2025 SGC Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: SGC's Market Position and Investment Value

KAI Battle of Three Kingdoms (SGC), as a blockchain-based strategy game token, has made significant strides since its inception. As of 2025, SGC's market capitalization stands at $899,796, with a circulating supply of approximately 2,048,250,000 tokens and a price hovering around $0.0004393. This asset, known as the "Three Kingdoms Gaming Token," is playing an increasingly crucial role in the blockchain gaming sector.

This article will provide a comprehensive analysis of SGC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to offer professional price predictions and practical investment strategies for investors.

I. SGC Price History Review and Current Market Status

SGC Historical Price Evolution

- 2025 June: SGC reached its all-time high of $0.0062, likely due to the initial launch hype

- 2025 November: The price hit its all-time low of $0.000166, indicating a significant market correction

- 2025 Overall: SGC experienced a volatile year, with price swinging from peak to trough

SGC Current Market Situation

SGC is currently trading at $0.0004393, showing a 24-hour decline of 5.51%. The token has seen a significant recovery over the past month, with an impressive 80.61% increase. However, the year-to-date performance remains deeply negative at -94.25%. The current price is 92.91% below its all-time high and 164.64% above its all-time low. With a market cap of $899,796 and a fully diluted valuation of $4,393,000, SGC ranks 2739th in the cryptocurrency market. The 24-hour trading volume stands at $6,019, indicating moderate market activity.

Click to view the current SGC market price

SGC Market Sentiment Indicator

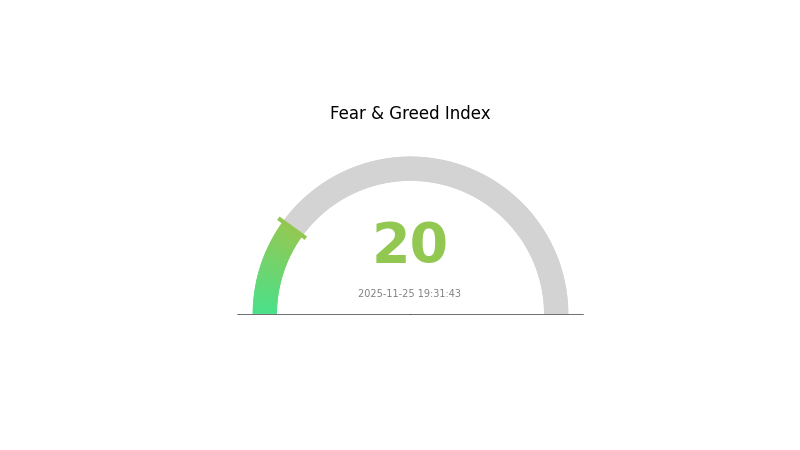

2025-11-25 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment has plunged into extreme fear territory, with the Fear and Greed Index registering a low of 20. This indicates a highly pessimistic outlook among investors, potentially signaling oversold conditions. During such periods of extreme fear, contrarian investors often view it as a potential buying opportunity, adhering to the adage "be greedy when others are fearful." However, caution is advised as market volatility may persist. Traders should consider their risk tolerance and conduct thorough research before making any investment decisions in this challenging market environment.

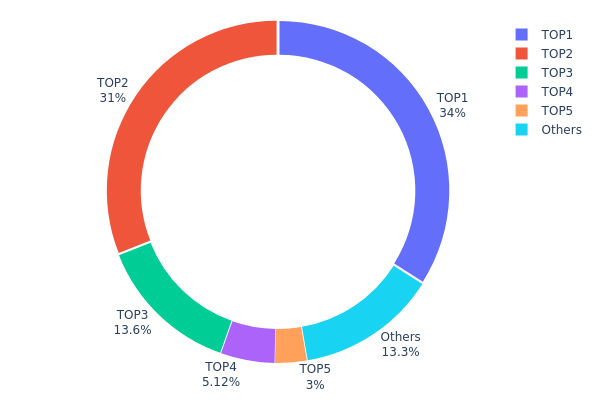

SGC Holdings Distribution

The address holdings distribution data for SGC reveals a highly concentrated ownership structure. The top five addresses collectively hold 86.69% of the total supply, with the two largest holders commanding a significant 65% of all tokens. This concentration level raises concerns about potential market manipulation and price volatility.

The top address holds 34% of the supply, while the second largest holds 31%, indicating a duopoly in SGC ownership. Such concentration could lead to increased market instability if these major holders decide to liquidate their positions. Additionally, the high concentration might impact the token's decentralization ethos, potentially undermining its governance structure and overall market confidence.

This distribution pattern suggests that SGC's market structure is currently vulnerable to large-scale movements by a few key players. It also implies a relatively low level of token dispersion among smaller holders, which could limit liquidity and increase the risk of price manipulation in the short to medium term.

Click to view the current SGC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x92ef...b4457e | 3400000.00K | 34.00% |

| 2 | 0x11a0...44a980 | 3100638.56K | 31.00% |

| 3 | 0x5e87...20eb40 | 1358375.00K | 13.58% |

| 4 | 0xae8a...6a99ea | 511856.59K | 5.11% |

| 5 | 0x93de...85d976 | 300000.00K | 3.00% |

| - | Others | 1329129.85K | 13.31% |

II. Key Factors Influencing SGC's Future Price

Supply Mechanism

- Gold Price Fluctuations: The volatility in gold prices significantly impacts SGC's supply and demand dynamics.

- Historical Patterns: Previous gold price increases have suppressed consumption demand, particularly for weight-based gold products.

- Current Impact: High gold prices are shifting consumer preferences towards value-added, design-focused gold products.

Institutional and Whale Movements

- Corporate Adoption: Companies in the jewelry retail sector, such as Luk Fook Group, are adapting their strategies to market conditions influenced by SGC prices.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of the Federal Reserve, play a crucial role in shaping SGC's price trends.

- Inflation Hedging Properties: SGC demonstrates potential as an inflation hedge, especially in high-inflation environments.

- Geopolitical Factors: International economic conditions and geopolitical tensions contribute to SGC's price volatility.

Technological Developments and Ecosystem Building

- Digital Channel Expansion: The growth of e-commerce and digital sales channels is influencing SGC's market penetration, especially in lower-tier cities and rural markets.

- Ecosystem Applications: The development of innovative product series and brand value-added services in the gold retail sector indirectly affects SGC's market dynamics.

III. SGC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00034 - $0.00044

- Neutral prediction: $0.00044 - $0.00048

- Optimistic prediction: $0.00048 - $0.00053 (requires favorable market conditions)

2026-2028 Outlook

- Market phase expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.00043 - $0.00068

- 2027: $0.00054 - $0.00073

- 2028: $0.00062 - $0.00080

- Key catalysts: Increased adoption, technological advancements, and market maturation

2029-2030 Long-term Outlook

- Base scenario: $0.00068 - $0.00076 (assuming steady market growth)

- Optimistic scenario: $0.00076 - $0.00110 (with strong bullish momentum)

- Transformative scenario: $0.00110+ (under extremely favorable market conditions)

- 2030-11-26: SGC $0.00074 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00053 | 0.00044 | 0.00034 | 0 |

| 2026 | 0.00068 | 0.00048 | 0.00043 | 10 |

| 2027 | 0.00073 | 0.00058 | 0.00054 | 32 |

| 2028 | 0.0008 | 0.00066 | 0.00062 | 49 |

| 2029 | 0.00076 | 0.00073 | 0.00068 | 65 |

| 2030 | 0.0011 | 0.00074 | 0.0007 | 68 |

IV. SGC Professional Investment Strategies and Risk Management

SGC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in blockchain gaming and strategic card games

- Operation suggestions:

- Accumulate SGC tokens during market dips

- Participate actively in the game ecosystem to earn SGCP

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor game updates and user adoption metrics

- Watch for significant partnerships or ecosystem expansions

SGC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance SGC with other gaming tokens and broader crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for SGC

SGC Market Risks

- Volatility: Gaming tokens can experience significant price swings

- Competition: Other blockchain gaming projects may impact SGC's market share

- User adoption: Slow growth in player base could affect token value

SGC Regulatory Risks

- Gaming regulations: Changes in laws governing online gaming could impact the project

- Cryptocurrency regulations: Evolving global crypto regulations may affect SGC trading

- Token classification: Potential for SGC to be classified as a security in some jurisdictions

SGC Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the token's underlying code

- Scalability issues: Game performance may be affected by high user traffic

- Blockchain network congestion: Could impact transaction speeds and costs

VI. Conclusion and Action Recommendations

SGC Investment Value Assessment

SGC presents an intriguing opportunity in the blockchain gaming sector, leveraging a popular IP. While it offers potential for growth, investors should be aware of the high volatility and regulatory uncertainties in the gaming token market.

SGC Investment Recommendations

✅ Beginners: Consider small, experimental positions to learn about blockchain gaming ✅ Experienced investors: Allocate a modest portion of portfolio, actively engage with the game ✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified gaming token strategy

SGC Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Staking: Explore staking options if offered by the project or exchanges

- In-game participation: Earn SGCP through gameplay and convert to SGC

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is SGC a good stock to buy?

Yes, SGC appears to be a good stock to buy. Analysts rate it as a 'Strong Buy' with a projected 96% price increase over the next 12 months, indicating strong growth potential.

What is the share price prediction for Springfield Properties in 2025?

Based on analyst consensus, the target price for Springfield Properties shares in 2025 is 152.00p.

What is the price prediction for SGB in 2030?

Based on current market analysis, SGB is predicted to reach $0.008766 by 2030, with a projected growth rate of 27.63%.

What is the price target for SPG?

The price target for SPG is $192.75, based on short-term forecasts from multiple analyst reports as of 2025-11-25.

Share

Content