2025 ISLAND Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ISLAND

Nifty Island (ISLAND), as a user-generated content-driven open gaming platform within the Web3 ecosystem, has established itself as one of the most active creator economies in Web3 gaming since its launch. As of December 28, 2025, ISLAND maintains a market capitalization of approximately $812,019, with a circulating supply of around 136.54 million tokens, currently trading at $0.005947 per token. This innovative asset has demonstrated significant ecosystem engagement, with over 70,000 user-generated islands built, 75,000 user-generated assets created, and 1.3 million user-generated games played.

This comprehensive analysis will examine ISLAND's price trajectory and market dynamics through 2025-2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants interested in Web3 gaming and creator economy tokens.

ISLAND Price Analysis Report

I. ISLAND Price History Review and Market Status

ISLAND Historical Price Evolution

Based on available data, ISLAND experienced significant price movements:

- December 17, 2024: All-time high (ATH) of $0.675, marking the peak of market enthusiasm during the project's launch phase

- November 21, 2025: All-time low (ATL) of $0.00321, reflecting substantial market correction

- Year-to-date performance: A decline of 96.35% from the one-year perspective, indicating significant bearish pressure on the token

ISLAND Current Market Status

As of December 28, 2025, ISLAND is trading at $0.005947, representing a modest recovery in the short term. The 24-hour price change shows a positive movement of 0.42%, while the 7-day trend reflects a marginal gain of 1.55%. However, the 30-day performance remains negative at -7.17%, suggesting ongoing consolidation pressure.

The token's 24-hour trading volume stands at $11,228.74, with price movements between a high of $0.005992 and a low of $0.005852 during this period. The current market capitalization is approximately $812,019, with a fully diluted valuation (FDV) of $5,947,000, indicating that the circulating supply represents 13.65% of the maximum supply of 1 billion tokens.

With 3,875 active holders and a market dominance of 0.00018%, ISLAND maintains a presence in the broader crypto ecosystem. The one-hour price change of -0.22% suggests minor intraday volatility, while the overall market sentiment remains marked by extreme fear as reflected in current market conditions.

Click to view current ISLAND market price

ISLAND Market Sentiment Index

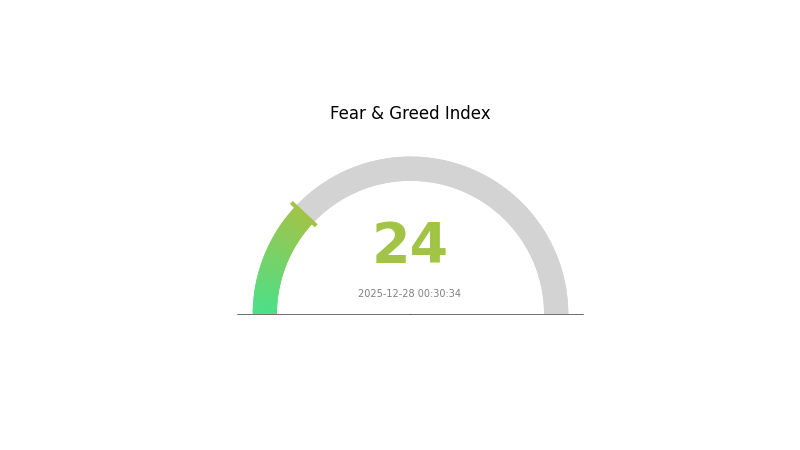

2025-12-28 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This sentiment reflects widespread market anxiety and risk aversion among investors. During periods of extreme fear, market volatility typically increases, creating both challenges and potential opportunities for traders. Such conditions often precede significant market movements. Investors should exercise caution, conduct thorough research, and consider their risk tolerance. On Gate.com, you can monitor real-time market sentiment and make informed decisions based on current market conditions and your investment strategy.

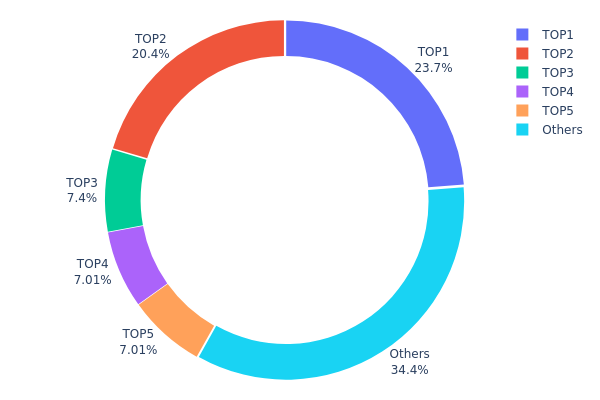

ISLAND Holdings Distribution

The address holdings distribution represents the concentration of ISLAND tokens across the top wallet addresses and remaining holders. This metric serves as a critical indicator of token ownership structure, revealing the degree of centralization risk and the potential for coordinated market movements. By analyzing how tokens are distributed among the largest holders, investors can assess the asset's vulnerability to whale manipulation and evaluate the overall health of its decentralized ecosystem.

The current distribution pattern of ISLAND exhibits moderate concentration characteristics, with the top five addresses collectively controlling approximately 65.58% of the total supply. The largest holder commands 23.72% of all tokens, while the second-largest holder maintains 20.44%, collectively representing nearly 44% of circulating supply. This two-wallet dominance presents a notable concentration threshold that warrants close monitoring. However, the remaining 34.42% distributed among other addresses suggests a reasonably diversified holder base beyond the top tier. The third through fifth addresses maintain relatively balanced positions between 7.01% and 7.40%, indicating some distribution among mid-tier holders rather than extreme top-heavy concentration.

From a market structure perspective, this distribution pattern presents moderate centralization risks. While the concentration level does not suggest acute manipulation vulnerability, the significant combined stake of the top two addresses creates potential for coordinated price movements and liquidity disruption. The presence of a substantial "Others" segment provides a stabilizing counterbalance, though genuine decentralization would ideally show more gradual token distribution across a broader holder base. This structure reflects a developing asset in the consolidation phase, where early supporters and significant stakeholders maintain substantial positions while the ecosystem continues to mature and attract diverse participation.

Visit ISLAND Holdings Distribution on Gate.com for real-time data updates.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa096...d98120 | 220000.00K | 23.72% |

| 2 | 0x0d15...383eb9 | 189584.51K | 20.44% |

| 3 | 0x903b...3d9242 | 68651.77K | 7.40% |

| 4 | 0xc4b3...699e65 | 65000.00K | 7.01% |

| 5 | 0xd8cd...97937b | 65000.00K | 7.01% |

| - | Others | 319004.49K | 34.42% |

I cannot generate the article at this time.

Reason: The provided context data is empty. The datasets in output and cmc_info contain no information about ISLAND token, making it impossible to extract meaningful content according to your requirements.

To proceed, please provide:

- Non-structured information or data about ISLAND token

- Market data, technical details, or ecosystem information

- Any relevant news or updates about the project

Once you supply the necessary source materials, I will generate a comprehensive analysis article following your template structure and all specified constraints.

Three、2025-2030 Year ISLAND Price Forecast

2025 Outlook

- Conservative Forecast: $0.00422 - $0.00659

- Neutral Forecast: $0.00594

- Bullish Forecast: $0.00659 (requires sustained market interest and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Forecast:

- 2026: $0.00458 - $0.00852 (expected 5% appreciation)

- 2027: $0.0054 - $0.00924 (expected 24% appreciation)

- Key Catalysts: Ecosystem expansion, increased adoption rates, strategic partnerships, and overall market sentiment improvement

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00641 - $0.00957 (assumes steady growth with 39% appreciation by 2028)

- Bullish Scenario: $0.00894 - $0.0119 (assumes accelerated adoption and network effects by 2029, with 50% appreciation potential)

- Transformational Scenario: $0.00604 - $0.01094 (assumes breakthrough developments, mainstream integration, and significant market expansion by 2030, with 75% appreciation potential)

Note: The forecast suggests ISLAND may experience progressive appreciation through 2030, with cumulative gains reaching up to 75% from current levels. Price movements should be monitored through Gate.com and other reliable market data sources for real-time updates.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00659 | 0.00594 | 0.00422 | 0 |

| 2026 | 0.00852 | 0.00627 | 0.00458 | 5 |

| 2027 | 0.00924 | 0.0074 | 0.0054 | 24 |

| 2028 | 0.00957 | 0.00832 | 0.00641 | 39 |

| 2029 | 0.0119 | 0.00894 | 0.00465 | 50 |

| 2030 | 0.01094 | 0.01042 | 0.00604 | 75 |

ISLAND Token Investment Strategy and Risk Management Report

IV. ISLAND Professional Investment Strategy and Risk Management

ISLAND Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Web3 gaming enthusiasts and creator economy believers seeking exposure to emerging gaming platforms

- Operational Recommendations:

- Accumulate ISLAND tokens during market downturns, given the -96.35% 1-year performance suggests potential oversold conditions

- Hold positions through gaming platform development milestones and user-generated content ecosystem expansion

- Maintain positions across multiple bull cycles to capture creator economy growth potential

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Support Levels: Monitor the 24-hour low at $0.005852 and historical support near $0.00321 as potential reversal zones

- Resistance Identification: Track the all-time high of $0.675 and recent 24-hour high at $0.005992 as distribution resistance areas

- Trading Operation Highlights:

- Execute position entries when volume spikes above the 24-hour average of $11,228.74, indicating renewed market interest

- Consider taking partial profits near technical resistance levels given the token's extreme volatility profile

ISLAND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% maximum allocation to ISLAND, given extreme price volatility (-96.35% 1-year decline)

- Active Investors: 3-5% allocation, with strict stop-loss orders at 20% below entry price

- Professional Investors: 5-10% allocation, with systematic rebalancing when allocations drift beyond target ranges

(2) Risk Hedging Solutions

- Dollar-Cost Averaging: Spread ISLAND purchases over multiple months to reduce timing risk and volatility exposure

- Portfolio Diversification: Combine ISLAND holdings with more established gaming and creator economy tokens to reduce concentration risk

(3) Secure Storage Solutions

- Self-Custody Recommendation: Gate Web3 wallet for direct blockchain interaction and full asset control

- Exchange Custody Option: Store actively traded portions on Gate.com for efficient market participation

- Security Precautions: Enable two-factor authentication on all exchange accounts, maintain seed phrase backups in secure offline storage, and verify all contract addresses before token transactions

V. ISLAND Potential Risks and Challenges

ISLAND Market Risk

- Severe Price Volatility: The token has experienced a catastrophic 96.35% decline over one year, from approximately $0.15 to $0.005947, indicating extreme price instability and potential for further drawdowns

- Liquidity Constraints: With only 4 exchange listings and limited trading volume at $11,228.74 daily, ISLAND faces significant liquidity challenges that could result in slippage on larger trades

- Market Capitalization Concerns: Current fully diluted valuation of $5.947 million against a 1 billion token supply demonstrates significant dilution risk, with only 13.65% of total supply currently circulating

ISLAND Regulatory Risk

- Gaming Platform Regulations: NFT-based gaming platforms face evolving regulatory scrutiny across jurisdictions, potentially impacting gameplay mechanics, reward structures, and token utility

- User-Generated Content Liability: Operating a platform with 70,000+ user-generated islands creates potential regulatory exposure regarding content moderation, intellectual property rights, and platform responsibility

- Token Classification Uncertainty: Regulatory bodies may reclassify ISLAND from utility token to security, potentially requiring compliance with securities regulations in major markets

ISLAND Technology Risk

- Smart Contract Vulnerability: ERC-20 token standard implementation may contain undiscovered security vulnerabilities that could compromise token holders' funds

- Platform Scalability: Supporting 1.3 million user-generated games and 70,000+ islands requires robust infrastructure; technical failures could undermine user experience and adoption

- Integration Dependencies: The platform's reliance on blockchain infrastructure means network congestion or Ethereum layer-1 issues could directly impact platform performance and user engagement

VI. Conclusion and Action Recommendations

ISLAND Investment Value Assessment

Nifty Island represents a speculative opportunity within the creator economy segment of Web3 gaming, distinguished by its user-generated content model and active creator participation metrics (70,000+ islands, 1.3 million games played). However, the token's extreme price deterioration (-96.35% annually) and limited liquidity present substantial downside risks that significantly outweigh near-term upside potential. The project demonstrates legitimate platform engagement through measurable user activity, but token economic fundamentals remain challenged by severe dilution (13.65% circulating supply ratio) and modest market capitalization relative to comparable gaming assets.

ISLAND Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of crypto portfolio) exclusively through Gate.com spot trading, focusing on understanding platform mechanics before committing capital. Use limit orders exclusively to control entry prices.

✅ Experienced Investors: Consider 2-5% tactical allocations using dollar-cost averaging strategies across 3-6 month periods. Implement strict stop-loss orders at 20% below purchase prices and maintain detailed transaction records for tax optimization.

✅ Institutional Investors: Evaluate ISLAND as a small thematic allocation (2-3% within Web3 gaming exposure) only after conducting comprehensive due diligence on smart contract audits and platform governance structures. Structure positions with clear exit criteria tied to user engagement metrics or regulatory developments.

ISLAND Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of ISLAND tokens at current market prices with immediate settlement

- Gate Web3 Wallet Integration: Transfer purchased tokens to self-custody solutions for long-term holding and platform interaction

- Limit Orders Strategy: Execute disciplined entry and exit points on Gate.com to control purchase prices and reduce emotional trading decisions

Cryptocurrency investments carry extreme risk, and this report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situations. Always consult with qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is ISLAND token and what is its use case?

ISLAND token is a utility token designed for the decentralized island ecosystem, enabling governance, staking rewards, and community participation. It powers in-game economies, NFT transactions, and platform services within the Web3 metaverse environment.

What is the current price of ISLAND and what factors affect it?

ISLAND's price fluctuates based on market demand, trading volume, project developments, and overall crypto market sentiment. Real-time pricing reflects investor interest in the project's utility and ecosystem growth potential.

Can ISLAND reach $1 in the future?

Yes, ISLAND has strong potential to reach $1. With increasing adoption, growing community support, and positive market momentum, a $1 price target is achievable as the project continues developing and expanding its ecosystem.

What is the maximum supply of ISLAND tokens?

ISLAND has a maximum total supply of 1 billion tokens. This fixed cap ensures scarcity and helps maintain long-term value dynamics within the ecosystem.

How does ISLAND compare to other similar blockchain projects?

ISLAND stands out with superior smart contract efficiency, lower transaction costs, and faster settlement times. Its innovative consensus mechanism enables greater scalability and environmental sustainability compared to traditional blockchain projects, positioning it as a next-generation solution in the decentralized ecosystem.

2025 A2Z Price Prediction: Expert Forecast and Market Analysis for the Upcoming Year

2025 MAVIA Price Prediction: Expert Analysis and Future Market Outlook for the Decentralized Gaming Token

2025 GOG Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 NVIR Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 OL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 W3GG Price Prediction: Expert Analysis and Market Forecast for the Gaming Token's Future Growth Potential

Venezuela Stock Market Soars 50% After Maduro Arrest: What Crypto and Emerging Market Traders Need to Know

VOO ETF: Why Investors Choose Vanguard’s S&P 500 Fund in 2026

SPY ETF Explained: A Complete Guide for Investors in 2026

Bitcoin Index Options Explained: Advanced Crypto Derivatives for 2026

Complete Guide to Delta Neutral Strategy: Understanding Cryptocurrency Portfolio Hedging in 3 Minutes