2025 DOGS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: DOGS' Market Position and Investment Value

DOGS (DOGS) is a community-driven token inspired by Spotty, a mascot created by TON founder Pavel Durov for the Telegram community, embodying its unique spirit and culture. Since its launch in August 2024, the project has gained significant traction within the Telegram ecosystem. As of December 20, 2025, DOGS has achieved a market capitalization of approximately $22.12 million with a circulating supply of 516.75 billion tokens, currently trading at $0.00004281. This charitable-focused asset, whose sales revenue supports orphanages and children's homes, is playing an increasingly important role in the community-driven token landscape.

This article will comprehensively analyze DOGS' price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

DOGS Market Analysis Report

I. DOGS Price History Review and Current Market Status

DOGS Historical Price Evolution

DOGS token was launched on August 20, 2024, entering the market at an initial trading phase. The token experienced significant price appreciation in its early trading period, reaching its all-time high (ATH) of $0.029 on July 30, 2024. Following this peak, the token has entered a prolonged correction phase, declining substantially over subsequent months. As of October 10, 2025, DOGS reached its all-time low (ATL) of $0.0000221, representing a 99.92% decline from its historical peak—a dramatic depreciation over the approximately 14-month period.

DOGS Current Market Dynamics

As of December 20, 2025, DOGS is trading at $0.00004281, with a 24-hour trading volume of approximately $471,073.34. The token's market capitalization stands at $22,122,067.50, while its fully diluted valuation reaches $23,545,500.00, representing a market dominance of 0.00073%.

Recent Price Performance:

- 1-Hour Change: -0.05%

- 24-Hour Change: +0.54%

- 7-Day Change: -12.61%

- 30-Day Change: -13.79%

- 1-Year Change: -91.71%

DOGS has a circulating supply of 516.75 billion tokens out of a maximum supply of 550 billion tokens, indicating a circulation ratio of 93.95%. The token is currently listed on 32 exchanges and has accumulated approximately 4.9 million holders. Market sentiment indicators reflect "Extreme Fear" conditions (VIX score: 20), suggesting heightened risk aversion across the crypto market.

The 24-hour trading range shows DOGS fluctuating between $0.0000413 and $0.00004333, with the token experiencing consistent downward pressure over longer timeframes despite slight short-term recovery in the past 24 hours.

Click to view current DOGS market price

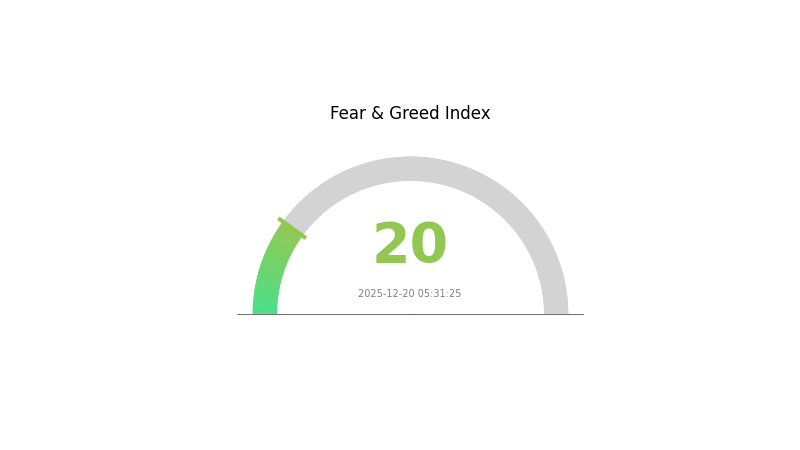

DOGS Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the Fear and Greed Index at 20, indicating heightened market anxiety and pessimism. During such periods, investors often panic-sell assets, creating significant volatility in the DOGS market. This extreme fear sentiment typically presents contrarian opportunities for long-term investors who can identify undervalued tokens. However, caution is advised as markets under extreme fear may continue declining before stabilizing. Monitor key support levels and consider dollar-cost averaging strategies rather than aggressive buying during such fearful conditions on Gate.com.

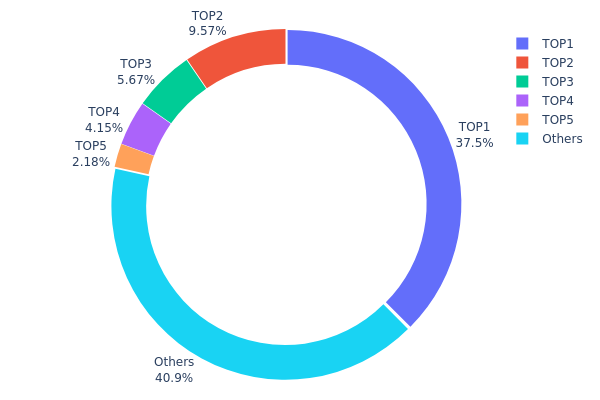

DOGS Holdings Distribution

Address holdings distribution refers to the allocation of token supply across different wallet addresses on the blockchain, serving as a critical indicator of asset concentration and decentralization. This metric reveals how DOGS tokens are distributed among holders and helps assess the level of market power concentration, potential price manipulation risks, and the overall health of the token's ecosystem.

The current DOGS holdings data exhibits moderate concentration characteristics. The top holder commands 37.50% of total supply, while the second and third largest holders possess 9.57% and 5.66% respectively. The top five addresses collectively control approximately 59.05% of circulating tokens, indicating a notable degree of concentration in the upper tier. However, the remaining 40.95% distributed among other addresses demonstrates a meaningful long tail of smaller holders, suggesting that token ownership is not entirely monopolized by a handful of entities. This distribution pattern reflects a transitional phase where early investors and major stakeholders maintain substantial positions while secondary and retail holders constitute a meaningful portion of the ecosystem.

From a market structure perspective, the concentration level presents both opportunities and risks. The substantial holdings by top addresses could facilitate large-scale market coordination or rapid liquidity provision but also introduces susceptibility to single-point-of-failure scenarios and potential price volatility triggered by major holder movements. The 40.95% held by dispersed addresses provides a stabilizing counterweight that reduces systemic fragility. This distribution pattern suggests moderate decentralization where significant price movements may be influenced by top-tier holders, while the distributed holdings among smaller addresses help maintain ecosystem resilience and prevent absolute market dominance by any single entity. The current structure indicates that DOGS maintains a reasonable balance between institutional concentration and community participation.

View current DOGS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQD4uG...tTYCQx | 204497641.63K | 37.50% |

| 2 | UQDckH...wSGwFA | 52180533.69K | 9.57% |

| 3 | UQCtkG...ZjLafF | 30906339.13K | 5.66% |

| 4 | UQBmoe...5E5Uii | 22628330.96K | 4.15% |

| 5 | UQBs6N...m9zeTl | 11869377.51K | 2.17% |

| - | Others | 223135133.14K | 40.95% |

Core Factors Influencing DOGE's Future Price

Supply Mechanism

-

Unlimited Supply Model: Unlike Bitcoin's fixed cap of 21 million coins, Dogecoin has no maximum supply limit. The protocol generates approximately 5 billion new DOGE coins annually through fixed issuance, creating a mild inflationary model designed to encourage circulation and usage rather than long-term hoarding.

-

Historical Impact: The inflationary supply mechanism has been a central factor in long-term valuation discussions. Analysts warn that the continuous annual inflation of 5 billion coins creates sustained downward price pressure unless accompanied by proportional demand growth.

-

Current Implications: As user adoption and transaction volume grow, the ability of demand expansion to outpace supply growth becomes critical for supporting long-term value. If usage scenarios and user base growth exceed new supply rates, price appreciation can be sustained; otherwise, deflationary pressures may intensify.

Celebrity and Public Figure Influence

-

Elon Musk Factor: Dogecoin's price trajectory has been significantly shaped by statements and actions from Elon Musk. His tweets and public endorsements frequently trigger sharp price volatility. In 2021, Musk's appearance on Saturday Night Live discussing Dogecoin drove the price to an all-time high of $0.7376. More recently, Musk announced plans for SpaceX's "DOGE-1 lunar mission," scheduled for late 2025, with the announcement alone generating substantial market attention.

-

Community Support: The asset maintains strong grassroots community engagement characterized by humor, generosity, and charitable initiatives. This cultural foundation has proven resilient across market cycles and continues to drive network activity and user retention.

-

Public Endorsements: Beyond Musk, other prominent figures including Mark Cuban and Snoop Dogg have publicly supported the cryptocurrency, with Cuban's Dallas Mavericks NBA team accepting DOGE as payment, providing real-world utility examples.

Macroeconomic Environment

-

Global Liquidity Dynamics: Dogecoin's price movements correlate with broader cryptocurrency market sentiment and global liquidity conditions. When the Federal Reserve implements rate cuts and monetary expansion, capital typically flows toward higher-risk assets including cryptocurrencies, supporting price appreciation. Conversely, monetary tightening and liquidity constraints trigger selling pressure on speculative assets like DOGE.

-

Risk Sentiment: As a high-beta asset with extreme volatility, Dogecoin is highly sensitive to shifts in market risk appetite and overall investor sentiment toward speculative positions within the cryptocurrency sector.

Technical Development and Ecosystem

-

Merged Mining with Litecoin: Dogecoin operates using Proof-of-Work consensus through merged mining with Litecoin, sharing computational resources and enhancing network security. This architectural choice distinguishes it from other meme coins that rely on external blockchains.

-

Low Transaction Costs and Speed: Fast block confirmation times and minimal transaction fees position Dogecoin as practical for micropayments and tipping scenarios, supporting its positioning as a spending-oriented rather than purely speculative asset.

-

Social Media Integration Potential: Future ecosystem expansion could include integration with social media platforms. X Platform (formerly Twitter) integration as a payment or tipping mechanism would dramatically expand use cases and user accessibility, potentially attracting significant new participants to the network.

-

Spot ETF Discussions: Ongoing discussions regarding Dogecoin spot exchange-traded funds have generated market attention, though initial capital inflows remain limited and approval outcomes remain uncertain. Historical precedent from Bitcoin and Ethereum ETF launches suggests early inflows do not guarantee immediate price appreciation.

Three、2025-2030 DOGS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00003-$0.00004

- Neutral Forecast: $0.00004

- Optimistic Forecast: $0.00006 (requires strengthened community engagement and increased trading volume on Gate.com)

2026-2027 Medium-term Outlook

- Market Stage Expectations: Potential recovery phase with gradual price appreciation driven by ecosystem development and increasing adoption.

- Price Range Forecast:

- 2026: $0.00004-$0.00006 (22% upside potential)

- 2027: $0.00003-$0.00007 (25% upside potential)

- Key Catalysts: Enhanced utility within the DOGS ecosystem, growing user base participation, integration with mainstream platforms, and positive market sentiment cycles.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00005-$0.00007 (assuming steady adoption and moderate market growth)

- Optimistic Scenario: $0.00006-$0.00008 (assuming accelerated ecosystem development and sustained bull market conditions)

- Transformational Scenario: $0.00008 (requires breakthrough utility adoption, significant institutional interest, and major market expansion; representing 65% cumulative growth by 2030)

By 2030, DOGS is projected to potentially reach $0.00008 as peak price, reflecting compound growth through multiple market cycles and strengthened fundamentals within its operational framework.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00006 | 0.00004 | 0.00003 | 0 |

| 2026 | 0.00006 | 0.00005 | 0.00004 | 22 |

| 2027 | 0.00007 | 0.00005 | 0.00003 | 25 |

| 2028 | 0.00007 | 0.00006 | 0.00005 | 41 |

| 2029 | 0.00008 | 0.00007 | 0.00004 | 53 |

| 2030 | 0.00008 | 0.00007 | 0.00005 | 65 |

DOGS Investment Analysis Report

IV. DOGS Professional Investment Strategy and Risk Management

DOGS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for investors: Community-focused supporters and charitable-minded investors who believe in the project's social mission

- Operation recommendations:

- Accumulate DOGS during market downturns when prices fall significantly below the all-time high of $0.029

- Hold positions for extended periods to benefit from potential community growth and charitable initiatives

- Reinvest any project distributions to maximize long-term compounding effects

(2) Active Trading Strategy

- Technical analysis considerations:

- Support and resistance levels: Monitor the 24-hour trading range ($0.0000413 to $0.00004333) for short-term price fluctuations

- Volume analysis: Track the 24-hour volume of approximately 471,073 DOGS to identify liquidity windows for entries and exits

- Range trading key points:

- Execute buy orders near the lower end of volatile ranges to maximize entry points

- Take profits near identified resistance levels before potential pullbacks

DOGS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5-1% of portfolio allocation

- Active investors: 1-3% of portfolio allocation

- Professional investors: 3-5% of portfolio allocation (subject to fund mandates and risk tolerance)

(2) Risk Hedging Solutions

- Dollar-cost averaging: Reduce timing risk by spreading purchases across multiple time periods

- Portfolio diversification: Balance DOGS holdings with less volatile assets to mitigate concentration risk

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 wallet for frequent trading and accessibility

- Cold storage approach: Transfer DOGS to cold storage solutions for long-term holdings exceeding 3 months

- Security considerations: Always verify contract address (EQCvxJy4eG8hyHBFsZ7eePxrRsUQSFE_jpptRAYBmcG_DOGS on TON blockchain), enable two-factor authentication on exchanges, and never share private keys or seed phrases

V. DOGS Potential Risks and Challenges

DOGS Market Risk

- Extreme price volatility: The coin has experienced a -91.71% decline over the past year, indicating severe downside risk potential

- Low market liquidity: With only 32 exchanges listing DOGS and relatively modest 24-hour volume, large transactions may face slippage

- Market sentiment dependency: As a community-driven token, DOGS is highly susceptible to social media trends and Telegram community engagement fluctuations

DOGS Regulatory Risk

- Evolving regulatory environment: Cryptocurrency regulations continue to change globally, potentially affecting trading access and token classification

- Charitable fund oversight: The project's commitment to donate sales revenue to orphanages may face regulatory scrutiny regarding fund management and transparency

- Exchange delisting risk: Regulatory pressure could result in DOGS being removed from trading venues, severely limiting liquidity

DOGS Technical Risk

- Blockchain dependency: As a TON-based token, DOGS is exposed to any technical vulnerabilities or network issues within the TON blockchain

- Smart contract risk: The token relies on underlying smart contract code; any undiscovered vulnerabilities could pose security threats

- Network adoption uncertainty: If TON blockchain fails to achieve mainstream adoption, DOGS utility and demand may diminish significantly

VI. Conclusion and Action Recommendations

DOGS Investment Value Assessment

DOGS presents a unique investment opportunity blending community engagement with charitable objectives. However, the token's -91.71% one-year performance and -13.79% 30-day decline demonstrate substantial volatility and downside risk. The project's valuation at approximately $23.5 million market cap with strong community support (4.9 million holders) suggests active participation, yet this must be weighed against limited liquidity and extreme price swings. The charitable mission differentiates DOGS from typical speculative tokens, but does not eliminate fundamental investment risks associated with emerging blockchain assets.

DOGS Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of crypto portfolio) through Gate.com, focusing on understanding the project's charitable mission and community dynamics before scaling positions

✅ Experienced investors: Implement dollar-cost averaging strategies during volatility, use Gate.com's advanced trading tools for technical analysis, and maintain strict stop-loss orders at -20% below entry points

✅ Institutional investors: Conduct thorough due diligence on fund governance, verify charitable contributions, and structure positions with appropriate risk controls given the token's extreme volatility

DOGS Trading Participation Methods

- Exchange trading: Purchase DOGS directly on Gate.com with fiat currency or stablecoins for immediate market exposure

- Peer-to-peer acquisition: Engage with the Telegram community (@dogs_community) to understand alternative acquisition methods and holder networks

- DeFi interaction: Utilize TON blockchain's native DeFi protocols to explore staking or liquidity provision opportunities (if available)

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose. DOGS has experienced severe losses (-91.71% yearly), and past performance does not guarantee future results.

FAQ

Will DOGS reach $1?

DOGS reaching $1 requires over 2,400% growth, which is unlikely based on current market trends and predictions. The token would need exceptional adoption and significant market expansion to achieve this milestone.

Will DOGS' coin prices increase?

DOGS' coin prices are expected to increase by 6.22% and reach $0.00003240 by December 31, 2025, based on current market trends and technical analysis.

What is the price prediction for DOGS in 2028?

Based on market analysis, DOGS is predicted to reach approximately $0.004763 by 2028, representing an estimated growth rate of 15.76%. This forecast reflects anticipated market developments over the coming years.

How much will a DOGS token be worth?

DOGS token is currently trading at $0.0000425 with a market cap of $21.95 million. As a meme token on TON blockchain, its value depends on community adoption and market demand. Price predictions suggest potential growth as the ecosystem expands, but valuations remain volatile.

Latest Shiba Inu Price Analysis for 2025: Insights into SHIB Token Market Trends

Shiba Inu (SHIB) in 2025: Ecosystem Growth and Price Analysis

What Does 'Stonks' Mean ?

FLOKI Decoded: Core Logic, Roadmap and $0.002 Price Potential by 2031

Jelly-My-Jelly: Beyond Memes - Analyzing Its Whitepaper Logic and Real Use Cases

why is crypto crashing and will it recover ?

Understanding Bitcoin and Smart Contracts for Beginners

Understanding the Latest Bitcoin Enhancements: A Beginner's Guide

Understanding the Role of a Ledger in Blockchain Technology

Ethereum vs Cardano: A Comprehensive Comparison Guide

Golden Cross Explored: Master Crypto Trading with Technical Analysis