Post content & earn content mining yield

placeholder

CryptoWorldDirector

"Market Analysis for January 13: Once January is over, the Dragon Head Market Will Begin!"

Yesterday's Bitcoin price was supported at 90488 after a spike, then it consolidated and attempted to push higher again without breaking the previous high of 925, forming a resistance level. The boring market created by the whale whales is gradually eroding the patience of retail investors, but there's no need to be anxious. January must be endured so that we can see the upward trend in February. Currently, on the daily chart, the indicators do not suggest the start of a downtrend. So relax and wait pati

View OriginalYesterday's Bitcoin price was supported at 90488 after a spike, then it consolidated and attempted to push higher again without breaking the previous high of 925, forming a resistance level. The boring market created by the whale whales is gradually eroding the patience of retail investors, but there's no need to be anxious. January must be endured so that we can see the upward trend in February. Currently, on the daily chart, the indicators do not suggest the start of a downtrend. So relax and wait pati

- Reward

- like

- Comment

- Repost

- Share

I'm already numb, brothers!!!

Lost everything! Lost everything!!!

Don't ever mess with me on contracts again, you idiots!!!

View OriginalLost everything! Lost everything!!!

Don't ever mess with me on contracts again, you idiots!!!

- Reward

- like

- Comment

- Repost

- Share

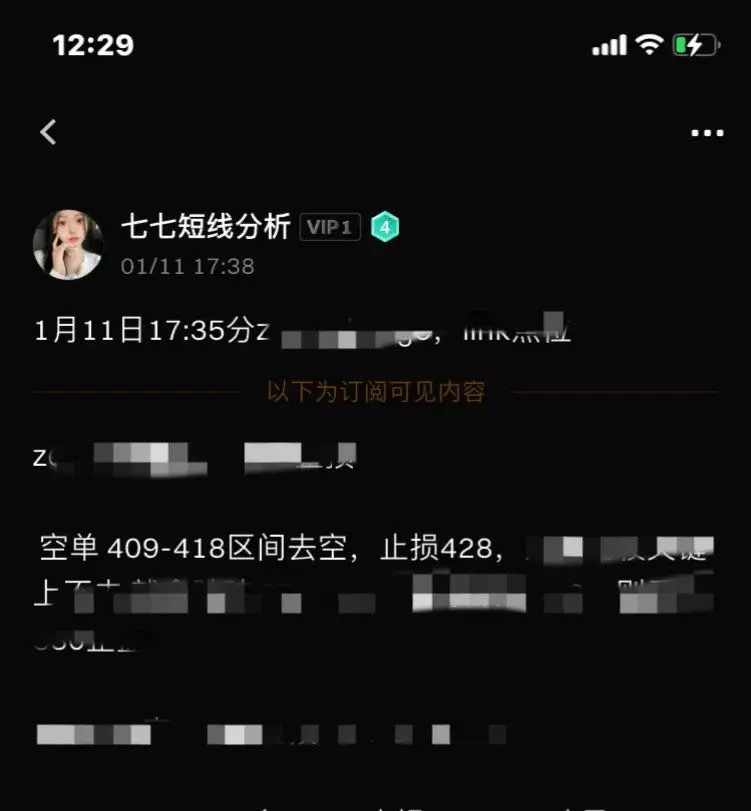

zec409-418 flat, 393.5 long. Did you seize the opportunity?

View Original

- Reward

- like

- Comment

- Repost

- Share

马上发

马马马

Created By@你喜欢夏天吗

Subscription Progress

0.00%

MC:

$0

Create My Token

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

My Gate 2025 Year-End Summary is here! See how I performed this year.

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VQJBBG1BBQ&ref_type=126&shareUid=U1dBVF5aBwAO0O0O

Click the link to view your exclusive #2025GateYearEndSummary and claim a 20 USDT Position Voucher. https://www.gate.com/competition/your-year-in-review-2025?ref=VQJBBG1BBQ&ref_type=126&shareUid=U1dBVF5aBwAO0O0O

- Reward

- like

- Comment

- Repost

- Share

Bitcoin (BTC, 91,425.11 USDT) is correcting due to profit-taking after the rise, but the fundamental factors remain strong: institutional purchases (MicroStrategy, Morgan Stanley), inflows into ETFs, and legislative changes in the US are boosting market confidence. At the same time, Ethereum and Solana are increasing network activity, creating a positive backdrop for the entire sector.$BTC

BTC-0,25%

- Reward

- 1

- Comment

- Repost

- Share

🚨 WARNING: CRYPTO IN 401(k) IS A RISK!

Senator Elizabeth Warren has written a letter to the SEC warning against the inclusion of crypto in retirement accounts.

Warren stated that a 401(k) is not a playground and that crypto's volatility could cause people to lose their entire life savings.

She questioned President Trump’s Executive Order that allows pension funds to hold volatile crypto assets.

Senator Elizabeth Warren has written a letter to the SEC warning against the inclusion of crypto in retirement accounts.

Warren stated that a 401(k) is not a playground and that crypto's volatility could cause people to lose their entire life savings.

She questioned President Trump’s Executive Order that allows pension funds to hold volatile crypto assets.

TRUMP-1,71%

- Reward

- like

- Comment

- Repost

- Share

#CPI数据将公布 $BTC January 13, 2026 14:20 (UTC+8), BTC price is approximately $91,180 USD, down 0.64% in 24h, trading range $90,128-$92,332 USD, volume $2.159 billion USD. Overall narrow consolidation with indicator divergence, awaiting a direction choice.

Key Levels

- Support: 90,618 (Strong, 89/100), 89,393, 84,467

- Resistance: 92,497 (Key, 83/100), 94,789, 93,947

Indicator Overview

- Trend: Price is above **EMA20 (91,151)**, short-term bullish; Supertrend signals a bearish trend, divergence in trend signals.

- Momentum: RSI(14)=52.06 neutral, no overbought or oversold; MACD red bars

Key Levels

- Support: 90,618 (Strong, 89/100), 89,393, 84,467

- Resistance: 92,497 (Key, 83/100), 94,789, 93,947

Indicator Overview

- Trend: Price is above **EMA20 (91,151)**, short-term bullish; Supertrend signals a bearish trend, divergence in trend signals.

- Momentum: RSI(14)=52.06 neutral, no overbought or oversold; MACD red bars

BTC-0,25%

- Reward

- 2

- Comment

- Repost

- Share

$SANA weekly candles

MA retest more or less done

demand zone from 10 weeks old candle overlapping the supply zone

MA retest more or less done

demand zone from 10 weeks old candle overlapping the supply zone

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is currently in a repeated oscillation pattern, with the price rebounding after touching the lower boundary of the channel, but facing obvious resistance near the midline in the short term. The market is less likely to break below the bottom directly; if it dips again around $90,000, it can still be considered a low-entry opportunity.

Ethereum's movement is constrained by a triangle consolidation pattern, with more obvious selling pressure above, and lacks a clear direction in the short term. It is recommended to focus on the test results of the price against the pattern boundary and o

View OriginalEthereum's movement is constrained by a triangle consolidation pattern, with more obvious selling pressure above, and lacks a clear direction in the short term. It is recommended to focus on the test results of the price against the pattern boundary and o

- Reward

- 1

- Comment

- Repost

- Share

#Gate 2025 年终社区盛典#

Peak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VQISBLEOBG&refType=2&refUid=47171750&ref_type=165&utm_cmp=xjdtmcgP

View OriginalPeak Host & Content Expert Year-End Selection

Who will become the Peak Host of the year? Who will top the Content Expert list? Come and vote with me, support your favorite hosts and creators, and witness the birth of community stars together!

https://www.gate.com/activities/community-vote-2025?ref=VQISBLEOBG&refType=2&refUid=47171750&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- like

- Comment

- Repost

- Share

牛气冲天

牛气冲天

Created By@LaoJiu_sLabel

Listing Progress

4.10%

MC:

$4.38K

Create My Token

Good night friends , say it back

- Reward

- like

- Comment

- Repost

- Share

Sometimes all you need to pay attention on what you are doing.

Hope you had a great night rest.

Just say GM when you get to see this post

Hope you had a great night rest.

Just say GM when you get to see this post

- Reward

- like

- Comment

- Repost

- Share

🚨 Powell Under Investigation? Markets on Alert

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

#FedWatch #MacroRisk #CryptoVolatility

Recent reports have sparked headlines around U.S. Fed Chair Jerome Powell and an alleged investigation tied to Fed HQ renovation spending.

⚠️ No verdict, no confirmation yet — but markets don’t wait for outcomes, they react to uncertainty.

📉 Why Markets Care The Federal Reserve runs on credibility and trust.

Even perceived governance risk can: • Shake investor confidence

• Increase volatility

• Delay risk-taking across markets

📊 Immediate Market Reaction 🔹 Stocks & Crypto: Sensitive to policy clarity → ch

- Reward

- like

- Comment

- Repost

- Share

Libtard car wash

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More17.61K Popularity

23.25K Popularity

36.49K Popularity

16.5K Popularity

98.1K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.7KHolders:20.58%

- MC:$3.55KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$3.54KHolders:10.00%

News

View MoreRIVER(River)24小时上涨20.85%

1 m

Hedge funds post their best performance since 2009: stock strategies and macro themes emerge as the biggest winners

4 m

"Strategy Opponent Position" switches from short to long again, with the total long position size approaching $159 million.

5 m

Lighter Price Prediction: LIT drops 20% below key level, selling pressure is still being released

6 m

BNB Chain's transaction fee revenue over the past 24 hours surpasses Solana

12 m

Pin