What Are ENA Futures? A Comprehensive Guide to Ethena Derivatives Trading

What is ENA Futures?

ENA Futures is a type of contract that allows traders to buy or sell ENA, which can be divided into traditional futures with expiration dates and perpetual contracts without expiration dates. With perpetual contracts, you can open or close positions at any time without having to consider contract rollovers. Whether or not you currently hold ENA, you can directly participate in market price movements through the contract. The advantages of ENA Futures include:

- Can go long or short: go long in a bullish market, go short in a bearish market.

- High Leverage Opening Position: Some platforms offer leverage up to 20 times or even 100 times.

- Hedging Tool: Shorting can hedge against the price decline risk when holding spot ENA.

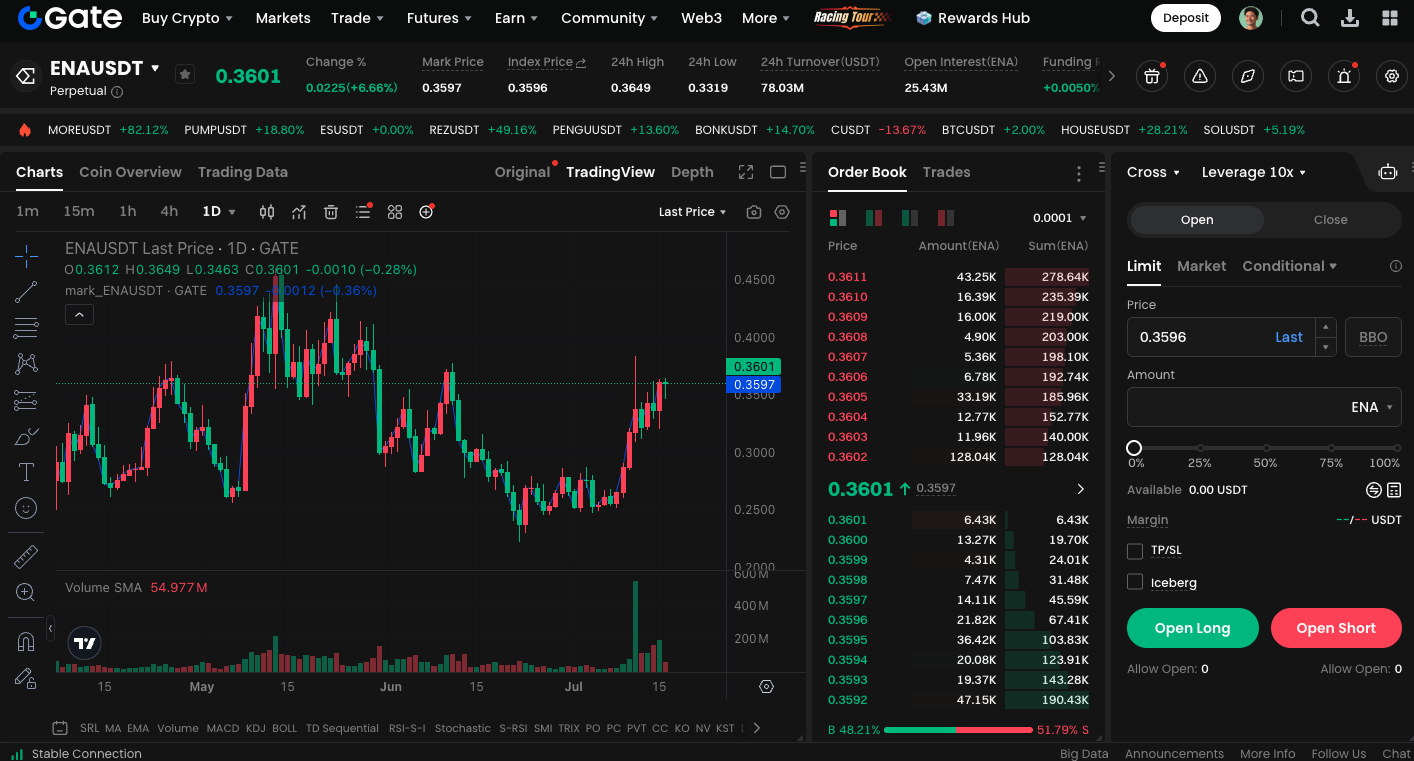

Where can I trade ENA Futures?

Gate Perpetual Contracts are a type of derivative used for investing in digital currencies. Users only need to buy (go long) or sell (go short), making it more convenient to use, while providing greater leverage than traditional futures contracts. Gate currently supports USDT Perpetual and BTC Perpetual Contracts.

The trading mechanism and strategy application of ENA Futures

- Can Long / Can Short

If you expect the ENA price to rise, you can open a long position; if you think the price will fall, you can open a short position. Regardless of the market direction, you can participate in trading and profit. - Use leverage to enhance efficiency

By using leverage ratios of 10X, 20X, or higher, trading profits can be amplified. However, this also increases the risk of being liquidated, so it is essential to set leverage and stop-loss orders carefully. - Hedging Tool

Users holding ENA spot can open short Futures as a hedging strategy to reduce asset value fluctuations, but if ENA rises, this strategy may also incur potential losses.

Strategies and Risks to Note When Trading ENA Futures

ENA Futures, as a derivative tool, is not suitable for all investors. Its high leverage, funding rates, and liquidity conditions mean that potential returns come with significant risks. For users with certain trading experience and familiarity with risk management techniques, ENA Futures can become a powerful tool. Whether going long, shorting, or using it as a hedge against spot positions, it offers great strategic flexibility.

However, for users who are new to crypto assets or have not yet established a complete trading system, entering high-leverage futures trading directly may lead to a rapid shrinkage of assets due to price fluctuations and funding rate changes. Investors also need to pay attention to changes in funding rates, especially during extreme market sentiment, when rates may spike, eroding the expected profits. The platform’s liquidation mechanism, price slippage, and trading depth are also aspects that must be carefully evaluated when conducting Futures Trading.

Start Futures Trading for ENA/USDT now:https://www.gate.com/futures/USDT/ENA_USDT

Summary

ENA Futures provides another effective way to manage investment costs and price fluctuations. From going long and short to hedging risks, all can be accomplished through Futures. However, the profits and losses as well as the options strategies carry risks, so it is essential to trade only after understanding the contract terms, funding rates, leverage effects, and other factors. By observing the opening volume, funding rates, and price fluctuations of ENA Futures, one can also gain a more comprehensive understanding of the acceptance and activity of the Ethena protocol in the market.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?