2025 LEGION Price Prediction: Analyzing Market Trends and Future Prospects for the Gaming Cryptocurrency

Introduction: LEGION's Market Position and Investment Value

LEGION (LEGION) as a pioneering Web3.0 platform for investment and OTC marketplace, has revolutionized the venture capital landscape for retail investors since its inception. As of 2025, LEGION's market capitalization has reached $58,391, with a circulating supply of approximately 256,326,688 tokens, and a price hovering around $0.0002278. This asset, hailed as "the first Web3.0 investment platform," is playing an increasingly crucial role in democratizing early-stage investments and unlocking liquidity in private investments.

This article will comprehensively analyze LEGION's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. LEGION Price History Review and Current Market Status

LEGION Historical Price Evolution

- 2024: LEGION reached its all-time high of $0.035 on June 23, 2024

- 2025: LEGION hit its all-time low of $0.000052 on April 19, 2025, marking a significant price drop

LEGION Current Market Situation

As of November 30, 2025, LEGION is trading at $0.0002278. The token has experienced a 6.4% increase in the last 24 hours, with a trading volume of $11,943.29. LEGION's market capitalization stands at $58,391.22, ranking it at 5516 in the cryptocurrency market.

The token has shown strong performance in recent periods, with a 23.34% increase over the past week and a substantial 56.14% gain in the last 30 days. However, it's worth noting that LEGION has seen a significant decline of 86.63% over the past year.

LEGION's circulating supply is currently 256,326,688 tokens, which represents 25.63% of its total supply of 1,000,000,000 tokens. The fully diluted market cap is $227,800.

Click to view the current LEGION market price

LEGION Market Sentiment Indicator

2025-11-30 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are wary and potentially creating buying opportunities for contrarian traders. However, it's crucial to remember that market sentiment can shift rapidly. Always conduct thorough research and consider your risk tolerance before making investment decisions. Gate.com offers tools and resources to help navigate these market conditions effectively.

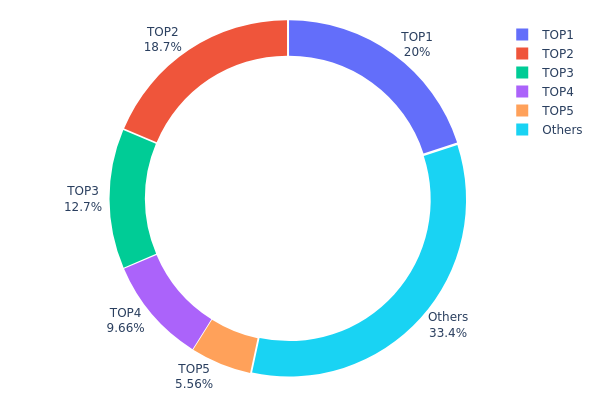

LEGION Holdings Distribution

The address holdings distribution data for LEGION reveals a highly concentrated ownership structure. The top 5 addresses collectively hold 66.61% of the total supply, with the largest holder controlling 20% alone. This concentration level raises concerns about potential market manipulation and volatility.

The second and third largest holders possess 18.67% and 12.73% respectively, further consolidating control among a small group of addresses. With only 33.39% distributed among other addresses, LEGION's current on-chain structure suggests limited decentralization. This concentration could lead to increased price volatility if large holders decide to sell, and it may also impact market liquidity and overall stability.

Such a concentrated distribution pattern typically indicates a young or developing project, where tokens have not yet been widely distributed. It also suggests potential risks in terms of governance and decision-making power being centralized among a few key stakeholders.

Click to view the current LEGION holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1c03...86845c | 200000.00K | 20.00% |

| 2 | 0x695e...eafa8a | 186700.00K | 18.67% |

| 3 | 0x280a...f82987 | 127336.51K | 12.73% |

| 4 | 0x1dee...8bbc6e | 96568.68K | 9.65% |

| 5 | 0xa24d...4806ec | 55635.00K | 5.56% |

| - | Others | 333759.81K | 33.39% |

II. Key Factors Affecting LEGION's Future Price

Supply Mechanism

- Burning Mechanism: LEGION implements a token burning mechanism to reduce the total supply over time.

- Current Impact: The ongoing token burning is expected to create deflationary pressure on LEGION's supply, potentially supporting price appreciation.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, LEGION may serve as a potential hedge against inflation, similar to other digital assets.

Technical Development and Ecosystem Building

- Ecosystem Applications: LEGION is actively developing its ecosystem, including DApps and other blockchain-based projects to increase utility and adoption.

III. LEGION Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00022 - $0.00023

- Neutral prediction: $0.00023

- Optimistic prediction: $0.00024 (requires positive market sentiment)

2026-2027 Outlook

- Market stage expectation: Gradual growth phase

- Price range forecast:

- 2026: $0.00015 - $0.00024

- 2027: $0.00022 - $0.00025

- Key catalysts: Increased adoption and project development milestones

2028-2030 Long-term Outlook

- Base scenario: $0.00024 - $0.00032 (assuming steady market growth)

- Optimistic scenario: $0.00032 - $0.00036 (assuming strong market performance)

- Transformative scenario: Up to $0.00036 (under extremely favorable conditions)

- 2030-12-31: LEGION $0.00032 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00024 | 0.00023 | 0.00022 | 0 |

| 2026 | 0.00024 | 0.00023 | 0.00015 | 2 |

| 2027 | 0.00025 | 0.00024 | 0.00022 | 4 |

| 2028 | 0.00032 | 0.00024 | 0.00023 | 7 |

| 2029 | 0.00036 | 0.00028 | 0.00018 | 24 |

| 2030 | 0.00036 | 0.00032 | 0.00018 | 42 |

IV. LEGION Professional Investment Strategies and Risk Management

LEGION Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate LEGION tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to LEGION

- Set stop-loss orders to manage downside risk

LEGION Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Dollar-Cost Averaging: Regular small investments to mitigate timing risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for LEGION

LEGION Market Risks

- High volatility: LEGION's price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades without impacting price

- Market sentiment: Susceptible to rapid shifts in investor sentiment

LEGION Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting token utility

- Cross-border compliance: Varying legal status in different jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrency investments

LEGION Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Ethereum network issues could affect token transfers

- Technological obsolescence: Risk of being surpassed by more advanced blockchain projects

VI. Conclusion and Actionable Recommendations

LEGION Investment Value Assessment

LEGION presents a high-risk, high-reward opportunity in the Web3 investment space. Long-term potential exists due to its unique platform, but short-term volatility and regulatory uncertainties pose significant risks.

LEGION Investment Recommendations

✅ Newcomers: Start with small investments, focus on education and understanding the project ✅ Experienced investors: Consider a moderate allocation as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

LEGION Trading Participation Methods

- Spot trading: Available on Gate.com for retail investors

- OTC trading: For large volume trades to minimize slippage

- DeFi liquidity provision: Participate in decentralized exchanges if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, or gaming sectors have the potential for massive growth. Always research thoroughly before investing.

Will Litentry go back up?

Yes, Litentry is likely to go back up. Crypto markets are cyclical, and with ongoing development and adoption, Litentry's price could see a resurgence in the future.

Is Leo coin a good investment?

Yes, Leo coin shows potential for good returns. Its innovative technology and growing adoption in the Web3 space make it an attractive investment option for 2025 and beyond.

What is the price prediction for Origin token 2025?

Based on market trends and potential growth, Origin token could reach $1.50 to $2.00 by 2025, reflecting a significant increase from its current value.

2025 MORE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 MLC Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 FPS Price Prediction: Analyzing Market Trends and Future Projections for First-Person Shooter Games

2025 GM Price Prediction: Navigating the Future of Automotive Stocks in a Shifting Market Landscape

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

2025 XCNPrice Prediction: Will XCN Token Reach New Heights in the Post-Halving Bull Market?

What are the main security risks and smart contract vulnerabilities in XDC Network?

Today's DONOT Daily Combo

Hamster Kombat Daily Combo & Cipher Answer 3 january 2026

Dropee Daily Combo for 3 january 2026

How Does Chainlink (LINK) Price Volatility Compare to Bitcoin and Ethereum in 2026?