2025 SPS Price Prediction: Expert Analysis and Market Forecast for Splinterlands Token

Introduction: Market Position and Investment Value of SPS

Splintershards (SPS) is a cryptocurrency governance token integrated into the Splinterlands game ecosystem, designed to provide high-level decision-making ability and product control for player groups, asset owners, and other stakeholders. Since its launch in 2021, SPS has established itself as a unique governance asset within the gaming and blockchain space. As of December 2025, SPS maintains a market capitalization of approximately $3.10 million, with a circulating supply of around 489.72 million tokens trading at $0.006337 per unit.

This governance token is playing an increasingly pivotal role in decentralized game management and community-driven decision-making within the Splinterlands ecosystem. The token's integration into the gaming platform enables stakeholders to participate directly in protocol governance and product development decisions.

This article will comprehensively analyze SPS price trends and market dynamics, combining historical price patterns, market supply-demand factors, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies for the period through 2030.

Splintershards (SPS) Market Analysis Report

I. SPS Price History Review and Market Status

SPS Historical Price Evolution

-

July 2021: SPS token launch and listing, reaching its all-time high of $1.065 on July 28, 2021, marking the peak of market enthusiasm for the governance token integrated into the Splinterlands gaming ecosystem.

-

2021-2022: Market correction phase following the initial launch peak, with significant price depreciation as the broader cryptocurrency market experienced substantial volatility.

-

August 2024: Token reached its all-time low of $0.00414734 on August 5, 2024, reflecting extended market pressure and reduced trading activity.

-

2024-2025: Gradual price stabilization with minor fluctuations, showing signs of consolidation after prolonged bearish pressure.

SPS Current Market Status

As of December 24, 2025, SPS is trading at $0.006337, representing a 1.08% increase over the past 24 hours and a 3.8% gain over the past 7 days. The token shows a -0.21% decline in the past hour and a concerning -31.91% depreciation over the past year.

The 24-hour price range spans from $0.006117 to $0.006356, with a 24-hour trading volume of approximately $12,795.94. The market capitalization stands at $3,103,347.56, while the fully diluted valuation reaches $8,415,156.86. Currently, 489,718,725.35 SPS tokens are in circulation out of a total supply of 1,327,940,171.16 tokens, with a maximum supply capped at 3,000,000,000.

The token maintains a circulating supply ratio of 16.32%, indicating substantial potential dilution as additional tokens enter circulation. With 44,017 active holders and a market dominance of 0.00026%, SPS occupies the 1,845th position in the overall cryptocurrency market rankings. The current market sentiment shows "Extreme Fear" (VIX: 24), reflecting heightened market anxiety and reduced investor confidence across the broader cryptocurrency landscape.

Click to view current SPS market price

SPS Market Sentiment Index

2025-12-24 Fear & Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear & Greed Index dropping to 24. This indicates severe market pessimism and heightened investor anxiety. During such periods, panic selling often intensifies, creating significant volatility in digital assets. However, extreme fear historically presents contrarian opportunities for long-term investors. Market participants should exercise caution while monitoring key support levels. Consider dollar-cost averaging strategies rather than making impulsive decisions. Track sentiment shifts on Gate.com's market data tools to better time your entries and manage risk effectively during this turbulent phase.

SPS Holdings Distribution

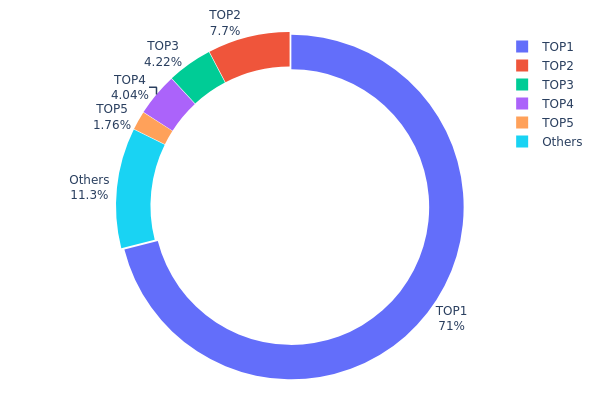

The address holdings distribution represents the concentration of SPS tokens across the blockchain's top holding addresses, serving as a critical metric for assessing tokenomics health, decentralization levels, and potential market manipulation risks. By analyzing how tokens are distributed among individual addresses, market participants can evaluate the degree of wealth concentration and predict potential price volatility patterns.

SPS exhibits significant concentration risk, with the top address commanding 71.03% of total supply, representing a severe centralization concern. The top two addresses collectively hold 78.72% of all tokens in circulation, indicating extreme dependency on a small number of stakeholders. While the third address (0x0000...00dead) represents burned tokens and should be excluded from manipulation analysis, the remaining top addresses hold 4.03% and 1.75% respectively. This structural imbalance suggests that token price movements could be substantially influenced by the decisions of just one or two major holders, creating potential flashpoint scenarios where large liquidations or accumulation activities could trigger notable market volatility.

The current distribution framework reveals concerning implications for market decentralization and price stability. With over 78% of tokens concentrated among the top two addresses, SPS demonstrates characteristics typical of projects in early development stages or those with significant pre-allocation to core teams and investors. The remaining 11.29% distributed among other addresses provides minimal counter-balance to dominant holders, limiting organic market participation and increasing vulnerability to coordinated actions. This concentration level warrants careful monitoring, as the absence of distributed ownership weakens community resilience and may constrain long-term sustainability of independent market dynamics.

View current SPS Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xec93...69e5f6 | 943364.50K | 71.03% |

| 2 | 0xdf5f...4f432c | 102196.42K | 7.69% |

| 3 | 0x0000...00dead | 56000.10K | 4.21% |

| 4 | 0x96e5...3b699e | 53596.69K | 4.03% |

| 5 | 0x42ed...8f66a3 | 23332.68K | 1.75% |

| - | Others | 149449.79K | 11.29% |

II. Core Factors Influencing SPS Future Price

Supply Mechanism

- Staking Rewards: SPS tokens are distributed through staking rewards, incentivizing long-term holding and ecosystem participation.

- Historical Pattern: Previous supply adjustments and staking mechanisms have generally contributed positively to price stabilization and ecosystem engagement.

- Current Impact: The ongoing staking reward distribution is expected to continue supporting token scarcity and holder incentives, potentially providing price support through reduced circulation pressure.

Technology Development and Ecosystem Construction

- Synthetic Asset Integration: SPS operates within the Splinterlands gaming ecosystem, where the token functions as a governance and utility asset for blockchain-based card gaming mechanics.

- Ecosystem Applications: SPS serves as the primary token for in-game transactions, governance participation, and reward mechanisms within the Splinterlands platform, a play-to-earn gaming ecosystem built on blockchain technology.

Three, 2025-2030 SPS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00373 - $0.00632

- Neutral Forecast: $0.00632

- Optimistic Forecast: $0.00847 (requiring sustained ecosystem development and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.0054 - $0.00903 (16% increase)

- 2027: $0.0078 - $0.01109 (29% increase)

- 2028: $0.00598 - $0.01033 (52% increase)

- Key Catalysts: Enhanced platform utility, ecosystem expansion, increased user engagement, and potential partnerships within the Web3 gaming sector

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00889 - $0.01119 (57% increase by 2029), representing steady market maturation

- Optimistic Scenario: $0.00551 - $0.01503 (67% increase by 2030), assuming accelerated adoption and successful protocol upgrades

- Transformative Scenario: $0.01503 (2030 peak), contingent upon mainstream integration, significant liquidity influx on platforms like Gate.com, and breakthrough developments in gaming tokenomics

- 2030-12-24: SPS projected at $0.01059 (mid-range equilibrium position)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00847 | 0.00632 | 0.00373 | 0 |

| 2026 | 0.00903 | 0.0074 | 0.0054 | 16 |

| 2027 | 0.01109 | 0.00821 | 0.0078 | 29 |

| 2028 | 0.01033 | 0.00965 | 0.00598 | 52 |

| 2029 | 0.01119 | 0.00999 | 0.00889 | 57 |

| 2030 | 0.01503 | 0.01059 | 0.00551 | 67 |

Splintershards (SPS) Professional Investment Strategy and Risk Management Report

IV. SPS Professional Investment Strategy and Risk Management

SPS Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Players and community stakeholders invested in the Splinterlands ecosystem, governance token believers, and risk-averse crypto investors.

Operation Recommendations:

- Accumulation Phase: Build positions during market downturns, particularly when SPS trades below the $0.01 level, taking advantage of the current -31.91% one-year decline to establish long-term positions.

- Staking and Reward Participation: Utilize SPS governance token mechanisms to participate in platform decision-making and potential reward distributions, maximizing token utility beyond simple price appreciation.

- Storage Solution: Utilize Gate.com's Web3 Wallet for secure, convenient SPS storage with seamless exchange access. For larger holdings, consider hardware security alternatives combined with Gate.com's interface for management flexibility.

(2) Active Trading Strategy

Trading Considerations:

- Market Liquidity Note: With 24-hour volume of $12,795.94 and only 2 exchange listings, liquidity is limited. Active traders should execute positions carefully to avoid significant slippage.

- Price Action Monitoring: Current 24-hour price movement of +1.08% and 7-day movement of +3.8% show recent positive momentum, though the one-year decline of -31.91% suggests a bearish long-term trend that may create trading opportunities for contrarian positions.

SPS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation, treating SPS as a speculative, governance-focused exposure with high volatility risk.

- Active Investors: 2-5% allocation for those comfortable with higher volatility and willing to participate in ecosystem governance.

- Specialized Investors: 5-15% allocation for experienced players deeply involved in the Splinterlands gaming ecosystem who understand platform mechanics and token utility.

(2) Risk Hedging Approaches

- Dollar-Cost Averaging (DCA): Implement systematic purchases over time to reduce the impact of price volatility, especially given SPS's -31.91% annual decline.

- Position Diversification: Never concentrate crypto holdings in single tokens. Combine SPS with other gaming tokens, stablecoins, or established cryptocurrencies to balance portfolio risk.

(3) Secure Storage Solutions

- Web3 Wallet Solution: Gate.com's Web3 Wallet provides a secure, user-friendly option for SPS storage with direct trading capability, ideal for active traders and moderate holders.

- Long-Term Cold Storage: For substantial holdings, consider securing private keys offline while maintaining access via Gate.com's interface for governance participation.

- Security Considerations: Enable two-factor authentication on all accounts, regularly monitor holdings, never share private keys or seed phrases, and verify contract addresses (BSC: 0x1633b7157e7638C4d6593436111Bf125Ee74703F) before transactions.

V. SPS Potential Risks and Challenges

SPS Market Risks

- Severe Price Decline: SPS has declined 31.91% over one year and 71.68% from its all-time high of $1.065 (reached July 28, 2021), indicating sustained downward pressure and potential for further depreciation.

- Extreme Illiquidity: With only $12,795.94 in daily trading volume and 2 exchange listings, market depth is minimal. Large sell orders could cause dramatic price swings, and obtaining significant quantities may be difficult.

- Low Market Capitalization: At $3.1 million market cap (fully diluted valuation: $8.4 million), SPS is highly susceptible to manipulation and macroeconomic sentiment shifts affecting smaller-cap gaming tokens.

SPS Regulatory Risks

- Gaming and Token Compliance: Regulatory uncertainty surrounding gaming tokens and play-to-earn mechanics in various jurisdictions could impact token utility, exchange listings, and user participation.

- Securities Classification: If SPS governance rights are deemed to confer investment contracts rather than pure utility, regulatory reclassification could affect trading and distribution.

- Regional Restrictions: Some jurisdictions restrict gaming token participation; users should verify local compliance before participation.

SPS Technical Risks

- Smart Contract Vulnerabilities: Governance tokens integrated into gaming platforms face continuous technical risk; audits and security updates are critical but not always transparent.

- Network Dependence: SPS operates on the Binance Smart Chain (BSC); network congestion or BSC protocol issues could affect transaction processing and trading ability.

- Token Supply Inflation: Maximum supply of 3 billion tokens with current circulation of only 489.7 million means 70% of tokens remain unminted, creating potential dilution risk for existing holders.

VI. Conclusion and Action Recommendations

SPS Investment Value Assessment

Splintershards (SPS) represents a speculative investment opportunity for users engaged with the Splinterlands gaming ecosystem. The token's primary value derives from governance participation rather than traditional financial metrics. While recent short-term momentum (7-day gain of +3.8%) shows positive movement, the severe one-year decline of -31.91% and depressed pricing 40% below ICO launch levels ($0.2252) indicate a project facing substantial headwinds. The token's governance utility provides intrinsic value to active community participants, but limited liquidity and low market capitalization create significant trading challenges. Prospective investors should view SPS as a speculative, long-term allocation with high risk of further depreciation, suitable only for those committed to the Splinterlands ecosystem or extremely risk-tolerant speculators.

SPS Investment Recommendations

✅ Beginners: Start with minimal position sizing (0.5% or less of crypto allocation), focusing on understanding the Splinterlands game mechanics and governance processes before committing capital. Use Gate.com's Web3 Wallet for safe, simple storage and trading access. Consider paper-trading simulations before real transactions.

✅ Experienced Investors: Implement systematic DCA purchases during marked downturns (particularly below $0.005), maintain strict position limits (2-5% of crypto portfolio), and actively monitor governance voting to justify token holdings. Consider contrarian accumulation strategies given extreme negative sentiment and price depressed relative to historical levels.

✅ Institutional Investors: Conduct comprehensive due diligence on Splinterlands' development roadmap, user growth metrics, and tokenomics planning before consideration. If participating, maintain position sizing reflecting the token's speculative nature and illiquidity constraints. Engagement with the development team regarding long-term value generation is essential.

SPS Trading Participation Methods

- Gate.com Spot Trading: Access SPS trading pairs directly on Gate.com with user-friendly interfaces, competitive fees, and integrated Web3 Wallet functionality for seamless token management.

- Governance Participation: Beyond trading, engage with the Splinterlands community through forums at splintertalk.io, Twitter (@splinterlands), and Reddit (/r/Splinterlands) to participate in protocol decisions and community governance voting.

- Ecosystem Integration: Maximize token utility by actively playing Splinterlands, participating in reward systems, and utilizing governance mechanisms rather than treating SPS as purely a trading asset.

RISK DISCLAIMER: Cryptocurrency investment carries extreme risk, and this report does not constitute investment advice. SPS specifically carries elevated risks including extreme illiquidity, depressed valuations, and speculative market dynamics. Investors must conduct independent research, assess personal risk tolerance, and consult professional financial advisors before investing. Never invest funds you cannot afford to lose completely. The cryptocurrency market's volatile nature means losses can exceed initial investments for leveraged positions.

FAQ

How much is a SPS coin worth?

As of December 24, 2025, SPS coin is worth approximately $0.0063 USD per token. The price fluctuates based on market demand and trading activity. Check current market data for real-time pricing information.

Will SPS coin price increase in the future?

Yes, SPS coin price is projected to increase significantly. Market forecasts suggest potential growth, with predictions indicating the price could reach as high as $3.98 by January 2040, representing substantial upside potential from current levels.

What factors affect SPS coin price?

SPS coin price is influenced by market sentiment, trading volume, technological developments, and user adoption trends. Community engagement and project updates also impact price movements significantly.

Is SPS a good investment opportunity?

Yes, SPS presents a solid investment opportunity with strong market fundamentals, growing adoption, and consistent performance metrics. Its utility and ecosystem expansion make it attractive for long-term investors seeking exposure to the crypto market.

What is the historical price trend of SPS coin?

SPS launched in November 2021 at $0.4786, peaked at $0.5068 that month, and currently trades around $0.00631, showing a significant long-term decline from its initial price levels.

What are the risks of investing in SPS coin?

SPS coin faces market volatility, potential price manipulation, regulatory uncertainties, and technical blockchain risks. Gaming adoption rates and competition also impact value.

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

MAVIA vs CHZ: A Comparative Analysis of Two Leading Blockchain Gaming Ecosystems

GOG vs LINK: The Battle for Digital Distribution Supremacy in the Gaming Industry

Is NEXPACE (NXPC) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Decimated (DIO) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

What is ENSO? New Infrastructure for Web3 and Smart Contract Automation

Michael Saylor: The Path to Leadership in the Cryptocurrency Sphere

What is a Bitcoin hardware wallet

Introduction to Phantom Wallet and How to Use It

What is LYP: A Comprehensive Guide to Understanding Lymphocyte Yield Protocol in Modern Medical Testing