2025 XCAD Price Prediction: Bullish Outlook as Adoption and Partnerships Drive Growth

The article "2025 XCAD Price Prediction: Bullish Outlook as Adoption and Partnerships Drive Growth" examines the investment value of XCAD, focusing on its market position in the creator economy. It analyzes historical price trends, current market status, and future predictions for 2025-2030, offering professional strategies for investment and risk management. Targeting investors interested in DeFi and creator economy assets, the piece highlights key factors like market sentiment, supply mechanisms, and ecosystem development. Available trading options include spot trading and staking on Gate, emphasizing the token's growth potential and associated risks.Introduction: XCAD's Market Position and Investment Value

Xcad Network (XCAD), as a DeFi tool provider for content creators, has made significant strides since its inception. As of 2025, XCAD's market capitalization stands at $955,731, with a circulating supply of approximately 102,623,399 tokens, and a price hovering around $0.009313. This asset, often referred to as the "creator economy enabler," is playing an increasingly crucial role in the fields of content monetization and NFT creation.

This article will comprehensively analyze XCAD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. XCAD Price History Review and Current Market Status

XCAD Historical Price Evolution

- 2021: XCAD launched, initial price at $0.1

- 2022: Reached all-time high of $9.06 on January 21

- 2025: Experienced significant decline, price dropped to all-time low of $0.0089351 on November 6

XCAD Current Market Situation

XCAD is currently trading at $0.009313, showing a 1.33% decrease in the last 24 hours. The token has seen a substantial decline of 97.54% over the past year. With a circulating supply of 102,623,399 XCAD tokens, the current market capitalization stands at $955,731. The fully diluted valuation is $1,814,339, indicating a market cap to FDV ratio of 51.31%. Trading volume in the last 24 hours amounts to $4,152.96.

Click to view the current XCAD market price

XCAD Market Sentiment Indicator

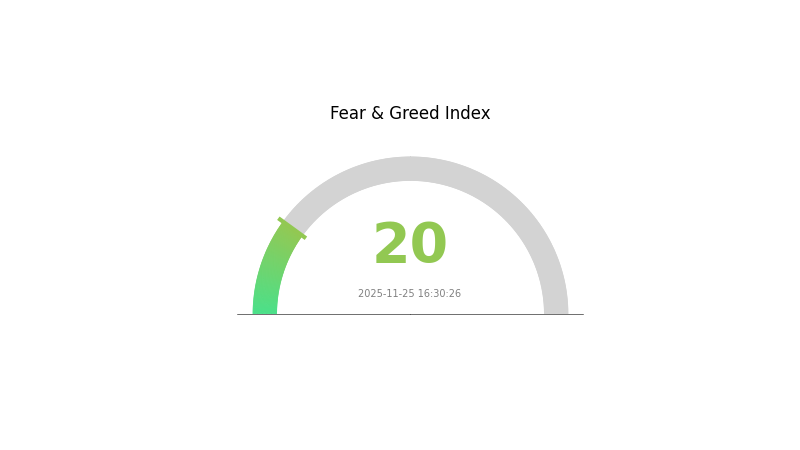

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The XCAD market is currently experiencing extreme fear, with the sentiment index plummeting to 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market volatility may persist. Traders should closely monitor key support levels and market developments. Remember, while fear can present opportunities, it's crucial to conduct thorough research and manage risk effectively before making any investment decisions in the cryptocurrency market.

XCAD Holdings Distribution

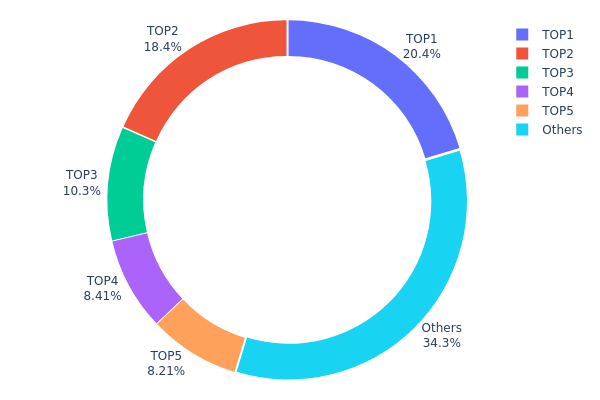

The address holdings distribution data for XCAD reveals a highly concentrated ownership structure. The top five addresses collectively hold 65.68% of the total supply, with the largest holder controlling 20.42%. This concentration level raises concerns about potential market manipulation and volatility.

Such a concentrated distribution could lead to significant price fluctuations if large holders decide to sell their positions. It also suggests a lower degree of decentralization, which may impact the project's governance and overall market stability. The high concentration in a few addresses indicates that XCAD's on-chain structure might be vulnerable to sudden changes initiated by these major stakeholders.

While 34.32% of the supply is distributed among other addresses, the dominance of the top holders remains a key factor to monitor. This distribution pattern reflects a market structure that could be susceptible to coordinated actions by major players, potentially affecting price discovery and liquidity dynamics for XCAD.

Click to view the current XCAD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x031b...7c72dc | 39800.00K | 20.42% |

| 2 | 0x3ee1...8fa585 | 35828.37K | 18.39% |

| 3 | 0xe019...a8d266 | 20000.00K | 10.26% |

| 4 | 0xf89d...5eaa40 | 16374.84K | 8.40% |

| 5 | 0xadb3...cc2bbc | 16000.00K | 8.21% |

| - | Others | 66814.78K | 34.32% |

II. Key Factors Affecting XCAD's Future Price

Supply Mechanism

- Strong Holder Offering (SHO): Users need to stake $DAO tokens and have long-term holding records to qualify for allocation, promoting long-term alignment of interests between investors and projects.

Institutional and Whale Dynamics

- Enterprise Adoption: XCAD has been adopted by notable projects such as My Neighbor Alice.

Technical Development and Ecosystem Building

- DAO Farms and Vaults: New features allow users to continuously earn token rewards during staking periods, with annual yields up to 300-1500%, extending community fund lock-up time.

- Ecosystem Applications: XCAD is part of the PLAY area of the XCAD Network, centered around the #Watch2Earn concept. In this ecosystem, Play Token is crucial for buying, trading, upgrading, and other activities.

III. XCAD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00859 - $0.00934

- Neutral prediction: $0.00934 - $0.01056

- Optimistic prediction: $0.01056 - $0.01177 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00808 - $0.01421

- 2028: $0.00967 - $0.0188

- Key catalysts: Technological advancements, partnerships, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.01621 - $0.01897 (assuming steady growth and market adoption)

- Optimistic scenario: $0.01897 - $0.022 (assuming strong project performance and favorable market conditions)

- Transformative scenario: $0.022+ (extreme positive developments in the project and crypto ecosystem)

- 2030-12-31: XCAD $0.022 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01177 | 0.00934 | 0.00859 | 0 |

| 2026 | 0.01552 | 0.01056 | 0.00549 | 13 |

| 2027 | 0.01421 | 0.01304 | 0.00808 | 39 |

| 2028 | 0.0188 | 0.01362 | 0.00967 | 46 |

| 2029 | 0.02172 | 0.01621 | 0.01313 | 74 |

| 2030 | 0.022 | 0.01897 | 0.01593 | 103 |

IV. XCAD Professional Investment Strategies and Risk Management

XCAD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors and believers in the creator economy

- Operation suggestions:

- Accumulate XCAD during market dips

- Stake XCAD to earn rewards and support the network

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor creator partnerships and platform adoption rates

- Pay attention to overall market sentiment in the creator economy sector

XCAD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance XCAD with other crypto assets and traditional investments

- Stop-loss orders: Use to limit potential losses during volatile periods

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. XCAD Potential Risks and Challenges

XCAD Market Risks

- Volatility: High price fluctuations common in small-cap tokens

- Liquidity: Limited trading volumes may impact entry and exit

- Competition: Emerging platforms in the creator economy space

XCAD Regulatory Risks

- Uncertain regulations: Potential changes in cryptocurrency laws

- Cross-border compliance: Varying rules across different jurisdictions

- Token classification: Possibility of being classified as a security

XCAD Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network load

- Dependency on creator adoption: Success tied to platform growth

VI. Conclusion and Action Recommendations

XCAD Investment Value Assessment

XCAD presents a unique opportunity in the creator economy sector, with potential for long-term growth. However, it faces short-term risks due to market volatility and regulatory uncertainties.

XCAD Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about the platform ✅ Experienced investors: Consider a balanced approach with regular DCA and staking ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

XCAD Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Staking: Participate in XCAD staking programs for passive income

- NFT marketplace: Engage with creator NFTs on the XCAD platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

Share

Content