- Trending TopicsView More

154.61K Popularity

67.06K Popularity

76.83K Popularity

24.37K Popularity

102.26K Popularity

- Pin

- 🚀 Gate Square Event: #GateNewbieVillageEpisode8

👤 Featured Creator: @ybaser

💬 Trading Quote: The market tests you, but panic is the only real loss.

Share your trading journey | Reflect on your strategy | Grow with the Gate Family

⏰ Event Time: Nov 26 04:00 – Dec 3 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode8

3️⃣ Share your trading experiences, strategy insights, or growth reflections

— The more genuine and insightful your post, the higher your chance to win!

🎁 Rewards

3 lucky participants → Gate X RedBull Cap + $20 Positi - 🎄 Gate Square · Christmas Warmth Creation Event

❄️ Winter is cold, but Gate Square is here to warm you up!

Post continuously on Gate Square for a chance to win heartwarming Christmas gift boxes + over 1000 USDT position voucher!

📅 Event Period: Nov 20 04:00 – Nov 27 16:00 UTC

📌 Event Details:https://www.gate.com/campaigns/3297

🎅 How to Participate

1. Post on Gate Square using the hashtags #Gate广场圣诞送温暖 or #GateChristmasGiveaway

2. Content can include market moods, Christmas wishes, investment insights, encouragement posts, lifestyle shares, memes, and more.

3. Participants must post for a - 📢 Gate Square TAG Posting Challenge: #MySuggestionsforGateSquare

Post & WIN 100 USDT in rewards!

Gate Square is constantly improving!

Do you have feature suggestions, feedback, or ideas for new functionalities? Share your experiences and insights, and help more people discover the charm of Gate Square!

💡 How to Participate

1️⃣ Follow Gate_Square

2️⃣ Open the Gate APP and tap “Square” at the bottom

3️⃣ Tap the Post button and publish your post with the hashtag #MySuggestionsforGateSquare

✍️ Post Examples

1️⃣ Which features do you use the most? What is your experience?

2️⃣ Which features cou - 🚀 Gate Square “Gate Fun Token Challenge” is Live!

Create tokens, engage, and earn — including trading fee rebates, graduation bonuses, and a $1,000 prize pool!

Join Now 👉 https://www.gate.com/campaigns/3145

💡 How to Participate:

1️⃣ Create Tokens: One-click token launch in [Square - Post]. Promote, grow your community, and earn rewards.

2️⃣ Engage: Post, like, comment, and share in token community to earn!

📦 Rewards Overview:

Creator Graduation Bonus: 50 GT

Trading Fee Rebate: The more trades, the more you earn

Token Creator Pool: Up to $50 USDT per user + $5 USDT for the first 50 launche

Bitcoin rebounded to $90,000 within a week... "Rebound preparation completed"

Source: DecenterKorea Original Title: Bitcoin Recovers to $90,000 in a Week···“Ready for a Bounce” [D.Centers Market] Original Link: https://www.decenter.kr/NewsView/2H0M8EO9V4/GZ03

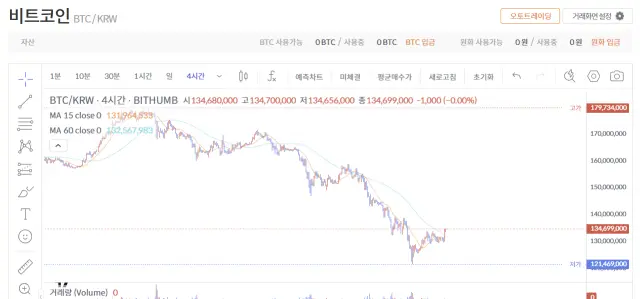

According to the data at 8 a.m. on the 27th, the price of Bitcoin (BTC) on domestic cryptocurrency exchanges increased by 2.86% compared to the previous day, reaching 134.68 million won.

Driven by the rebound in U.S. stocks, Bitcoin (BTC) has broken through $90,000 again within a week. Recently, the overheating in the market during the adjustment process has eased, and as long as the macro environment remains stable, the market has ample room for rebound, industry analysts believe.

According to data from global cryptocurrency market websites, at 8 AM on the 27th, Bitcoin (BTC) rose by 3.43% compared to 24 hours ago, trading at $92,273.61. Ethereum (ETH) also increased by 2.52% to $3,023.22. Ripple (XRP) climbed 1.18% to $2.222, while a major exchange's token (BNB) rose by 3.83% to $891.47. Solana (SOL) increased by 3.48% to $142.93.

The domestic market also shows a similar trend. The BTC on domestic cryptocurrency exchanges rose by 2.86% compared to the previous day, reaching 134,680,000 KRW. ETH increased by 1.51% to 4,510,000 KRW, and XRP rose by 0.52% to 1,490 KRW.

U.S. stocks rebounded broadly last week after a correction in tech stocks. The Dow Jones Industrial Average and the S&P 500 rose by 0.7% each, and the Nasdaq increased by 0.8%. The risk-averse sentiment has eased somewhat, leading to an inflow of buying funds into the cryptocurrency market.

The evaluation of the market's strength has also improved. Wintermute stated in the report, “The BTC funding rate has turned negative for the first time since reaching $115,000 at the end of October and has remained unchanged, while the scale of futures open interest (OI) has decreased from $230 billion to $135 billion, significantly adjusting leverage.” It further explained, “The overheated structure of the futures center has been resolved, and the market has shifted to the spot center, with the possibility of a rebound as long as the macro situation remains stable.”

However, the psychological state of cryptocurrency investment is still in a “state of extreme fear.” The fear and greed index from cryptocurrency data analysis firms has decreased by 5 percentage points from the previous day to 15 percentage points. The closer this index is to 0, the more frustrated the investment sentiment is, while the closer it is to 100, the more overheated the market is.