ATL ($0.00000305) to current price ($0.00011963) suggests either renewed interest or speculative positioning. Success depends critically on NWS platform adoption and developer partnerships that remain largely undiscovered in current data.

NVIR Investment Recommendations

✅ Beginners: Start with minimal position sizing (0.5-1% portfolio) on Gate.com to observe platform development progress before scaling; use only capital you can afford to lose entirely

✅ Experienced Investors: Implement dollar-cost averaging over 6-12 months to establish core positions; actively monitor smart contract security and development velocity through official channels

✅ Institutional Investors: Conduct thorough due diligence on development team credentials, technology roadmap verification, and regulatory compliance framework before any material allocation

NVIR Trading Participation Methods

- Spot Trading: Purchase NVIR directly on Gate.com for long-term conviction positions

- Gateway Monitoring: Track project updates on official website (https://www.nvirworld.com/) and Twitter (@NvirWorld) to signal entry/exit timing

- Risk-Limited Engagement: Consider deploying capital only after major platform milestones deliver measurable traction metrics

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is NVIR? What are its uses and application scenarios?

NVIR is an ERC-20 utility token on Ethereum blockchain powering the NvirWorld ecosystem. It enables governance functions, facilitates ecosystem transactions, and serves as a core utility token for decentralized finance innovations within the NvirWorld platform.

What is the historical price performance of NVIR? What are the main factors affecting its price fluctuations?

NVIR has experienced significant volatility typical of emerging crypto assets. Key factors influencing its price include market sentiment, trading volume, project developments, adoption trends, and broader cryptocurrency market conditions.

What is the expert prediction for NVIR's future price? What is it based on?

Experts predict NVIR price will rise based on market trends and company performance. Predictions rely on financial growth and industry demand. Current data is insufficient for precise forecasts.

What are the main risks of investing in NVIR? How should I assess investment risks?

NVIR's main risks include high volatility and market uncertainty due to its smaller market cap and emerging project status. Assess risks by monitoring market trends, project development progress, and trading volume to make informed decisions.

What are the advantages and disadvantages of NVIR compared to similar tokens?

NVIR offers strong technical potential comparable to Ethereum, with innovative tokenomics design. Advantages include deflationary mechanisms and community governance. Disadvantages may include lower liquidity and market adoption compared to established tokens, requiring time to build ecosystem maturity.

How is NVIR's market liquidity and trading volume? On which exchanges can it be traded?

NVIR maintains moderate market liquidity with consistent daily trading activity. The token is listed on multiple cryptocurrency exchanges supporting 24-hour trading. Market depth varies across platforms, reflecting liquidity distribution. Current trading volume demonstrates steady investor interest in the NVIR ecosystem.

2025 ISLAND Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 A2Z Price Prediction: Expert Forecast and Market Analysis for the Upcoming Year

2025 GOG Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 MAVIA Price Prediction: Expert Analysis and Future Market Outlook for the Decentralized Gaming Token

2025 OL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 W3GG Price Prediction: Expert Analysis and Market Forecast for the Gaming Token's Future Growth Potential

2025 RUNI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 FTR Price Prediction: Expert Analysis and Market Forecast for Fractal's Native Token

Satoshi-Era Bitcoin Address Moves $1 Billion of BTC After 14 Years

2025 MIDNIGHT Price Prediction: Expert Analysis and Market Outlook for the Next Generation Cryptocurrency Token

Is Parex Ecosystem (PRX) a good investment?: A Comprehensive Analysis of Performance, Tokenomics, and Market Potential