2025 TONC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: TONC's Market Position and Investment Value

TONCommunity (TONC) is a decentralized blockchain asset that has been operating since its launch in 2020. As of December 25, 2025, TONC maintains a market capitalization of approximately $1.76 million, with a circulating supply of approximately 268.12 million tokens, trading at around $0.006563 per token. This digital asset continues to evolve within the decentralized blockchain ecosystem.

This article will provide a comprehensive analysis of TONC's price movements and market trends for 2025-2030, incorporating historical performance data, market dynamics, ecosystem developments, and macroeconomic factors to offer investors professional price forecasts and practical investment strategies. Whether you are an experienced trader or a cryptocurrency enthusiast considering exposure to TONC, this guide aims to equip you with the insights needed to make informed investment decisions on platforms such as Gate.com.

I. TONC Price History Review and Current Market Status

TONC Historical Price Evolution

- 2020: FreeTON blockchain network launched on May 7, 2020, marking the genesis of the TONC ecosystem on a decentralized global network infrastructure.

- 2020 (September): TONC reached its all-time high of $0.104949 on September 3, 2020, representing the peak valuation during the early adoption phase.

- 2021 (August): TONC declined to its all-time low of $0.00331783 on August 10, 2021, marking a significant correction from the historical peak.

- 2025 (December): TONC has experienced a cumulative decline of -63.23% over the one-year period, reflecting sustained downward pressure on the asset price.

TONC Current Market Conditions

As of December 25, 2025, TONC is trading at $0.006563 with a 24-hour trading volume of $11,872.94. The token exhibits mild downward momentum in the short term, declining 0.37% over the past 24 hours. Over extended timeframes, the asset demonstrates significant bearish pressure: the 7-day change stands at -2.06%, the 30-day change at -21.78%, and the 1-year change at -63.23%.

The fully diluted market capitalization is $2,625,200.00, while the current market capitalization stands at $1,759,680.46. With a circulating supply of 268,121,355.45 TONC tokens against a maximum supply of 5,047,558,527.70 tokens, the circulating supply represents approximately 5.31% of the maximum supply. The token maintains a market dominance of 0.000082% in the broader cryptocurrency ecosystem.

TONC is primarily traded on Gate.com, with the contract address 0x6a6c2ada3ce053561c2fbc3ee211f23d9b8c520a on the Ethereum blockchain. The asset currently holds a ranking of 2,210 among cryptocurrencies and maintains 4,951 token holders.

Click to view current TONC market price

TONC Market Sentiment Indicator

2025-12-25 Fear and Greed Index: 23 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 23, indicating heightened investor anxiety and pessimism. Such low readings typically reflect significant market concerns, including potential price declines or broader economic uncertainty. During periods of extreme fear, risk-averse investors often retreat from positions. However, contrarian traders view extreme fear as potential buying opportunities, as markets frequently recover after prolonged periods of pessimism. On Gate.com, you can track real-time sentiment indicators to inform your trading decisions and monitor market psychology trends.

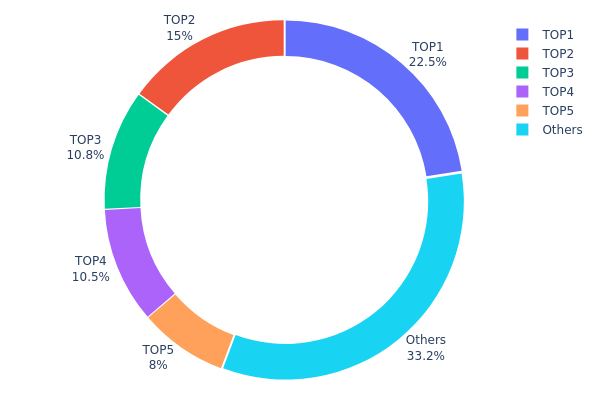

TONC Holdings Distribution

The address holdings distribution chart illustrates the concentration of TONC tokens across individual wallet addresses on the blockchain. This metric is critical for assessing the decentralization level of a token and identifying potential risks associated with large holder concentration, which can influence market dynamics and price stability.

Current analysis of TONC's top holder distribution reveals a moderate degree of concentration. The top five addresses collectively control approximately 66.77% of the total token supply, with the largest holder accounting for 22.49% and the second-largest holding 15.00%. While this concentration pattern is not atypical for tokens in their growth phases, the cumulative holdings of the top four addresses—totaling 58.77%—indicate a meaningful concentration risk. The remaining 33.23% is dispersed among other addresses, suggesting some degree of decentralization at the lower tiers, though the vast majority of tokens remain in relatively few hands.

This distribution pattern presents both structural implications and market considerations. The concentrated holdings among top addresses could potentially amplify price volatility during significant liquidation or accumulation events, as large-scale transactions from these wallet addresses may disproportionately impact market momentum. However, the presence of distributed holdings beyond the top five addresses suggests that TONC maintains reasonable dispersion throughout its holder base, mitigating extreme centralization risks. The current structure reflects a typical profile for mid-cap tokens, where institutional or early investors maintain substantial positions while retail participation gradually expands. This configuration indicates that TONC's on-chain structure demonstrates moderate decentralization characteristics, with sufficient distribution to support market functioning while retaining influence from key stakeholders.

View current TONC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9eee...89d51c | 89999.60K | 22.49% |

| 2 | 0xc4a8...e62008 | 60000.00K | 15.00% |

| 3 | 0x42b3...b12a52 | 43308.91K | 10.82% |

| 4 | 0x45fc...47faba | 41879.04K | 10.46% |

| 5 | 0x88bd...4e1c2c | 32000.00K | 8.00% |

| - | Others | 132812.45K | 33.23% |

Core Factors Influencing TON's Future Price

Network Utility and Ecosystem Adoption

- Toncoin Utility: Toncoin's utility within the TON ecosystem is a key factor affecting its price. The network's effectiveness and adoption rate directly influence token demand and value.

Market Dynamics and Investor Sentiment

-

Supply and Demand Dynamics: Price predictions for TON are influenced by multiple factors including market dynamics, investor sentiment, and supply-demand fluctuations. These elements play crucial roles in determining short-term and long-term price movements.

-

Market Sentiment Impact: Social media and community engagement significantly influence investor decisions and price momentum. Broader market sentiment can amplify or dampen price movements regardless of fundamental factors.

III. 2025-2030 TONC Price Forecast

2025 Outlook

- Conservative Estimate: $0.00576 - $0.00655

- Neutral Estimate: $0.00655

- Optimistic Estimate: $0.00708 (pending sustained market momentum)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation period with selective growth opportunities

- Price Range Forecast:

- 2026: $0.00477 - $0.00933

- 2027: $0.00452 - $0.00912

- 2028: $0.00439 - $0.01238

- Key Catalysts: Increased institutional adoption, ecosystem development milestones, market sentiment improvement, and technological upgrades

2029-2030 Long-term Outlook

- Base Case: $0.00997 - $0.01217 (2029) and $0.00589 - $0.01461 (2030), assuming steady adoption and moderate market expansion

- Optimistic Case: $0.01217+ (2029) and $0.01461+ (2030), contingent on breakthrough partnerships and significant user growth

- Transformational Case: $0.015+ (2030), predicated on mainstream adoption, regulatory clarity, and major ecosystem integration achievements

Note: All price predictions should be viewed as analytical references only. Market volatility in cryptocurrency space remains substantial. Investors are advised to conduct comprehensive due diligence through platforms like Gate.com and maintain appropriate risk management strategies.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00708 | 0.00655 | 0.00576 | 0 |

| 2026 | 0.00933 | 0.00681 | 0.00477 | 3 |

| 2027 | 0.00912 | 0.00807 | 0.00452 | 23 |

| 2028 | 0.01238 | 0.0086 | 0.00439 | 31 |

| 2029 | 0.01217 | 0.01049 | 0.00997 | 59 |

| 2030 | 0.01461 | 0.01133 | 0.00589 | 72 |

TONC Investment Strategy and Risk Management Report

I. Overview of TONC

Token Name: TONCommunity (TONC)

Current Price: $0.006563

Market Capitalization: $1,759,680.46

Fully Diluted Valuation: $2,625,200

Circulating Supply: 268,121,355.45 TONC

Total Supply: 400,000,000 TONC

Maximum Supply: 5,047,558,527.7 TONC

24H Trading Volume: $11,872.94

Market Ranking: 2,210

Project Background

FreeTON is a decentralized global blockchain network that was launched on TONOS on May 7, 2020. TONC represents the community token associated with this ecosystem.

II. Price Performance Analysis

Recent Price Movements

| Time Period | Price Change | Change Amount |

|---|---|---|

| 1 Hour | +0.0018% | +$0.000000118 |

| 24 Hours | -0.37% | -$0.000024373 |

| 7 Days | -2.06% | -$0.000138041 |

| 30 Days | -21.78% | -$0.001827437 |

| 1 Year | -63.23% | -$0.011285790 |

Historical Price Levels

- All-Time High: $0.104949 (September 3, 2020)

- All-Time Low: $0.00331783 (August 10, 2021)

- 24H High: $0.006588

- 24H Low: $0.00654

III. Market Analysis

Market Position

- Market Dominance: 0.000082%

- Market Cap to FDV Ratio: 5.31%

- Active Holders: 4,951

- Trading Venues: 1 (Gate.com)

Market Sentiment

The token shows significant long-term depreciation (-63.23% over one year) with moderate short-term weakness (-0.37% in 24 hours). The low circulating supply ratio (5.31% of max supply) indicates substantial dilution potential.

IV. TONC Professional Investment Strategy and Risk Management

TONC Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Developers and community members interested in the FreeTON ecosystem

- Operational Recommendations:

- Accumulate during periods of market weakness with small positions

- Maintain a long-term perspective aligned with FreeTON network development milestones

- Regularly review the project's technical progress and ecosystem adoption

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Support/Resistance Levels: Monitor the 24-hour high and low prices as dynamic support and resistance points

- Volume Analysis: Track the relatively low 24-hour volume ($11,872.94) which indicates limited liquidity

-

Trading Operation Points:

- Exercise caution due to limited trading volume and potential slippage

- Avoid large position entries that could significantly impact the thin order book

- Monitor price action around historical resistance at $0.0066

TONC Risk Management Framework

(1) Asset Allocation Principles

Given the high-risk nature of this token:

- Conservative Investors: 0-1% of portfolio

- Active Investors: 1-3% of portfolio

- Professional Investors: 3-5% of portfolio (with robust risk management)

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine TONC with established cryptocurrencies to reduce concentration risk

- Position Sizing: Use strict position limits to cap maximum potential loss

- Stop-Loss Implementation: Establish predetermined exit points to limit downside exposure

(3) Security Storage Solutions

- Self-Custody: For TONC held on Ethereum network, ensure secure management of private keys through hardware wallets or secure software solutions

- Exchange Storage: TONC can be held on Gate.com with consideration of exchange security protocols

- Security Precautions: Never share private keys, use hardware wallets for significant holdings, enable two-factor authentication on exchange accounts

V. Potential Risks and Challenges

TONC Market Risks

- Severe Long-Term Depreciation: The token has declined 63.23% over the past year, indicating sustained selling pressure and potential loss of investor confidence

- Extremely Low Liquidity: With only $11,872.94 in 24-hour volume, large trades face severe slippage risk and potential market impact

- Significant Supply Dilution: Maximum supply of 5,047,558,527.7 TONC vastly exceeds current circulation, posing substantial dilution concerns for existing holders

TONC Regulatory Risks

- Unclear Project Status: Limited information about ongoing development activities and regulatory compliance measures

- Ecosystem Uncertainty: FreeTON's network evolution and regulatory stance across different jurisdictions remains undefined

- Token Classification Risk: Regulatory treatment of TONC tokens may change, affecting trading venues and holder rights

TONC Technical Risks

- Network Dependency: TONC's value is entirely dependent on FreeTON ecosystem viability and adoption

- Smart Contract Risk: As an Ethereum-based token, TONC faces inherent blockchain and smart contract vulnerabilities

- Low Community Engagement: Limited social media presence and community activity suggest reduced development support and ecosystem activity

VI. Conclusion and Action Recommendations

TONC Investment Value Assessment

TONC presents a highly speculative investment opportunity with significant downside risks. The 63.23% decline over one year combined with extremely low trading volume indicates limited market confidence. The token's viability depends entirely on FreeTON ecosystem development and adoption. Investors should approach this asset with extreme caution and allocate only capital they can afford to lose entirely.

TONC Investment Recommendations

✅ Beginners: Avoid this token. Focus on established cryptocurrencies with higher liquidity and clearer fundamentals first.

✅ Experienced Investors: Only consider minimal positions (under 2% of portfolio) if you have deep knowledge of the FreeTON ecosystem and can tolerate extreme volatility.

✅ Institutional Investors: Conduct extensive due diligence on FreeTON's development roadmap and network adoption metrics before consideration.

TONC Trading Participation Methods

- Via Gate.com: Access TONC trading directly on Gate.com's platform with support for both spot and margin trading

- Direct Ethereum Network: Interact with the TONC smart contract address (0x6a6c2ada3ce053561c2fbc3ee211f23d9b8c520a) on the Ethereum network using compatible wallets

- Liquidity Provision: Participate in token liquidity pools, though current volume suggests limited trading opportunities

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Will tonic reach 1 cent?

Tonic may reach 1 cent eventually, but not in the near term. Current market conditions and projections suggest this milestone could be achieved in the long term as the project develops and gains adoption.

Can Toncoin reach $50?

Yes, in a bullish scenario with mass adoption and growing ecosystem development, Toncoin could potentially reach $50 by 2030. This would require significant market expansion and increased utility.

Can Toncoin reach $100?

While Toncoin has strong growth potential driven by Telegram ecosystem expansion and increasing adoption, reaching $100 would require significant market capitalization growth. Current projections suggest this could take decades, depending on mainstream adoption and market conditions.

What will Ton be worth in 2025?

In 2025, Toncoin is expected to trade between $1.47 and $1.91, with an average price projection of $1.72 based on comprehensive market analysis.

What factors could drive Toncoin's price up or down?

Toncoin's price is driven by Bitcoin trends, overall crypto market movements, investor sentiment, and regulatory developments. Trading volume, adoption rates, and macroeconomic factors also significantly influence its price direction.

Is Toncoin a good investment and what are the risks?

Toncoin shows strong growth potential with its robust blockchain infrastructure and expanding ecosystem. However, consider regulatory uncertainties and market volatility risks before investing. Conduct thorough research to align with your investment goals.

How Will HOLO Price Evolve by 2030 Based on Current Market Trends?

2025 TCT Price Prediction: Navigating the Future of Cryptocurrency Investments

2025 TRUST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 COS Price Prediction: Expert Analysis and Market Forecast for the Decentralized Storage Token

2025 10SET Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 INTER Price Prediction: Expert Analysis and Market Forecast for the Coming Year

What is ENSO? New Infrastructure for Web3 and Smart Contract Automation

Michael Saylor: The Path to Leadership in the Cryptocurrency Sphere

What is a Bitcoin hardware wallet

Introduction to Phantom Wallet and How to Use It

What is LYP: A Comprehensive Guide to Understanding Lymphocyte Yield Protocol in Modern Medical Testing