2025 AA Price Prediction: Comprehensive Market Analysis and Expert Forecasts for the Year Ahead

Introduction: Market Position and Investment Value of AA

ARAI (AA) is building the next-generation interaction layer for Web3, powered by autonomous AI agents. Since its launch in September 2025, ARAI has established itself as an innovative project in the Web3 ecosystem. As of January 2026, ARAI's market capitalization stands at approximately $8.47 million, with a circulating supply of around 14.45 million tokens and a current price of $0.00847. This emerging asset, characterized as a "Web3 AI infrastructure solution," is playing an increasingly significant role in automating complex operations across decentralized gaming and on-chain finance.

This article will comprehensively analyze ARAI's price trends from 2026 to 2031, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. AA Price History Review and Market Status

AA Historical Price Movement

- September 16, 2025: All-time high (ATH) reached at $0.20146, marking the peak of ARAI's value during its early market phase.

- December 26, 2025: All-time low (ATL) recorded at $0.007723, representing the lowest point in the token's trading history.

- 30-day performance: Significant decline of -86.03%, reflecting sustained downward pressure over the past month.

AA Current Market Situation

As of January 3, 2026, ARAI (AA) is trading at $0.00847 with a 24-hour price decline of -14.98%, pulling back from the 24-hour high of $0.010399 to the low of $0.00823. The token has experienced considerable volatility, with a one-year decline of -84.59%, demonstrating substantial challenges since its market inception.

Market Capitalization and Supply Metrics:

- Fully Diluted Valuation (FDV): $8,470,000

- Current Market Cap: $122,391.50

- Market Cap to FDV Ratio: 1.44%

- Circulating Supply: 14,450,000 tokens (1.44% of total supply)

- Total Supply: 1,000,000,000 tokens

- Token Holders: 30,680 addresses

- Market Dominance: 0.00025%

Trading Activity:

- 24-hour Trading Volume: $23,887.05

- Exchange Listings: 10 exchanges

- Network: BSC (BEP-20 standard)

Recent Price Trends:

- 1-hour change: -0.83%

- 7-day change: +0.96%

- Current market sentiment indicates fear conditions (VIX: 29)

Click to view current AA market price

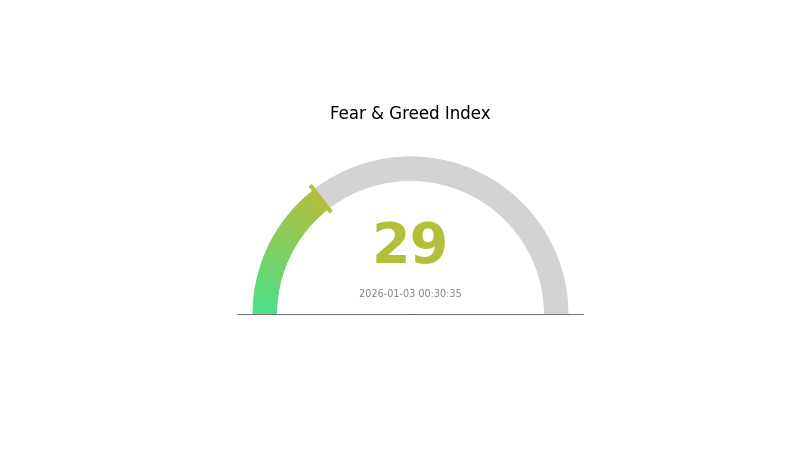

Crypto Market Sentiment Indicator

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing heightened fear sentiment, with the Fear and Greed Index standing at 29. This reading indicates that investors are showing significant caution and pessimism in their trading decisions. During fear-driven market conditions, volatility typically increases, presenting both risks and potential opportunities for experienced traders. Market participants should exercise careful risk management and consider their investment strategies accordingly.

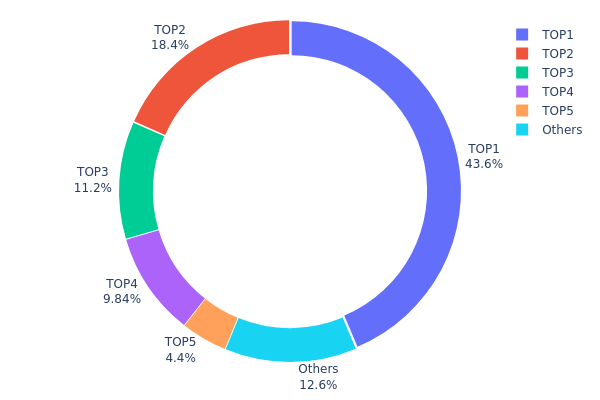

AA Holdings Distribution

The address holdings distribution represents the concentration of token ownership across the blockchain network, measured by tracking the cumulative percentage of total supply held by individual addresses ranked by holding size. This metric serves as a critical indicator of decentralization levels and potential systemic risks associated with token concentration.

The current distribution data reveals significant concentration dynamics within the AA ecosystem. The top four addresses collectively control approximately 83.04% of the total supply, with the leading address alone commanding 43.64% of all tokens in circulation. This substantial concentration in the top tier is complemented by a more dispersed secondary layer, where the fifth-largest holder maintains 4.39% of the supply, while remaining addresses account for 12.57%. The stark disparity between the dominant addresses and the broader holder base suggests a heavily top-heavy distribution structure.

This pronounced concentration pattern presents both structural and market implications. The extreme centralization—particularly the single-address dominance exceeding 43%—creates considerable vulnerability to potential large-scale liquidations or coordinated movements that could materially impact price discovery and market stability. The cumulative 83.04% held by the top four addresses substantially constrains the effective free float available for organic market trading, thereby limiting true price discovery mechanisms and increasing susceptibility to volatility spikes. From a decentralization perspective, this distribution indicates limited dispersion of governance influence and economic control, which may warrant monitoring regarding long-term protocol resilience and community participation dynamics.

Click to view current AA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd128...184cc9 | 436452.37K | 43.64% |

| 2 | 0x61bf...698c04 | 184000.00K | 18.40% |

| 3 | 0xd78a...befd6f | 111600.00K | 11.16% |

| 4 | 0x4005...d8ce0c | 98400.00K | 9.84% |

| 5 | 0x5292...071626 | 43999.00K | 4.39% |

| - | Others | 125548.63K | 12.57% |

Core Factors Influencing AA Token's Future Price

AI and Web3 Market Development

-

AI and Blockchain Integration: The combination of artificial intelligence with blockchain technology represents a significant current trend. Market attention and capital inflows into AI and Web3 projects will directly impact AA token's price trajectory. ARAI is building the next-generation interactive layer for Web3, powered by autonomous AI agents with real-time perception, strategic reasoning, and adaptive decision-making capabilities.

-

Market Sentiment and Project Adoption: Recent price performance demonstrates strong market interest in AI-Web3 fusion projects. AA token experienced a 40.13% price increase within 24 hours and maintained a 53.23% gain over a 30-day period, reflecting sustained positive market sentiment.

Exchange Support and Trading Activity

-

Gate.com Platform Support: Gate.com's support has proven crucial for AA token's visibility and accessibility. The exchange has launched USDT perpetual contracts for AA with 1 to 20x leverage options and introduced CandyDrop airdrop activities (Phase 84) featuring 1,100,000 AA tokens in reward pools. These initiatives significantly enhance market liquidity and trading volume, with reported trading reaching $53.96 million in 24-hour volume.

-

Trading Infrastructure: The availability of spot trading, derivatives, and leverage trading options on Gate.com provides investors with diverse trading strategies and increases overall market participation.

Project Partnerships and Technological Innovation

-

Google AR Hardware Collaboration: ARAI's partnership with Google on augmented reality eyeglasses projects adds significant credibility and potential real-world utility to the ecosystem, attracting institutional and retail attention alike.

-

Core Technology: The Arai Systems engine features modular Co-Pilot agents with sophisticated autonomous capabilities, positioning ARAI as a technical leader in the AI-Web3 space.

Market Risk Factors

Cryptocurrency price volatility remains substantial. Any predictions carry significant uncertainty and should not be treated as investment advice. Long-term token value ultimately depends on successful technology implementation, ecosystem development, and expansion of real-world application scenarios.

Market sentiment volatility, competition from other AI-Web3 projects, regulatory developments affecting crypto markets, and broader macroeconomic conditions all pose potential risks to AA token's price performance.

III. Price Forecast for AA Token (2026-2031)

2026 Outlook

- Conservative Forecast: $0.0071 - $0.0098

- Neutral Forecast: $0.00845 (average expected level)

- Bullish Forecast: $0.0098 (stable market conditions maintained)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with steady accumulation and consolidation patterns emerging as market sentiment stabilizes.

- Price Range Predictions:

- 2027: $0.00502 - $0.01187 (7% upside potential)

- 2028: $0.00745 - $0.0127 (23% upside potential)

- 2029: $0.00789 - $0.01334 (36% upside potential)

- Key Catalysts: Increased institutional adoption, ecosystem development improvements, and positive regulatory clarity in major markets.

2030-2031 Long-term Outlook

- Base Case Scenario: $0.01072 - $0.01721 (47% upside potential by 2030)

- Bullish Scenario: $0.01632 - $0.01721 (75% cumulative upside by 2031, assuming sustained network growth and widespread mainstream adoption)

- Transformational Scenario: $0.01721+ (under conditions of breakthrough technological advancement, major enterprise partnerships, or significant macroeconomic tailwinds favoring digital assets)

Notable Observation: The forecast trajectory demonstrates a consistent appreciation pattern through 2031, with the most significant growth acceleration expected in 2030-2031 periods, reflecting anticipated maturation of the asset's underlying fundamentals.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.0098 | 0.00845 | 0.0071 | 0 |

| 2027 | 0.01187 | 0.00913 | 0.00502 | 7 |

| 2028 | 0.0127 | 0.0105 | 0.00745 | 23 |

| 2029 | 0.01334 | 0.0116 | 0.00789 | 36 |

| 2030 | 0.01721 | 0.01247 | 0.01072 | 47 |

| 2031 | 0.01632 | 0.01484 | 0.01053 | 75 |

ARAI (AA) Professional Investment Strategy and Risk Management Report

IV. AA Professional Investment Strategy and Risk Management

AA Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Risk-averse investors seeking exposure to AI agent infrastructure in Web3, investors with medium to long-term time horizons (12+ months)

- Operational Recommendations:

- Accumulate positions during market downturns, particularly when ARAI drops below 30-day moving averages

- Dollar-cost averaging (DCA) approach: allocate fixed capital at regular intervals to reduce timing risk

- Hold through market volatility cycles to benefit from potential protocol adoption and ecosystem expansion

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the historical low of $0.007723 (ATL on 2025-12-26) as critical support; use $0.010399 (24H high) as immediate resistance

- Volume Analysis: Current 24H trading volume of $23,887 indicates relatively low liquidity; trade during high-volume periods for better execution

- Swing Trading Key Points:

- Enter positions near support zones during minor bounce attempts

- Establish stop-losses below key support levels to limit downside exposure

- Take profits at resistance zones or when daily gains exceed 5-10%

AA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation (highly speculative asset)

- Active Investors: 2-5% portfolio allocation (small-cap growth position)

- Professional Investors: 5-10% portfolio allocation (as part of diversified crypto strategy)

(2) Risk Hedging Solutions

- Position Sizing Discipline: Limit individual trade size to no more than 2% of total portfolio to contain downside risk

- Stablecoin Reserves: Maintain 20-30% of intended trading capital in stablecoins to capitalize on sudden price drops without panic selling

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for frequent trading and platform interactions

- Cold Storage Approach: For long-term holdings, transfer ARAI to self-custody solutions where you control private keys

- Security Considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify contract addresses before any transaction (official ARAI contract: 0x01bf3d77cd08b19bf3f2309972123a2cca0f6936 on BSC)

V. ARAI Potential Risks and Challenges

Market Risk

- Extreme Volatility: ARAI has experienced 86% decline over 30 days and 84.59% decline over 1 year, indicating high price instability and potential for further significant losses

- Low Liquidity: With only $23,887 in 24H volume and presence on 10 exchanges, ARAI faces liquidity challenges that could result in slippage during large trades

- Circulation Concentration: Only 1.44% of total supply circulating (14.45M of 1B tokens) creates risk of severe dilution if vesting schedules release additional tokens

Regulatory Risk

- Emerging Technology Uncertainty: AI agent classification in decentralized finance remains unsettled across multiple jurisdictions; regulatory clarity may negatively impact valuation

- Smart Contract Governance: As a BEP-20 token on BSC, ARAI faces potential regulatory scrutiny on Binance Smart Chain operations depending on evolving compliance frameworks

- Cross-Border Compliance: Web3 interaction layer platforms face increasing regulatory pressure globally; changes in DeFi regulations could impact ARAI ecosystem viability

Technical Risk

- Adoption Risk: Arai Systems' modular Co-Pilot agent technology requires significant developer adoption and integration; failure to achieve ecosystem traction would undermine token value

- Smart Contract Vulnerability: No audit information provided in available data; potential undisclosed security vulnerabilities could result in loss of user funds and token value collapse

- Competitive Pressure: AI agent infrastructure remains highly competitive space; larger funded projects with established user bases may outpace ARAI's development

VI. Conclusion and Action Recommendations

ARAI Investment Value Assessment

ARAI presents a high-risk, speculative investment opportunity targeting the emerging AI agent infrastructure segment of Web3. While the conceptual positioning around autonomous agents and on-chain automation addresses real use cases in gaming and decentralized finance, the token has experienced severe depreciation (86% over 30 days) indicating either market repricing or fundamental concerns. The extremely low circulating supply ratio (1.44%) and modest trading volume suggest limited market confidence and liquidity constraints. Investors must weigh the potential for disruption through AI-powered Web3 interactions against significant execution risks, regulatory uncertainty, and the competitive landscape of AI agent platforms.

ARAI Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% portfolio allocation) through Gate.com after thorough research; use only capital you can afford to lose entirely; prioritize understanding the Arai Systems whitepaper before investing

✅ Experienced Investors: Consider DCA strategies during extreme price drops; monitor technical levels and volume patterns for entry points; implement strict stop-loss discipline at 10-15% below entry

✅ Institutional Investors: Conduct comprehensive technical and security audits of Arai Systems smart contracts; evaluate team background and development roadmap; consider position sizing within 3-5% of venture-stage crypto allocation

Ways to Participate in ARAI Trading

- Gate.com Platform Trading: Access ARAI spot trading pairs with competitive fees and secure custody options

- BSC Blockchain Direct: Interact with ARAI smart contract (0x01bf3d77cd08b19bf3f2309972123a2cca0f6936) for advanced users requiring direct on-chain transactions

- Dollar-Cost Averaging Programs: Set up recurring purchases on Gate.com to automate portfolio building while reducing timing risk

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose entirely.

FAQ

What is AA? What are its basic characteristics and uses?

AA is a type of standard alkaline battery with a diameter of 14.5mm and height of 50.5mm. It's widely used in various small electronic devices and consumer appliances as a common power source for everyday portable equipment.

What are the main factors affecting AA's price?

AA's price is primarily influenced by supply and demand dynamics, market sentiment driven by news and investor confidence, and regulatory developments. These factors collectively determine AA's market performance and price movements.

How to predict AA's price? What are the analysis methods?

Predict AA's price using technical indicators like moving averages, RSI, and MACD to identify trends and reversals. Analyze trading volume and price patterns for momentum confirmation. Combine multiple indicators for improved accuracy and better prediction results.

AA的历史价格表现如何?过去有什么价格波动规律?

AA价格在过去一周下跌19.05%,近30天累计跌幅46.69%,显示近期波动较大。长期来看,AA表现为周期性调整,建议关注市场动态和项目发展。

What are the risks of investing in AA for price prediction trading?

AA price prediction trading involves high volatility and potential losses. Leverage amplifies both gains and losses. Market fluctuations, liquidity risks, and trading volume changes may impact positions significantly. Only invest capital you can afford to lose.

AA与其他同类资产相比,价格表现有什么区别?

AA demonstrates distinct price performance driven by inflation sensitivity and macroeconomic cycles. During high inflation periods, AA typically outperforms traditional assets. Its volatility profile differs from bonds, offering stronger growth potential while exhibiting moderate drawdown risks compared to equities.

2025 AA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

2025 ASM Price Prediction: Future Trajectory Analysis and Key Factors Influencing Market Value

2025 VVV Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 AIL Price Prediction: Navigating the Future of Artificial Intelligence Tokens in a Rapidly Evolving Market

2025 NPC Price Prediction: Analyzing Market Trends and Potential Factors Influencing Virtual Asset Values

What Are Bitcoin Options? Learn Everything About BTC Options

TAO Trades in Controlled Descent Amid 4-Hour Compression Near Key Resistance

Ethereum's Resilience Outperforms Bitcoin Amid Capitulation Risks in Recent Market Cycles

What is ETH Dominance? Understanding the ETH Dominance Chart and What It Means

Linea Airdrop: Everything You Need to Know About It