2025 MRLN Price Prediction: Expert Analysis and Market Forecast for Merlin Chain Token

Introduction: MRLN's Market Position and Investment Value

Project Merlin (MRLN) is an integrated Web3 ecosystem that unites blockchain entrepreneurs, investors, and communities to bring ideas to life, scale them, and ensure sustainable growth. As of January 3, 2026, MRLN has achieved a market capitalization of $724,000, with a circulating supply of approximately 110,760,038 tokens, trading at a current price of $0.000905. This innovative platform, which provides integrated solutions through Crowdfunding, Freelify, Taskium, and Funddex, is playing an increasingly critical role in supporting blockchain innovation and sustainable development.

The ecosystem operates as a decentralized, transparent, and community-focused environment where founders can access funding, talent, and market entry opportunities in one unified platform. This comprehensive approach to addressing the needs of blockchain entrepreneurs positions MRLN within a vital segment of the Web3 infrastructure space.

This article will provide a comprehensive analysis of MRLN's price trends through 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging Web3 ecosystem.

Project Merlin (MRLN) Price Analysis Report

I. MRLN Price History Review and Current Market Status

MRLN Historical Price Evolution

- September 2025: Project Merlin reached its all-time high (ATH) of $0.08302, representing peak market sentiment during the initial trading phase.

- January 2026: MRLN experienced significant depreciation, declining from its historical high to $0.0008722 on January 2, 2026, marking the lowest price point recorded.

MRLN Current Market Condition

As of January 3, 2026, MRLN is trading at $0.000905, reflecting a -6.26% decline over the 24-hour period. The token has demonstrated notable downward pressure across multiple timeframes:

- 1-hour change: -1.83%

- 7-day change: -12.29%

- 30-day change: -3.62%

- 1-year change: -98.25%

The 24-hour trading volume stands at approximately $167,337, with a total market capitalization of $724,000. The circulating supply is 110,760,038 MRLN out of a maximum supply of 800,000,000 tokens, representing a circulation ratio of 13.85%. The token currently ranks 4,904 in overall market capitalization, with a market dominance of 0.000022%.

The current market sentiment remains bearish, characterized by significant volatility and declining momentum. MRLN is trading near its 24-hour low of $0.0008722 and shows weakness relative to its recent price history.

Click to view current MRLN market price

MRLN Market Sentiment Index

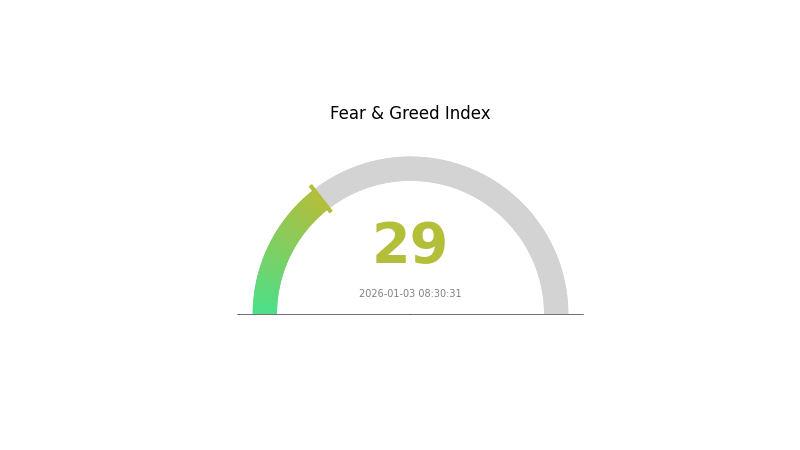

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened market anxiety and pessimistic investor outlook. During such periods, market volatility tends to increase as traders become more cautious. Fear-driven markets often present contrarian opportunities for long-term investors, as assets may be undervalued. However, it's crucial to exercise proper risk management and avoid panic selling. Monitor market movements closely and consider your investment strategy based on personal risk tolerance and portfolio objectives.

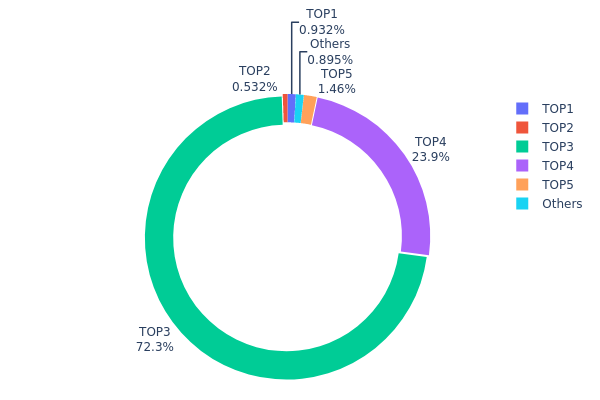

MRLN Holdings Distribution

The holdings distribution chart illustrates the concentration of MRLN tokens across different addresses on the blockchain, serving as a critical metric for evaluating the decentralization level and market structure of the token. By analyzing the proportion of tokens held by top addresses relative to total supply, investors can assess liquidity risks, governance concentration, and potential vulnerability to large-scale sell-offs or market manipulation.

MRLN's current holdings distribution reveals significant concentration concerns. The top three addresses collectively control approximately 96.71% of all tokens in circulation, with a single address (0x1861...df8fe0) commanding 72.31% of the total supply. This extreme concentration is further amplified by the fourth-largest holder maintaining an additional 23.87%, creating a highly centralized token structure where decision-making power and liquidity provision are substantially controlled by a limited number of stakeholders. The remaining addresses, including the fifth-largest holder at 1.45% and all other addresses at 0.91%, possess minimal influence over the token's market dynamics.

This pronounced concentration pattern raises substantial concerns regarding market maturity and decentralization. The dominance of a small number of addresses creates elevated risks of sudden price volatility should these major holders execute large transactions. Additionally, the heavily skewed distribution suggests limited liquidity outside concentrated holdings, potentially restricting natural price discovery mechanisms and increasing susceptibility to coordinated market movements. Such structural characteristics typically indicate early-stage tokens or projects with substantial retained holdings by development teams or early investors, warranting careful monitoring of future distribution patterns and liquidity events to assess long-term market stability.

Click to view current MRLN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfc89...0bdec3 | 3729.42K | 0.93% |

| 2 | 0x2b3b...8e7921 | 2126.15K | 0.53% |

| 3 | 0x1861...df8fe0 | 289240.02K | 72.31% |

| 4 | 0x0d07...b492fe | 95484.27K | 23.87% |

| 5 | 0xa23e...b13f1a | 5839.34K | 1.45% |

| - | Others | 3580.82K | 0.91% |

II. Core Factors Affecting MRLN's Future Price

Supply Mechanism

-

Fixed Total Supply Model: MRLN has a capped total supply of 800 million tokens with no future issuance planned. This fixed supply mechanism is designed to ensure sustainable growth, market stability, and long-term ecosystem development.

-

Current Circulation Impact: At launch on September 16th, initial circulating supply represented only 7.75% of total supply, which contributed to initial market challenges and price volatility as token unlocks gradually increase market availability.

Macroeconomic Environment

-

Inflation Hedge Properties: MRLN's fixed supply model provides certain inflation-resistant capabilities within the broader cryptocurrency asset class, similar to other fixed-supply tokens.

-

Monetary Policy Effects: Interest rate fluctuations and US dollar strength impact MRLN similarly to other cryptocurrency assets, as it remains sensitive to macro-level policy shifts and traditional market dynamics.

Three, 2026-2031 MRLN Price Forecast

2026 Outlook

- Conservative Forecast: $0.00083 - $0.00092

- Neutral Forecast: $0.00092 - $0.00111

- Optimistic Forecast: $0.00111 (requires sustained market interest and positive ecosystem developments)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental price appreciation driven by increasing adoption and protocol maturation

- Price Range Forecast:

- 2027: $0.00074 - $0.00124

- 2028: $0.00086 - $0.00158

- 2029: $0.00096 - $0.00184

- Key Catalysts: Expanded platform functionality, strategic partnerships, growing user engagement, and overall market sentiment improvement in the cryptocurrency sector

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00144 - $0.00165 (assuming steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.00162 - $0.00240 (assuming accelerated adoption and strong institutional interest)

- Transformational Scenario: $0.00240+ (assuming breakthrough technological achievements and mainstream market integration)

- 2031-12-31: MRLN projected at $0.00240 (peak growth trajectory achieved)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00111 | 0.00092 | 0.00083 | 1 |

| 2027 | 0.00124 | 0.00101 | 0.00074 | 11 |

| 2028 | 0.00158 | 0.00113 | 0.00086 | 24 |

| 2029 | 0.00184 | 0.00135 | 0.00096 | 49 |

| 2030 | 0.00165 | 0.0016 | 0.00144 | 76 |

| 2031 | 0.0024 | 0.00162 | 0.00104 | 79 |

Project Merlin (MRLN) Professional Investment Analysis Report

IV. MRLN Professional Investment Strategy and Risk Management

MRLN Investment Methodology

(1) Long-term Holding Strategy

- Suitable For: Investors with medium to long-term horizons seeking exposure to Web3 ecosystem projects with community-driven models

- Operational Recommendations:

- Accumulate during market downturns when volatility presents entry opportunities

- Hold through ecosystem development phases, particularly as platform adoption of Crowdfunding, Freelify, Taskium, and Funddex expands

- Dollar-cost averaging to mitigate single-point entry risk

(2) Active Trading Strategy

- Market Analysis Considerations:

- Volume Analysis: Monitor the 24-hour trading volume of $167,337 as a baseline for liquidity assessment

- Price Action Monitoring: Track support and resistance levels between the 24-hour low of $0.0008722 and recent highs around $0.001018

- Wave Trading Key Points:

- Observe the significant 24-hour decline of -6.26% for potential bounce opportunities

- Monitor the 7-day decline of -12.29% to identify possible consolidation patterns

- Pay attention to ecosystem milestone announcements that may trigger price movements

MRLN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation, focusing on smaller exploratory positions

- Active Investors: 2-5% of portfolio allocation with regular rebalancing based on ecosystem progress

- Professional Investors: 5-10% of portfolio allocation with advanced hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual MRLN holdings to prevent excessive concentration risk in early-stage ecosystem projects

- Portfolio Diversification: Balance MRLN exposure with established blockchain and Web3 assets to reduce idiosyncratic risk

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for active trading and frequent ecosystem interactions

- Cold Storage Approach: For holdings exceeding 30 days, transfer to hardware solutions with multi-signature setup

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware wallet for amounts exceeding your monthly risk tolerance, never share private keys or recovery phrases

V. MRLN Potential Risks and Challenges

MRLN Market Risks

- Severe Price Volatility: The asset has experienced a -98.25% decline over one year, indicating extreme market exposure and potential sustainability concerns

- Low Market Capitalization: With a fully diluted valuation of $724,000 and ranking #4904 by market cap, MRLN faces significant liquidity and price manipulation risks

- Limited Trading Volume: Daily volume of $167,337 suggests thin order books that could amplify price swings during significant buy or sell events

MRLN Regulatory Risks

- Evolving Legal Framework: Web3 ecosystem projects operating across multiple jurisdictions face uncertain regulatory treatment for crowdfunding and task-based platforms

- Compliance Uncertainty: Funddex and other fundraising mechanisms may encounter regulatory scrutiny depending on regional securities laws

- Geographic Restrictions: Project expansion and token distribution may face limitations in jurisdictions with strict cryptocurrency regulations

MRLN Technical Risks

- Smart Contract Vulnerabilities: Multi-platform ecosystem (Crowdfunding, Freelify, Taskium, Funddex) increases attack surface and potential security exposure

- Blockchain Dependency: BSC network congestion or security incidents could impact platform accessibility and user confidence

- Ecosystem Adoption Risk: Failure to achieve critical mass on interconnected platforms could undermine the integrated Web3 ecosystem value proposition

VI. Conclusion and Action Recommendations

MRLN Investment Value Assessment

Project Merlin presents a community-driven Web3 ecosystem concept addressing real problems in blockchain entrepreneurship. However, the token faces significant headwinds: a -98.25% one-year decline, extremely low market capitalization, minimal trading volume, and only 88 token holders. While the ecosystem model combining crowdfunding, talent networks, task-based engagement, and project launches offers theoretical value, the extreme price deterioration and low adoption metrics suggest substantial execution risk. The project requires demonstrable platform growth and user adoption to validate its investment thesis.

MRLN Investment Recommendations

✅ Beginners: Avoid or conduct minimal exploratory purchases only after thorough platform research; if interested, limit exposure to 0.1-0.5% of portfolio ✅ Experienced Investors: Consider small speculative positions (1-2% allocation) contingent on verified ecosystem metrics and community growth indicators ✅ Institutional Investors: Conduct comprehensive due diligence on platform governance, smart contract audits, and regulatory compliance before any consideration

MRLN Trading Participation Methods

- Direct Purchase on Gate.com: Access MRLN trading pairs through the Gate.com exchange platform with full order book transparency

- DCA Strategy: Execute recurring small purchases through Gate.com to average entry prices over time

- Ecosystem Participation: Engage directly with Project Merlin platforms (Crowdfunding, Freelify, Taskium, Funddex) to understand product-market fit before token investment

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose.

FAQ

What is MRLN? What are its basic information and uses?

MRLN is the stock ticker for Marlin Business Services Corporation. It tracks short interest net data and is primarily used for analyzing investor short activity on company stocks.

What is the historical price trend of MRLN tokens?

MRLN's all-time high price was BTC0.066714, with a low of BTC0.089687. Currently trading 98.80% below its peak and 6.60% above its lowest point, showing significant price volatility since launch.

What will be the MRLN price prediction for 2024?

Based on market analysis, MRLN's 2024 price prediction is estimated at $0.001204. Long-term projections suggest potential growth, with forecasts reaching $0.001613 by 2030.

What are the main factors affecting MRLN price?

MRLN price is primarily influenced by supply and demand dynamics, market sentiment, and news events. Investor confidence, trading volume, and overall market trends also play significant roles in price movements.

How does MRLN's investment potential compare to mainstream cryptocurrencies?

MRLN offers unique value as a gold-backed asset, providing stability and intrinsic worth compared to purely speculative cryptocurrencies. Its limited supply and strong fundamentals position it competitively within the digital asset market.

What technical analysis signals does MRLN show?

MRLN technical analysis indicates bullish momentum with strong uptrend formation. Key indicators show buying signals across multiple timeframes, with resistance levels being broken. Volume metrics demonstrate healthy trading activity, supporting continued price appreciation potential.

What are the main risks of purchasing MRLN?

MRLN purchases carry market volatility risks, potential for misinformation, and security threats. Conduct thorough research and use secure wallets to mitigate these risks.

What is the liquidity and trading volume situation of MRLN?

MRLN demonstrates solid market activity with a 24-hour trading volume of approximately ¥9.94 million CNY. The token maintains healthy liquidity across multiple EVM and SVM chains including Polygon, Arbitrum, Optimism, BNB Chain, Base, Avalanche, and Solana, supporting efficient trading and cross-chain operations within the Project Merlin ecosystem.

What do experts think about MRLN's future prospects?

Experts believe MRLN has long-term value potential driven by decentralized finance growth. Short-term outlook depends on market volatility and user adoption rates. The project's ability to attract and retain multi-platform users will be crucial for sustained development.

2025 MMT Price Prediction: Analyzing Market Trends and Potential Growth Factors

GT Token in 2025: Buying, Staking, and Use Cases for Investors

2025 CFX Price Prediction: Analyzing Growth Potential and Market Factors for Conflux Network Token

2025 GRT Price Prediction: Analyzing Graph Protocol's Future Value Trajectory and Market Potential

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

2025 XCNPrice Prediction: Will XCN Token Reach New Heights in the Post-Halving Bull Market?

What is ENSO? New Infrastructure for Web3 and Smart Contract Automation

Michael Saylor: The Path to Leadership in the Cryptocurrency Sphere

What is a Bitcoin hardware wallet

Introduction to Phantom Wallet and How to Use It

What is LYP: A Comprehensive Guide to Understanding Lymphocyte Yield Protocol in Modern Medical Testing